Fed raises interest rates for the first time since 2018, signals it will make 6 hikes this year

After a two-day meeting, the US Federal Reserve (Fed) decided to raise interest rates for the first time in more than three years. This is a move to cope with the hot inflation situation without causing a great impact on the economy.

After keeping the benchmark interest rate near zero since the start of the pandemic, the Federal Open Market Committee (FOMC) said it would raise interest rates by 0.25%, or 25 basis points.

Accordingly, interest rates are currently in the range of 0.25-0.5% and raise the financial costs of some forms of borrowing such as consumer loans and credit. Fed officials said the rate hike also comes with a result that economic growth will decelerate this year.

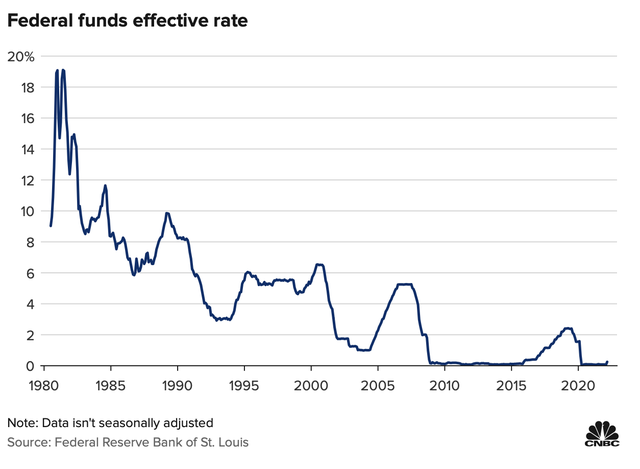

Base rate since 1980.

In addition, the FOMC also gave a signal about the roadmap for 6 rate hikes this year and the consensus increase by the end of this year will be 1.9%. This is higher than the agency’s estimate in December. The FOMC is expected to make three more rate hikes in 2023 and not the following year.

The 0.25% interest rate hike was approved when there were some objections, for example Fed President Louis James Bullard wanted a 50 basis point increase.

The FOMC last raised interest rates in December 2018, then paused in July and forced to lower rates.

During the meeting, central bank officials also revised the economic outlook on many aspects, amid expectations that inflation will rise much higher than expected in December and GDP growth will slow significantly.

FOMC members raised their inflation estimates, predicting that the personal expenditures (PCE) price index excluding food and energy will grow 4.1% this year, compared with a forecast of 2.7% in October. 12/2021. Core PCE is expected to grow by 2.7% and 2.3% respectively over the next 2 years, then decline to 2% in the long term.

The FOMC said after the meeting: “Inflation remains high, reflecting the imbalance between supply and demand due to the impact of the pandemic. Rising energy prices and price pressures will have an effect on a broader scale. “

In terms of GDP, December’s estimate of 4% growth has now been downgraded to 2.8%, as the FOMC specifically notes the potential effects of Russia-Ukraine tensions. Estimates for the following years are unchanged. The Committee still forecasts the unemployment rate this year will be at 3.5%.

at Blogtuan.info – Source: Soha.vn – Read the original article here