After 1 year of hard work “cutting losses”, Tan Hiep Phat’s daughter switched to “surfing” code YEG?

Ms. Tran Uyen Phuong – daughter of Tan Hiep Phat’s family – has just sold 107,300 shares of YEG. Thereby, Ms. Phuong will reduce her ownership from 14.33% to 13.98% of charter capital, the transaction will be made on March 4, 2022.

Ms. Phuong’s move to sell took place after YEG’s stock surged and peaked at nearly 30,000 VND/share. This is also the highest level of YEG in the past 1 year.

Notably, Ms. Phuong also had continuous buying and selling transactions of YEG shares, after the previous hardening of ownership reduction when YEG’s market price was in a sharp downtrend. Specifically, on 11/11/2021, Ms. Phuong has just sold 1.6 million shares of YEG to reduce her ownership from 7.5% to 2.47% of charter capital at YEG and is no longer a major shareholder in YEG. YEG. However, at the beginning of January 2022, Ms. Phuong bought 3,696,808 shares of YEG to raise her ownership from 2.51% to 14.33% of charter capital, the transaction was made on January 10/ 2022.

Ms. Phuong’s “surfing” took place in the uptrend of YEG again. Along with the wave of stock increases, another major shareholder, VinaCapital – DFJ VinaCapital Venture Investment Ltd (DFJV) – registered to sell all of more than 3 million YEG shares from February 22 to March 23, 2022 to take advantage of the opportunity. directory structure. Transactions will follow the agreed method.

Regarding the “love” between YEG and Tan Hiep Phat, at the beginning of 2020, Ms. Phuong spent up to VND 300 billion to buy more than 6 million shares of YEG and became the second largest shareholder, after the Chairman, Mr. Nguyen Anh Nhuong. Tong. Estimated purchase price of Ms. Phuong is 50,000 VND/share.

At that time, answering the press about buying shares, Tan Hiep Phat said that this was a move in the cooperation strategy between the two sides. In particular, Yeah1 after the shock with Youtube began to find a new direction: Developing the M2C (manufacturer to consumer) multi-channel commercial business, starting with the Mega1 “promotion king” app, later developing into a ecosystem. Thai Giga1.

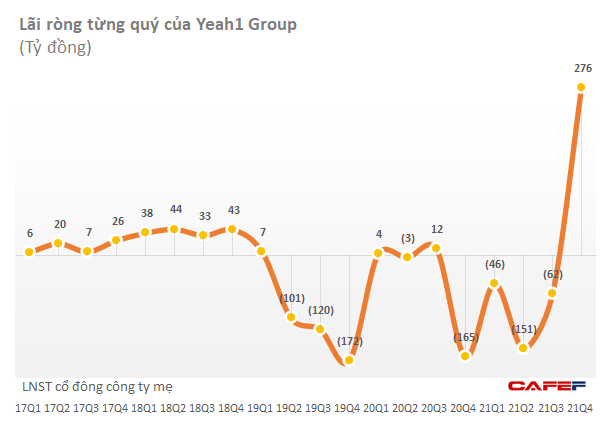

Bringing many expectations at the beginning, but so far Giga1 has not brought any sweet fruit for Yeah1. Difficult business caused YEG to suffer losses for 3 consecutive quarters in 2021. In the market, the stock also fell to the bottom, Ms. Phuong had to continuously “cut loss” and bring her ownership back to 2.47% of capital. 11/11/2021.

However, in the fourth quarter of 2021, thanks to the sudden financial revenue, through the divestment of subsidiaries, YEG made a profit of 276 billion dong in the fourth quarter of 2021. As a result, for the whole year, YEG recorded a net profit of nearly 17 billion dong, getting rid of the forced listing cancellation (because 2019-2020 all suffered losses).

Business and Marketing

at Blogtuan.info – Source: cafebiz.vn – Read the original article here