Which businesses will receive 30% CIT reduction from Hanoi Tax Department?

From March 15, 2022 to May 4, 2022, the Tax Department of Ho Chi Minh City. Hanoi implements the program “Accompanying businesses, organizations and individuals to make tax finalization in 2021”. The program is deployed simultaneously at the bureau’s office and 25 tax branches in districts, towns and affiliated areas with 3 supporting functions: policy support, information technology, tax declaration.

According to current regulations, the deadline for submitting corporate income tax (CIT) finalization documents for enterprises having the same fiscal year as the calendar year is the last day of the third month from the end of the year. solar calendar (March 31, 2022).

Three notable points in the content of this year’s CIT finalization revolve around supporting businesses related to “Covid”:

firstCIT is reduced according to Resolution No. 406/NQ-UBTVQH15 dated October 19, 2021 of the National Assembly Standing Committee and Decree No. 92/2021/ND-CP dated October 27, 2021 of the Government. : Reduce 30% of the payable CIT amount of the corporate income tax period of 2021 if the enterprise has a turnover in the tax period of 2021 not exceeding VND 200 billion and the revenue in the tax period of 2021 is lower than that of the tax period of 2021. with revenue in the tax period 2019.

So, There are 2 business objects eligible for CIT reduction. One is a small and medium-sized enterprise with a revenue of less than or equal to VND 200 billion in 2021. The other is an enterprise with a decrease in revenue compared to 2019.

Some listed companies whose stocks are of great interest to investors will benefit from this policy in terms of corporate income tax, such as CEO Group Joint Stock Company (stock code CEO – HNX), whose revenue in 2021 is only 901 ,8 billion dong, down 80% compared to 2019.

Or like Vietnam Oil and Gas Power Corporation – JSC (code POW – HOSE), revenue in 2021 is 24,565 billion VND, down 30% compared to 2019.

Despite the decline in business results, at the end of the year both companies were profitable and the CIT payable in the period was positive.

In addition to the two examples mentioned above, many small and medium-sized businesses and businesses whose revenue is affected by Covid are also included in the CIT reduction of the National Assembly and the Government.

Second is the Enterprise will be included in the deductible expenses when determining the taxable income of the CIT period 2021 for the expenditures to support and sponsor in cash and in kind for the Covid-19 epidemic prevention and control activities. 19 in Vietnam through units receiving donations and sponsorships specified in Decree No. 44/2021/ND-CP dated March 31, 2021 of the Government.

CEO Group in 2021 will support the Covid-19 vaccine fund with an amount of VND 19 billion

There are many businesses, both 100% foreign capital or domestic capital will be recorded the amount of Covid-19 support as a deductible expense in the tax period.

Samsung Electronics Vietnam Company donated 40 billion VND

Tuesday is deductible expenses related to medical isolation costs and Covid-19 testing costs (Official Letter 4110/TCT-DNNCN dated October 27, 2021 of the General Department of Taxation)

Specifically, including: (i) Medical isolation costs due to the Covid-19 epidemic at home and abroad for business trips abroad (meals, accommodation costs; Covid-19 testing costs) – 19; transportation costs from the place of entry to Vietnam or from the place where the subject must undergo medical isolation to the medical isolation facility; expenses for living needs during the quarantine days economic; …)

(ii) Cost of Covid-19 test or purchase of Covid-19 test kit for employees

(iii) Expenses for purchasing equipment for employees to protect employees from the risk of infection during the working process and expenses for accommodation and meals of employees staying at enterprises operating under the plan. 3 in place”.

These expenses are real and have sufficient invoices and documents to be included in the deductible expenses before corporate income tax.

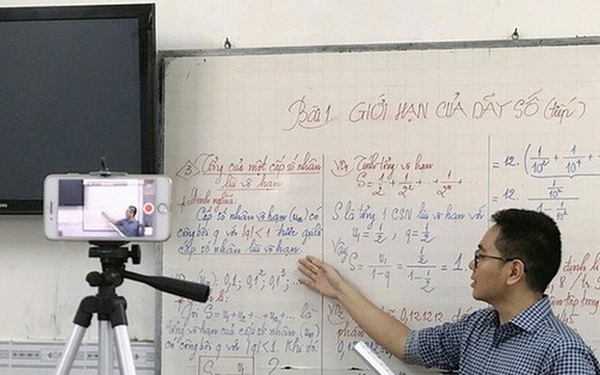

In 2021, businesses have to stretch themselves to fight the epidemic and ensure production

By Business and Marketing

at Blogtuan.info – Source: cafebiz.vn – Read the original article here