The costs related to loans at the bank need to know

In the context that banks are increasing the collection of service fees to increase non-interest income, borrowers need to carefully understand the fees related to the loan before signing a loan agreement with the bank.

The article analyzes a number of fees that borrowers have to bear when borrowing capital at a bank. Including the group of fees payable to state agencies and the group of fees that banks will collect. The fees collected by the bank are published publicly on the website, easy for borrowers to refer to.

Group of fees paid by customers to state agencies

1. Security contract notarization fee

For loans with collateral, most banks require customers to sign a security contract. The security contract is notarized or authenticated at the Notary Public Office/Department. According to regulations, the fee for notarization of Mortgage and Pledge Contracts at the Notary Office/Department is determined based on the value of the property; In case the property mortgage or mortgage contract contains the loan value, the loan value shall be calculated (Point a6, Clause 2, Article 4 of Circular 257/2016/TT-BTC).

Customers will have to pay more notarization fees than the mortgage contract without specifying the loan value because the Notary Office/Department determines the rate of collection based on the value of the property. While the bank always lends customers an amount less than or equal to the property value stated in the Mortgage Contract. Therefore, to support customers, the bank will specify the value of the collateral being secured for the specific loan value of the customer.

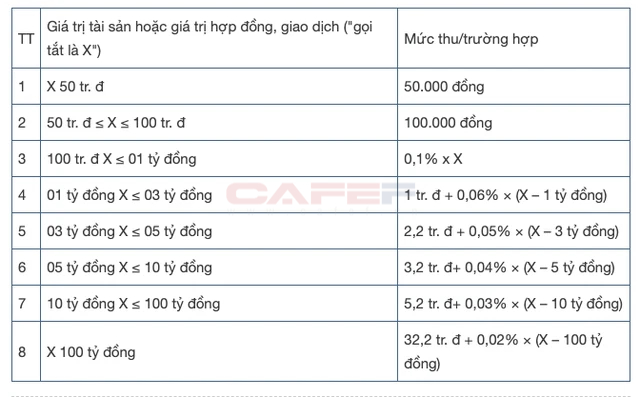

The fee for notarization of mortgage and pledge contracts according to current regulations is at least VND 50,000 (asset value or contract value, under VND 50 million for transactions), and a maximum of VND 70 million. asset value or contract value, transaction over 100 billion dong). Specifically:

|

2. Fee for registration, deregistration of security interest (or security transaction)

For loans secured by real estate (land use rights, land use rights and land-attached assets) after the security contract has been notarized at the Notary Office/Office, the registration will be made. Sign the security interest at the Office/Branch of the Land Registration Office. Fees for registration and deregistration of security interests vary from place to place. This fee is decided by the People’s Council of the province or centrally run city on the basis of the report of the People’s Committee of the same province.

The fee for registration of security interest may be collected according to the registration dossier or the number of certificates of land use rights, ownership of houses and other land-attached assets or the number of land parcels and land-attached assets. certified on a certificate in the application for the security or other registrations as appropriate. For common ground in localities, the fee for registration of security interests (real estate and movables) is about 80,000 VND/document. The fee for deregistration of security interests (real estate and movables) is about 20,000 VND/document.

Group of bank fees collected from customers

According to the provisions of Article 14 of Circular No. 39/2016/TT-NHNN regulating the lending activities of the bank, the bank and the customer themselves agree on the collection of fees related to lending activities including: : (i) early repayment fee; (ii) the fee for the standby line of credit; (iii) syndicated loan arrangement fee; (iv) capital withdrawal commitment fee; (v) other fees related to lending activities. For loans for individual customers, banks often apply early repayment fees, capital withdrawal commitment fees and collateral valuation fees.

1. Early repayment fee

When a borrower requests to settle a debt before the agreed time limit in the credit contract, the bank will collect a fee for early repayment. For example: a customer borrows for a period of 24 months, but after 10 months, the customer requests to pay off the loan to the bank. At this time, the bank will collect an additional fee in addition to the principal and interest that customers have to pay.

Why do borrowers repay their loans early but are charged a fee by the bank? To put it simply, the bank collects this fee to partially offset the bank’s cost of capital and operating costs. Suppose, in order to have money to lend to customers for 24 months, the bank must “borrow capital” and pay interest to depositors with a term of 24 months. When customers repay their loans before the due date, the bank will lose interest income but still have to pay interest to depositors. In addition, the bank must pay the costs related to the customer’s loan application such as contract printing paper, ink, salary for employees, etc. Therefore, the bank is entitled to request the customer ” share” a part of the cost that the bank “advance” to serve customers.

Currently, the prepayment fee between banks is quite similar, about 1% – 3% depending on whether the loan is short term or medium and long term. In addition, in order to compete and harmonize with the interests of customers, some banks also offer early repayment rates that decrease gradually over the remaining loan period. The shorter the remaining loan period, the lower the prepayment fee or even no early repayment fee as Nam A Bank applies no early repayment fee for medium and long-term loans of which the maturity date is limited. actual loan period ≥ 70% of the loan period.

Therefore, borrowers need to carefully read the terms of early repayment fee in the credit contract or ask the credit officer to explain in detail the terms and rates of the early repayment fee before signing the credit contract. use.

2. Capital withdrawal commitment fee

According to Clause 4, Article 14 of Circular 39/2016/TT-NHNN, “The capital withdrawal commitment fee is from the effective date of the loan agreement to the date of first loan disbursement”. Circular 39 does not specifically guide the determination of fees for capital withdrawal commitments.

According to the writer’s observations, currently banks are determining to collect capital withdrawal commitment fees in two ways. First, the bank collects a commitment to withdraw capital right after the first disbursement of the loan amount to the customer. Second, the bank will collect the capital withdrawal commitment fee if the customer does not comply with the capital withdrawal commitment as agreed in the credit contract. At SHB, the bank will charge a withdrawal commitment fee of 0.1% if the customer does not receive the first disbursement within 3 months from the date of signing the credit contract. At SeABank, the bank also charges a fee for breaching the commitment not to withdraw all of the capital, which is 0.2% x the undisbursed amount, applicable in the case that on the loan settlement date, the customer still does not receive the full disbursement. loan agreed upon.

Normally, the commitment fee to withdraw capital collected in the second way will be more reasonable than the first method. Because, based on the agreement, the bank has prepared money to disburse to the customer, but the customer does not receive the disbursement or violates the committed time, it will incur a fee. While customers receive debt according to their commitments and still be charged a commitment fee to withdraw capital, it is not appropriate.

The commitment fee for capital withdrawal at banks ranges from 0.1% – 0.4%, the minimum amount the bank collects is from VND 50,000 to VND 1,500,000 depending on each bank.

3. Security asset appraisal fee

Some banks establish or associate with independent valuation companies to appraise property prices and collect appraisal fees from customers. This is also a significant source of non-interest income if the bank has a subsidiary that conducts asset valuation activities.

Through the exchange of information with a valuation company that is a subsidiary of a bank, the appraisal fee is determined according to the type of asset (movable or immovable property) and the value of the appraised asset. . The same value of property, but the fee charged for movable property will be higher than that of immovable property. The minimum fee is 1.5 million dong for assets valued at 0-1 billion dong, the maximum fee can be up to 395 million dong for assets valued at 3,000-4,000 billion dong. . The assets are valued from 5 to 10 billion VND, the fee is from 3.4 to 5.4 million VND.

Some other costs related to the loan

Besides the fees specified above, borrowers also have to bear a number of other costs related to the loan such as:

1. Mortgage insurance

For loans where the collateral is movable property such as cars, production lines, machinery and equipment, goods, … or real estate such as apartments, banks will ask customers to borrow required to buy insurance for the property and the beneficiary is the lending bank.

2. Term insurance for borrowers

Some customers when taking loans at a bank are required by the bank to register a life insurance package, the bank is the beneficiary in case the customer suddenly dies and has not paid off the outstanding balance at the bank. row. Banks that provide loan products for retirees and people with meritorious services to the revolution such as LienVietPostBank and Dong A Bank will encourage customers to buy term insurance.

In short, borrowers need to carefully read the terms of the credit contract, ask the bank’s credit officer to clearly advise on the conditions for early repayment, the commitment fee for capital withdrawal, the expenses that may be incurred by the borrower. may arise in connection with the loan. Compare and choose the right bank for your credit needs and repayment plan.

(According to Economic Lifestyle)

at Blogtuan.info – Source: vietnamnet.vn – Read the original article here