Bitter because the “wind changes”, flooded with a debt of 1 billion USD, even the skyscraper is “in a debt squeeze”

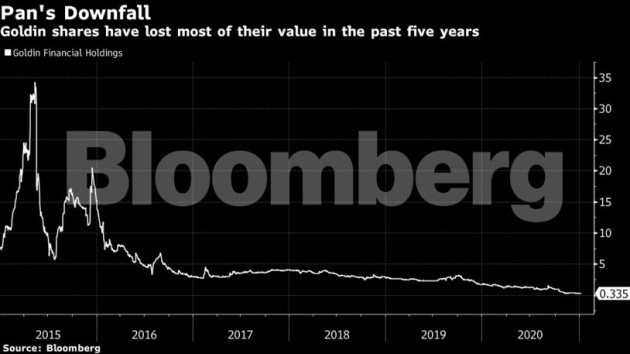

According to the Bloomberg Billionaires Index, this is a long slide for Pan, 57, who was in the top 4 richest billionaires in Asia in 2015 with a net worth of $27 billion. However, after shares of Goldin Financial Holdings Ltd. Due to his ownership plummeting, most of his assets became collateral for loans, causing the billionaire today to be “kicked” out of the list of 500 richest people in the world.

Glorious past and grim reality

Accordingly, Mr. Pan’s initial “huge” fortune did not come from real estate, but from business and later electronics manufacturing – an area he ventured into after retiring from business. California moved to Hong Kong. This billionaire has turned to real estate investment since 2008, when the real estate market had just had a boom, creating a red fever that brought countless fortunes in Hong Kong, making this place become one of the most expensive real estate markets in the world.

One-time Hong Kong real estate mogul: Pan Sutong

However, now, this billionaire and investors who used to borrow “too much” during the boom period are reeling and miserable because they have lost a lot of money after months of civil unrest and the Covid pandemic. -19 took place in Hong Kong, pushing it into the worst recession in its history.

Tang Shing-bor, a veteran investor known as the “King of Shopping” with a huge retail fortune is looking to sell properties worth billions of dollars. A group of investors who once spent $ 5.2 billion to buy The Center – the world’s most expensive office deal also struggled because the Hong Kong real estate market froze a year earlier.

Given the situation, Edward Chan, a credit analyst at S&P Global Ratings in Hong Kong, said: “If foreclosure happens, those companies will be in a very bad financial position, with high debt and leverage.” He also declined to comment specifically on Goldin Financial’s situation because S&P does not report on the developer.

According to stock exchange filings and data compiled by Bloomberg, Pan and Goldin Financial were saddled with approximately HK$38 billion ($4.9 billion) in debt between May 2017 and September 2020. for four properties in Hong Kong. At least $1 billion of that debt remains unpaid and belongs to Goldin.

Other figures also show that Goldin’s debt/EBITDA ratio is around 9 times at the end of 2018. Meanwhile, Sun Hung Kai Properties Ltd.’s. – Hong Kong’s largest developer is 2.3 and of HKR International Ltd. is 2 times. Even a $1.1 billion loan in September from CK Asset Holdings Ltd. The support of billionaire Ly Gia Thanh is not enough to help Goldin Financial.

Mr. Pan switched from manufacturing consumer electronics such as cell phones and MP3 players to real estate in 2008. At that time, the billionaire also changed the name of his electronics company to Goldin Properties Holdings Ltd. . and bought a listed company, named Goldin Financial. In 2017, Goldin Properties was delisted and Pan both held controlling stakes in both companies.

Wrong steps are the source of the downfall

It is thought that the collapse of Goldin Financial can be traced back to the billionaire’s strategy of separating asset ownership between the company and his personal interests.

Between 2011 and 2020, Mr. Pan and Goldin Financial purchased a commercial center and two residential properties. In which, Goldin Financial holds 60% ownership, Mr. Pan holds the remaining 40%. The ownership structure is similar for the third lot.

However, starting in 2018, Mr. Pan decided he wanted full ownership of one of the residential properties and a majority stake in another property, located in a prestigious neighborhood in Kowloon with Good profit potential.

In return, he sold his shares in the remaining two properties to Goldin Financial, including a 40% stake in the Goldin Financial Global Center and an expensive plot of land near the former Kai Tak airport.

As a result, Mr. Pan became the sole guarantor of a HK$7.19 billion loan for one of the residential developments. At least four banks involved in the loan did not agree to the terms of the deal and refused to lend the billionaire money. This makes it difficult for Goldin Financial to access the next lines of credit.

The Kai Tak project then failed. At the end of 2019, Goldin Financial was also unable to raise any loans to finance this project. The company then had to sell the land for about HK$3.5 billion, less than half of what it paid in 2018.

The company’s skyscraper of the same name also became an “asset” for creditors to tear apart after Goldin Financial failed to pay its debts in a timely manner. In July 2020, the creditor of the HK$3.4 billion loan asked the company to repay it immediately. Meanwhile, the company’s holders of HK$6.8 billion in premium bonds threatened to seize the mortgaged office block.

Finally, those involved in the other bonds successfully applied to the High Court of Hong Kong for the right to take over this 27-storey building and were granted ownership in September of that year. After that, the whole house was quickly sold after many months of long bidding.

Reportedly, the sale of this building was enough to pay off both the bonds and the loans. Its board of directors believes that once the transaction is completed, the legal proceedings related to the bonds and loans will also “be resolved amicably.”

However, after this sale, Goldin Financial was in an ironic situation, from the position of a landlord to a tenant because the building is also the headquarters of the company.

(According to economictimes, indiatimes)

at Blogtuan.info – Source: cafebiz.vn – Read the original article here