Branded investment fever: How delicious is it that Gen Z borrows hot

Only about a year ago, if I say buy branded goods It is also a form of investment, 90% of the people do not believe it. Because buying luxury goods was previously only seen as a pastime of the rich. Clothes, shoes, bags, watches… but it’s not real estate, gold, silver, and securities that claim to be profitable for investment?

However, along with the story of escalating prices, the big brands also adjusted and increased the prices of many products. As a result, what was once considered a waste product now has a price, profitable faster than real estate, gold, silver, securities. Households rushed to bring brand bags, watches … each lined up in the closet to check how much profit or loss. Brand investment fever Officially start here.

Like any investment story, branded goods look so easy to eat, but pouring money must have knowledge and learn from those who have gone before to avoid risks. Let’s quickly “catch” a few “experts” in the field, try to decipher this game!

Recently, the story of high-priced brands, the players – collectors gain great benefits are being talked about, what do you think?

This is a very normal thing that I expected before. Branded goods are a very potential investment channel at present, and are expected to “explode” even more in the future.

This time, I also earned a certain amount of profit. For example, new products purchased in 2021 such as bags, clothing, and collectibles are about 20-30% increase. The products that have been bought for a long time, the profit is calculated by times, some items have been ten times already.

What about cutting losses when investing in brands?

The story of cutting losses, I see that investing in luxury brands is rare, but not without.

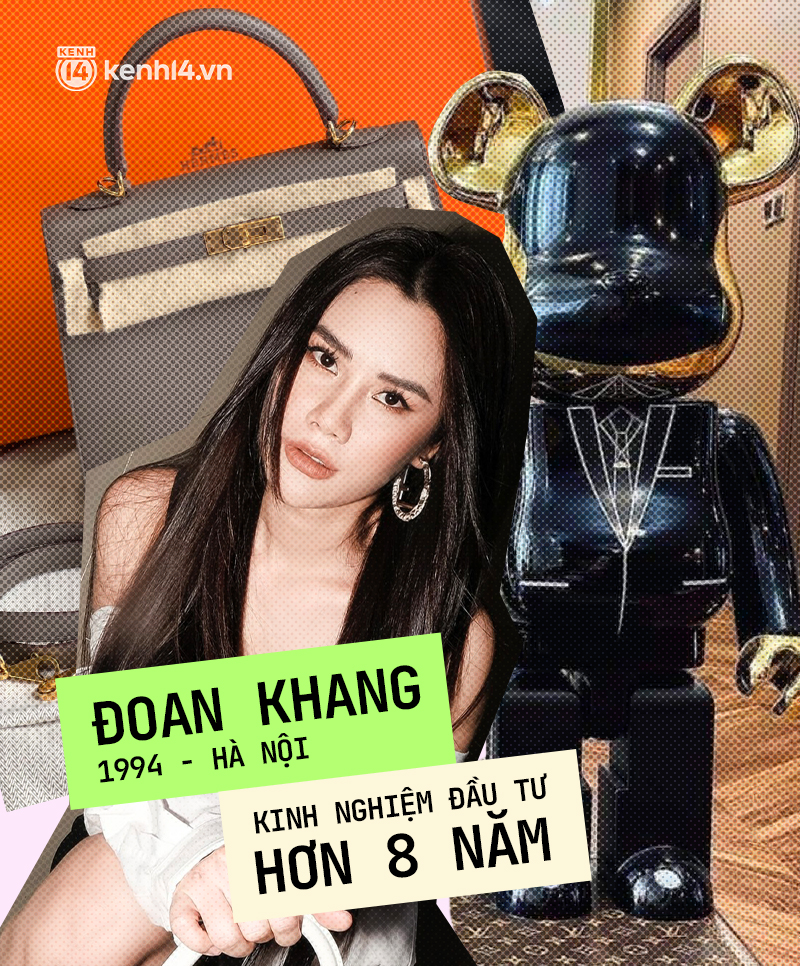

Last year, I once lost half a week in 1 week because trot… was lured by customers. The number is that I own a pair of Be@rbrick Daft Punk, just sold to customers a week ago when there was information that the band disbanded. Calculated that I am passionate about collecting, I have to ask “redeem” immediately for a price more than half times higher (about 100 million). However, I don’t regret it at all because the price of this bear pair is currently steadily increasing, money continues to make money.

A small revelation is that I used to make 10 times more profit when I sold some special and limited edition bags and collectibles. In the past few years, big brands have increased their prices continuously, so almost all branded goods have kept their value very well compared to the general merchandise level.

The Be@rbrick Daft Punk pair made Doan Khang lose hundreds of millions in just 1 week

Compared with other forms of investment such as securities, real estate, gold, foreign currency… what are the advantages and disadvantages of branded investment?

As an investor who participates in different investment channels, I see that in addition to stable long-term profitability, branded goods also help you build a very good personal image. The biggest disadvantage is probably the liquidity is not equal to the other channels because the buyers are picky, the price is also quite expensive, making many people hesitate.

What is a branded product that connoisseurs know right away that the investment will be profitable?

As a fashionista, I still want the majority of people to choose a fashion item because of its core value, rather than just looking at the investment criteria to make money. Only then will you always “profit” in every choice. As an investor, I reveal that Hermes will always be a safe and sustainable choice for those who want to try.

A corner of the Hermes collection is “producing” money every day by Doan Khang

Recently, the story of high-priced brands, the players – collectors gain great benefits are being talked about, what do you think?

The story of high-priced brands, many people flocking to collectibles has appeared for a long time. In recent years, with the explosion of the need to buy expensive items from the locals, the brand new world has become more “crazy” than ever.

The collectors who are reaping the rewards are well-deserved. Because since the brand name is not really popular, they have dared to spend huge amounts of money to own expensive items. I firmly believe that at that time, few people thought that it would be profitable, shopping was also to satisfy their personal preferences.

For the past 2 years, despite facing a pandemic, fortunately, customer demand has not decreased but even increased, so my store’s revenue is quite good. Some items that are collected and owned as well as goods stored at the store are also continuously increased by the company, bringing me a profit of about 20-30% / item.

Is it so bad to invest in a “delicious” brand?

Unlike real estate, stocks or gold, luxury goods bring the advantage of being “used” – this is true ownership. On the other hand, with the exclusivity of leading brands and the constant innovation and advancement of the brands, the brand name will increase in price. Investment in branded goods 90% is stable and profitable, the remaining 10% is also profitable but…slowly wait for the time!

However, this advantage of the brand name is also a huge disadvantage. Now that you like an item, you should spend money to buy it right away, otherwise maybe next month you will have to spend a few tens of millions more to own it.

I myself have been in business for many years, cheating on my back with a lot of knowledge is still “eating onions” continuously in 2020-2021. There are many products that have just been sold, and immediately after that, the price has been doubled and doubled, buying back will lose several tens of millions of dollars / item, but I still have to bite my teeth to pull out my wallet.

Well, consider it as a lesson in the long-term in investment.

Lam Tung on his Be@rbrick BST has a “terrible” value

Borrowing to invest in branded goods, have you tried it yet?

Already.

I am also just a young person just starting a business, business items are of high value, borrowing is inevitable.

There were times when the deals were so good that capital was poured into hoarding goods or customers ordered orders of too large value, I had to advance money in a credit card, even take a hot loan to hunt for it.

What is a branded product that connoisseurs know right away that the investment will be profitable?

Clothes, shoes, bags or collectibles that I personally invest in are very profitable. The most successful are probably collectibles that have little depreciation and “increase” in value for the whole collection.

Another tip is that the products of long-standing and historic brands such as Chanel, Hermes, LV, Goyard are all well worth the investment. As for other brands, I think people need to have a good look and standard knowledge of fashion and then decide. Choosing the right one will bring a profit that is even much higher than traditional products, but choosing the wrong one is unknown!

Recently, the story of high-priced brands, the players – collectors gain great benefits are being talked about, what do you think?

If you pay attention, a year high-end brands can increase prices 2-3 times. In the past year alone, Chanel increased the price by 4 times, making many classic bags also skyrocket in price and are actively sought. Collecting and selling for a profit is a common thing from the past to now, even buying a branded item a year is already profitable.

Perhaps in recent years, more and more fashionable young people, playing with brand names, have begun to pay attention and think about investing in this field. Personally, I think if you have the eyes, the knowledge and the “gut”, this can be a good investment channel for those who want to earn more.

What about cutting losses when investing in brands?

There is no easy piece of cake to eat, where to invest without risk, without loss of capital? Brand name too.

Before I was an investor, I was a collector. So there are items that will definitely lose money, but I still decide to own it because of the value of the design, not the hot hit, the profit of the item. Basically, what I invest is the designer’s brain, that value is never outdated, how can I lose?

What is your most “delicious” investment? Do you have any tips to choose a profitable product?

My most “fishing” time is probably selling Supreme Bogo products for 5 times the listed price.

To be sure, I think new investors should aim directly at the company’s “icon” items. For example, Hermes Birkin, Chanel Classic Flap Bag, Supreme Bogo… These are items that are always hot hits, are thoroughly sought after and have only ever increased in price, not decreased.

According to Xuan Le, a year just need to buy a product from big brands is already profitable

Photo: NVCC

at Blogtuan.info – Source: Kenh14.Vn – Read the original article here