Oil prices fall, gold flat, iron ore recovers

Oil falls after Russia-Ukraine talks

Oil prices fell for the fifth day out of the last six as the market awaited progress in the Russia-Ukraine peace talks and an unexpected increase in US oil inventories.

Brent oil price this session fluctuated in a range of 6 USD (97.55 USD to 103.70 USD) before closing at 98.02 USD, down 1.89 USD/barrel, or 1.9%. The price of US West Texas Intermediate (WTI) oil also fell $1.40, or 1.5%, to settle at $95.04 per barrel.

Several factors have driven the current price change, including hopes of a peace deal between Russia and Ukraine and faint signs of progress in the US-Iran relationship to restore The 2015 deal allows the Islamic Republic to export oil if Iran agrees to limit its development of nuclear ambitions.

Chinese demand is expected to slow down due to the rising number of Covid-19 infections.

Stable Gold

Gold prices were stable in the past session as the dollar weakened after the US Federal Reserve (Fed) raised interest rates by a quarter of a percentage point as the market expected.

At the end of the session, spot gold price increased by 0.1% to 1,920.45 USD/ounce; Gold futures in April fell 1.1% to $1,908.40.

Tai Wong, an independent metals trader in New York, said: “Gold is holding up as the recent sharp drop may have been on track. I expect gold to trade around 1,880 – $1,960 in the near future”.

Aluminum, copper recovered, nickel fell

Aluminum prices rose as the market expected more economic stimulus measures from China, while nickel prices fell as soon as trading resumed after a week of trading halt.

Three-month aluminum futures on the LME rose 2.1% to $3,345.50 a tonne, copper also rose 1.4% to $10,044, while nickel fell 5% but electronically traded for this commodity. has been paused due to technical problems.

Wheat fell

U.S. wheat futures fell to a ceiling on Tuesday as investors pondered whether negotiations between Ukraine and Russia could lead to a truce in the three-week war. Rainfall forecasts in the American Plains allayed concerns about dry weather that could harm crops.

Corn prices ended the session lower as negotiations between Moscow and Kyiv eased concerns about a prolonged disruption to grain exports in the Black Sea.

Soybean prices rose at the beginning of the session but also fell towards the end of the session amid concerns about falling US soybean export sales due to competition from Brazil.

At the end of this session, the price of wheat fell to the end of its daily limit of 85 cents, to 10.69-1/4 USD/bushel.

Corn futures for May ended down 28 US cents to $7.30/bushel, while soybeans for the same term fell 9-1/2 US cents to $16.49-1/4/bushel.

Recovery Coffee

Arabica coffee futures futures rose at the close, recovering from a four-month low of the previous session as the recent wave of liquidations from long-term funds appears to have subsided.

Specifically, the price of arabica coffee delivered in May increased by 6.35 cents, or 3.0%, to $2,175/lb, and robusta coffee delivered in May increased by $67, or 3.2%, to $2,148/lb. ton.

Rubber goes sideways

Rubber futures futures in Japan ended almost unchanged on support from a weakening yen and tight raw material supplies, despite falling prices on the Shanghai Exchange.

Rubber contract for August delivery on the Osaka Exchange dropped slightly by 0.2 yen, or 0.1%, to 244.7 yen ($2.07)/kg.

Raw material supplies are tight due to the ongoing winter in southern parts of Thailand.

The rubber contract for May delivery on the Shanghai futures exchange in the same session fell 135 yuan to 13,335 yuan (US$2,100.10) per ton. Earlier in the session, the price hit its lowest level since July 28, at 13,150 yuan.

Iron ore increased

Iron ore futures in Dalian and Singapore both recovered from two-week lows, after China’s Vice Premier Liu He said Beijing plans to take measures to boost the domestic economy. and ensure stable capital markets.

The most-traded iron ore contract, for May delivery, on China’s Dalian Commodity Exchange ended the daytime session up 5.2 percent to 804 yuan ($126.65). )/ton after two days of selling.

On the Singapore Exchange, April delivery rose 9.9% to $151.25 a tonne after six consecutive declines.

Coal rose sharply

The price of coke used in steelmaking in China on March 16 was at 3,338 yuan/ton ($525/ton), up 6.3% from the previous session. Since the beginning of the year, the price of this item has increased by 37%.

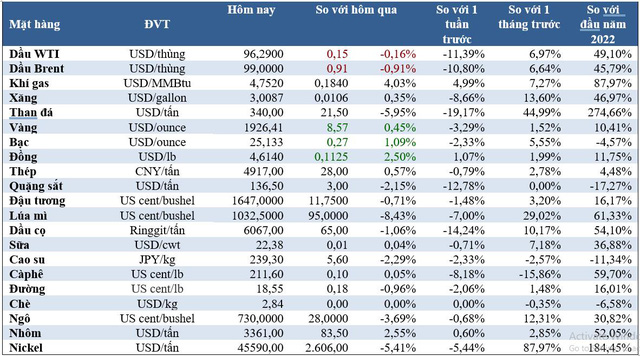

Prices of some key items in the morning of March 17:

Market on March 16: Oil price broke through $100, gold hit a 2-week bottom, coffee hit a 4-month low

at Blogtuan.info – Source: cafebiz.vn – Read the original article here