Stocked at 42 trillion when steel prices rose hot, the EU banned iron and steel imports from Russia, but Hoa Phat was “hit” by soaring coal prices.

Hoa Phat has a stockpile of 42 trillion dong, accounting for more than half of the industry amid rising steel

According to the fourth quarter 2021 financial report, Hoa Phat Group (code: HPG) has total assets of VND 178.235 billion, a sharp increase from VND 131.511 billion at the beginning of the year, equivalent to a 35% increase year-on-year.

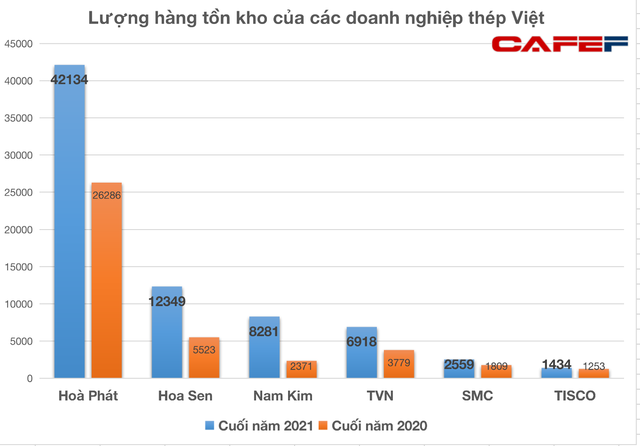

The main reason for the strong asset increase is that Hoa Phat’s inventory has increased sharply in the last year and reached VND 42,134 billion by the end of 2021, an increase of almost VND 16,000 billion, equivalent to 61.5% of the initial figure. this year. It can be said that in 2021, Hoa Phat has accumulated a very large stockpile at the end of the year.

Hoa Phat also has an abundance of cash and time deposits totaling over VND 40,000 billion by the end of 2021.

In Hoa Phat’s inventory structure, raw materials make up the largest share with VND 19.939 billion. This partially indicates that Hoa Phat has stockpiled a large source of raw materials for production by the end of 2021. Meanwhile, finished products reached VND 9,968 billion, goods reached VND 1,196 billion, goods purchased on the road 6128 billion dong…

Compared with enterprises in the steel sheet industry, Hoa Phat’s inventory has the largest scale. However, in the steel sheet industry last year, many businesses also experienced a very strong increase in inventory.

For example, Hoa Sen Group’s inventory has more than doubled, reaching VND 12.349 billion by the end of 2021. In Hoa Sen’s inventory structure, mainly finished products, goods and raw materials, are on the way.

Nam Kim Steel also experienced a very strong increase in inventories to VND 8,281 billion, up 256% over the previous year. In Nam Kim Steel’s revenue structure, revenue from exports is double that of sales from the domestic market. Therefore, the accumulation of large inventories in the context of rising world steel prices also makes businesses gain significant profits.

Several other iron and steel companies also experienced sharp increases in inventories: Vietnam Steel Corporation (code: TVN) also had inventories of VND 6.918 billion, up 83% compared to the beginning of the year; SMC Trading Investment Joint Stock Company (code: SMC) has a total inventory of 2,559 billion dong; TISCO has a stockpile of VND 1434 billion….

Domestic steel prices rise sharply, Hoa Phat affected by soaring coal prices

In general, all steel companies had a strong increase in inventories at the end of 2021. This is considered very good by investors in the context of rising steel prices and HRC in recent days due to the effects of the Russo-Ukrainian war.

In particular, China’s HRC price is trading at 865 USD/ton, although it has decreased significantly compared to its peak level, it is still increasing by 105 USD/ton compared to the beginning of 2022. This price increase has an impact on domestic steel prices.

Regarding domestic steel prices, on March 14, steel prices simultaneously exceeded 18,230 VND/kg with Hoa Phat construction steel, especially D10 steel, steel prices reached 18,430 VND/kg.

Recently, Russia announced a ban on the export of 200 items until the end of 2022 to “retaliate” for the punitive actions of Western countries and the US. Soon after, European Union countries took countermeasures when the European Union (EU) announced an embargo on imports of iron and steel from Russia.

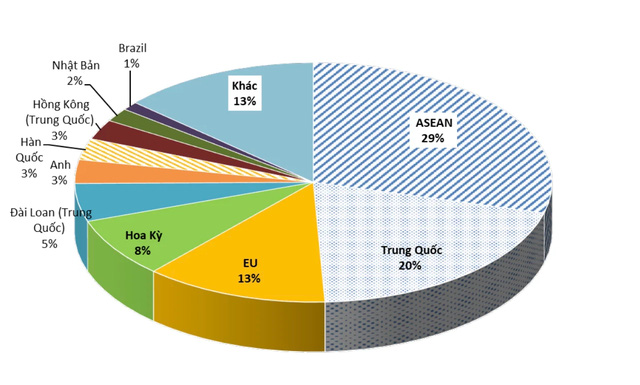

Russia is a major steel exporter in the world, especially in the European market (accounting for 15% of the export market share to the EU, together with two related countries, Ukraine and Belarus, the total steel exports of these three countries to the European Union). The European Union accounts for 38%.

In the EU, Russia and Ukraine were the 2nd and 4th largest steel exporters to the region, respectively, in the first 11 months of 2021 with about 21% of total output, according to Eurofer.

According to data from the Vietnam Steel Association, the EU ranks in the top third of Vietnam’s steel export market, accounting for 13% of the proportion (equivalent to 1.6 million tons) in 2021. This number has increased to more than 10 percentage points compared to 2020 (2, 86%).

Vietnam and the EU’s main steel import markets have increased imports

Therefore, the embargoes of the European Union, US and Russia against each other will greatly affect the supply and demand of the steel industry. The EU must seek from new markets. Vietnam has the EU-Vietnam Free Agreement (EVFTA) with a very prominent tariff preference roadmap. Therefore, investors think that steel exporting companies such as Hoa Phat, Nam Kim, Hoa Sen… will benefit from the embargo and sanctions above.

For companies with closed production processes from iron ore, such as Hoa Phat, the Russo-Ukrainian war and Russia’s export ban were both beneficial and negative. The positive is the increase in steel prices, the opportunity to expand the export market to the US, European Union and other countries around the world as Russia is a major steel exporter in the world.

However, with Hoa Phat, the surge in coal prices due to the Russo-Ukrainian conflict is also a “high point” for the business. According to steel industry experts, coal prices account for 25-30% of steel production costs. Therefore, the dizzying rise in coal prices is currently at 368 USD/ton, the highest record so far, which is expected to greatly affect the prices of Hoa Phat products. Of course, Hoa Phat could increase its selling price to better suit the context of sharp increases in input prices. However, this will greatly affect the domestic steel market and construction companies.

The galloping rise in coal prices “shows” into Hoa Phat’s excellent profit margins an opportunity to expand the market as Russia, the European Union and the US embargo each other when businesses hold more than 42 trillion in inventory.

In a recent report, Dragon Capital also assessed that Hoa Phat steel has increased its selling price in the past, however, the company has to face a sharp increase in the cost of coke, leading to more unexpected profits.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here