“Sharp increases in input costs make Hoa Phat’s profits difficult to predict”

In a newly released report, Dragon Capital has assessed the impact of a “galloping” rise in commodity prices on Vietnam’s businesses as well as the economy.

Dragon Capital has adjusted earnings forecasts for commodity-related stocks (accounting for 15% of the market), including steel, fertilizer and energy. However, rising commodity prices have a two-way impact on business.

In particular, Hoa Phat steel has increased its selling price in recent years, however, the company has had to face a sharp increase in the cost of coking coal, leading to more unexpected profits. For the remaining 85% of the index, businesses are fully focused on the domestic market, benefiting from the strong post-Covid economic recovery and fiscal stimulus package.

The Banking, Real Estate and Retail sectors are expected to record profit growth of more than 30% in 2022. Some industry groups may face certain risks such as Electricity, Water, Aviation, only accounting for less than 3% of the index.

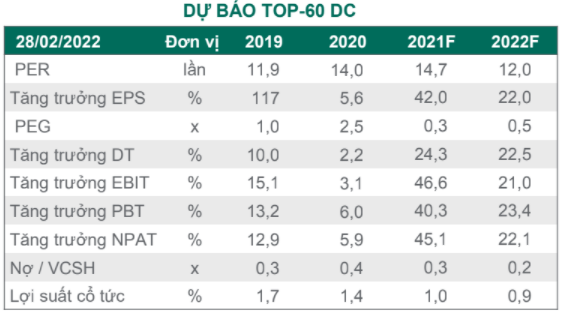

With the growth of the goods manufacturing business, Dragon Capital forecasts a 22% growth in the top 60 large companies’ profits and 12 times PE. The bright economic outlook and attractive stock valuations have explained the stability of investor sentiment in recent years.

Many issuers plan to raise capital and approach institutional investors in these favorable conditions. Dragon Capital estimates that about a third of large cap stocks will be able to have equity deals this year. In which, a number of securities companies are in the process of issuing stock options. Several IPOs are also expected in the second half of 2022.

Dragon Capital believes that Vietnam’s biggest risk does not come from macro/domestic market problems, but from the spillover effect that is unavoidable if the crisis in Ukraine continues and commodity prices spike sharply. Inflation is stagnant in developed countries. However, even in the worst case scenario, Dragon Capital believes that Vietnam can still outperform other markets thanks to positive internal factors.

Risk with inflation

According to Dragon Capital, Vietnam’s biggest risk at the moment is inflation. The consumer price index in 2 months increased by 1.7% over the same period last year as gasoline prices, accounting for 3.6% of the inflation basket, rose 43% when the price of Brent oil approached 130 USD/barrel. The other groups of items in the inflation basket such as food, education, health care, building materials,… did not change too much in the first 2 months of the year, but it is necessary to closely monitor the indirect effects of rising Gasoline prices on these groups over the course of the year. the next few months to gauge the overall impact on inflation.

In Vietnam, the current price of gasoline includes various tax costs and other price stabilizing factors, including 4,000 VND/liter of gasoline and an environmental protection tax. Therefore, to control inflation, the Government could reduce the environmental tax to 2,000 VND/liter, provide financial support to increase domestic production, and possibly conduct oil auctions from national reserve sources. To reflect recent developments in world commodity markets, Dragon Capital adjusted its inflation forecast for 2022 from 3.5% to 4.2%, and thinks that this rate will have little effect on the key interest rates in 2022.

Dragon Capital assesses that the conflict between Russia and Ukraine will not have a major impact on the Vietnamese economy except for the increase in raw material prices. Net fuel imports over the past few years, coupled with some possible disruptions in global production and supply chains, could affect trade, reducing the surplus from 13.2 to 10.1 billion USD. However, the VND/USD exchange rate will not be affected by abundant FDI inflows, high foreign exchange reserves, and low outstanding foreign debt. The biggest concern at the moment is inflation as rising gasoline prices accompanied by rising building material prices could affect consumption and disbursements of public investment.

Business and Marketing

at Blogtuan.info – Source: cafebiz.vn – Read the original article here