The expansion of the Long Chau pharmacy chain and the first in the history of FPT Retail

FPT Digital Retail Joint Stock Company (FPT Retail – FRT) has just released its audited consolidated financial statements for 2021. Thus, at the end of 31 December 2021, the company’s after-tax profit was VND 444 billion, 44 times higher than in 2020 .

The reason is that revenue in 2021 increased mainly due to the high demand for laptops for studying and working in the second half of 2021. Meanwhile, in the fourth quarter, Apple’s industry was successful in opening and selling the iPhone 13 and Macbook Pro 2021 series, resulting in a sharp increase in revenue throughout the year. . At the same time, Long Chau’s subsidiary made a slight profit so far this year, instead of losing as much as in 2020.

Along with the increase in revenue, by 2021, the assets of this business will also double to VND 10,786 billion, short-term financial investments will increase by 2.3 times to VND 1,820 billion, inventory will increase by 2.7 times, almost 5,000 billion VND.

However, the outstanding point in this report is that in the Retail FPT capital structure, the company’s debt for the first time in history exceeds VND 6,000 billion, 2.4 times higher than the first year.

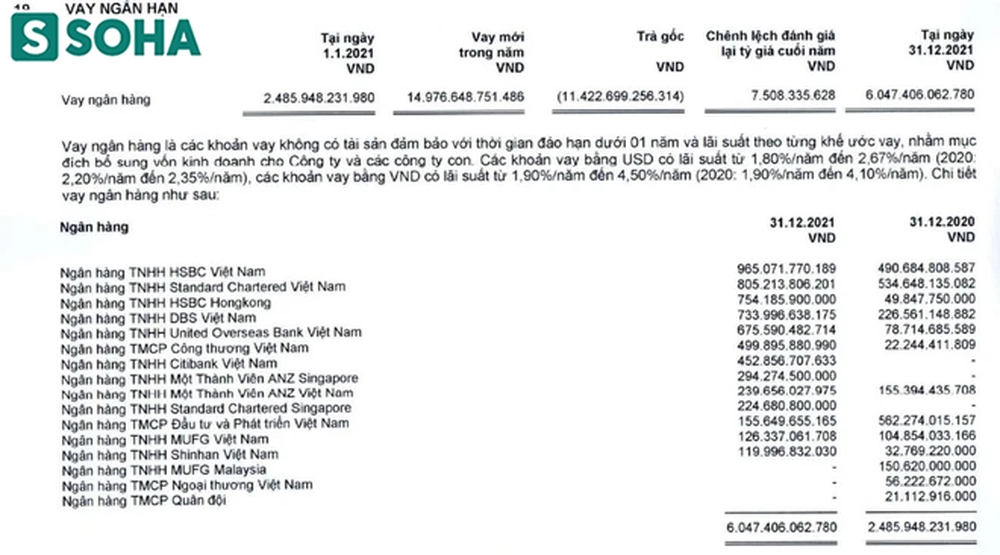

In particular, the company’s short-term loans amounted to more than VND 6,047 billion. Where, bank loans are unsecured loans, with maturities of less than 1 year and interest rates in accordance with the respective loan agreements, with the aim of increasing business capital for the company and other subsidiaries. Loans in USD have an interest rate of only 1.8 – 2.67%/year and loans in VND have an interest rate of 1.9 – 4.5%/year.

In the FPT Retail “creditor” structure, there are mostly foreign banks. HSBC Vietnam is the most lending bank with more than 965 billion VND, Standard Chartered Vietnam is 805 billion VND, HSBC Hong Kong is 754 billion VND, Vietnam DSB is 733 billion VND, Unites Overseas Bank Vietnam is 675 billion VND… Two banks, Vietnam Foreign Trade Bank and Military Bank, had no new loans in the past year.

FPT Retail’s debt spike was mainly due to the expansion of the Long Chau pharmacy chain.

In a report describing 2021 profit, FPT Retail said, Long Chau in 2021 has achieved revenue of nearly 4,000 billion VND, almost 3 times higher than in 2020. During this year, the company opened 200 more new product stores. The scale of Long Chau’s assets has increased to VND 2,144 billion, 3.4 times higher than the first year.

This morning, the domestic stock market was “on fire”. Updated at 10:55′, the VN-Index fell 24.11 points (1.64%) to 1,442.33 points; The HNX-Index fell 1.68% to 434.75 points.

Influenced by the market, FRT shares this morning fell 5,000 dong per share or the equivalent of a 3.89% decline, trading at 123,700 dong/share.

Since the beginning of the year until now, the stock has grown rapidly, from 100,200 VND/share (31 December 2021) to 123,700 VND/share, an increase of almost 24%.

In its business plan for 2022, the company sets a revenue target of VND 27,000 billion – an increase of 20% and profit after tax of VND 720 billion – an increase of 30% over 2021. It is expected that Long Chau will be the engine of FRT’s growth this year.

at Blogtuan.info – Source: Soha.vn – Read the original article here