Nghi Son Refinery: 2 commitments, Vietnam ‘lost single and double loss’

The incentives for Nghi Son refinery have at least two key points that make Vietnam now face a ‘dilemma’ with this foreign-invested megaproject.

Co., Ltd Nghi Son Refinery and Petrochemicals (NSRP) is a joint venture company established in April 2008 by four capital contributors, including Kuwait International Petroleum Company (KPE), Japan Idemisui Kosan Company (IKC) and the company. Mitsui Chemicals Japan (MCI), of which the Vietnam Oil and Gas Group (PVN) only contributes 25.1%. The project started commercial operation in December 2018.

This project was approved in 2008 with a capital of 6.1 billion USD, then the capital increased to 9.2 billion USD.

On November 5, 2012, the Prime Minister gave instructions (in Notice No. 367/TB-VPCP dated November 5, 2012 of the Government Office) on the results of negotiation on the Agreement on Guarantee Commitment of the Government. The Government for the Project (GGU) for the Project, in which: Agreeing in principle to the draft FPOA through which PVN consumes refined petroleum products for the project.

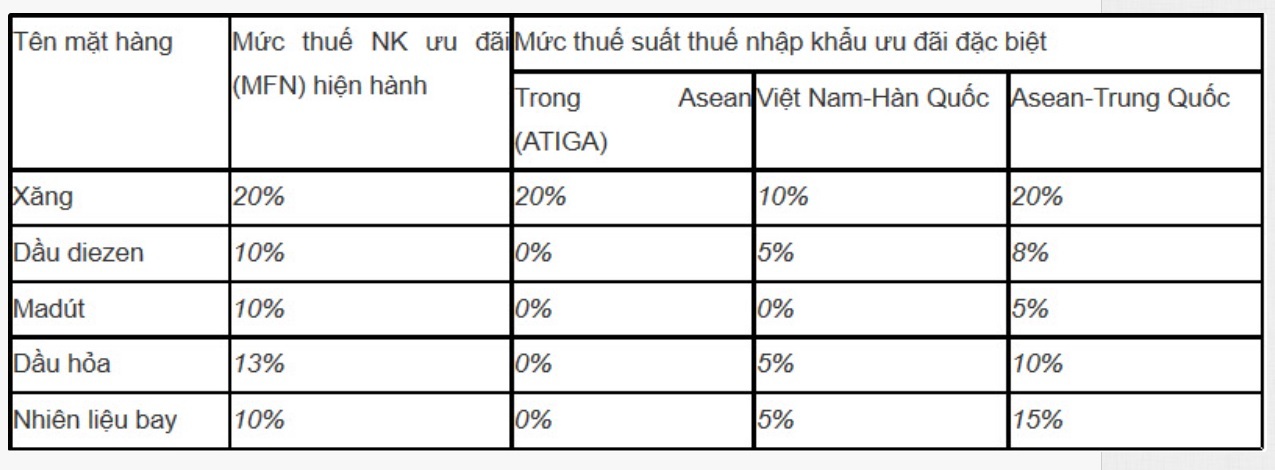

In addition, on behalf of the Government, PVN has committed to preferential import tax on oil refining products. The Government has committed to give preferential treatment to the project.

|

| Nghi Son Oil Refinery still faces an uncertain future |

How much to produce, Vietnam is forced to buy it all

With the above guarantee commitment, how many products does Nghi Son oil refinery produce, PVN must cover it all.

According to the principles specified in the Government Guarantee Commitment Agreement and the Fuel Product Outsourcing Agreement (FPOA), the selling price of Nghi Son oil refinery is equivalent to that of imported petroleum.

Meanwhile, this time Vietnam also signed many multilateral and bilateral free trade agreements. The import tax rate applied to domestic oil refineries is higher than the preferential tax rate under the Free Trade Agreements. So in theory, the product price of Nghi Son oil refinery will always be higher than that of imported gasoline.

However, the advantages of buying domestically is being paid in local currency, saving transportation costs… are issues that petroleum wholesalers can consider when buying from Nghi oil refinery. Paint.

In a report to the Prime Minister dated February 3, 2016, the Ministry of Industry and Trade warned that the consumption of products of Nghi Son oil refinery would be very difficult because it could not compete with imported petroleum in the market. Vietnam. Meanwhile, key traders gradually increase the import volume of goods originating from countries enjoying special preferential tax such as Korea because they are cheaper.

Having to buy all the products produced by Nghi Son refinery while the current regulations on petroleum trading do not require major petroleum traders to buy from domestic oil refineries is a problem. The issue used to cause headaches for management agencies.

Meanwhile, imported products may be cheaper than buying from domestic refineries, so at that time the Ministry of Industry and Trade was concerned if the Government did not strictly control the amount of imported petroleum, there were no changes in the quality of petroleum products. With mechanisms and policies in petroleum business, the consumption of off-take products will face many difficulties and great risks.

At that time, there was a proposal that the Ministry of Industry and Trade only grant import quotas (quota) after balancing to ensure the consumption of all products of domestic oil refineries. But ministries and sectors simultaneously protested fiercely due to violations of WTO commitments and signed trade agreements.

However, so far, the import of petrol and oil has always been carefully calculated by the Ministry of Industry and Trade to ensure that Nghi Son oil refinery is not ‘failed’.

During the past time, when there are fluctuations, the consumption of products of Nghi Son or Dung Quat oil refineries is difficult, the Ministry of Industry and Trade often has written requests to petroleum wholesalers to prioritize buying from domestic oil refinery.

Import tax incentives, compensation when import tax is lower

According to the Government Guarantee Agreement and Commitment, Nghi Son Refinery may apply the wholesale price at the factory gate which is the import price plus 7% import tax for refined products (except 5%). for LPG) and 3% for petrochemical products. This offer is valid for a period of 10 years after the date of commercial operation (year 2027).

Within the above period, if Vietnam stipulates a lower import tax rate, the Government will ensure that PVN will pay to Nghi Son Refinery the difference between the actual import tax rate and the 7% tax rate for refining products (except 5% for LPG) and 3% for petrochemical products, in all cases Nghi Son Refinery sells its products to the domestic market, whether through PVN or an external party. other target.

On the basis of the Government’s direction, on January 15, 2013, PVN and NSRP signed a Product Offtake Contract (FPOA), in which the import tax incentives corresponding to each product have been approved. included in the price formula of this Contract.

Ironically, despite such commitment to Nghi Son oil refinery, the Vietnam – Korea Free Trade Agreement signed on May 5, 2015 and took effect from December 20, 2015 has tax commitments. import of diesel oil remained at 5%, other petrochemical products remained at 0-5%. Meanwhile, the ASEAN-Korea FTA, which took effect on September 1, 2009, commits to 0% import tax on oil products.

Thus, in theory, oil imported from Korea will be cheaper than domestic factories such as Nghi Son and Dung Quat. That special preferential tax rate is lower than the import tax committed for Nghi Son refinery, so PVN immediately has to compensate for the tax on oil products for Nghi Son refinery.

|

| Vietnam’s petroleum import tax in international commitments |

The currently applied gasoline import tax of 20% is still higher than the preferential rate for Nghi Son of 7%, so PVN does not have to compensate for tax (according to the committed schedule, from 2017 to 2022, the tax rate is the same as the tax rate). The import tax applied to gasoline products will remain at 20%, but the tax on gasoline imported from Korea under the FTA signed with Korea is only 10%).

Therefore, when Nghi Son oil refinery comes into operation, within 10 years, PVN will have to spend billions of USD to offset taxes for this plant so that the selling price of these plants can be competitive with the price of imported gasoline. .

In 2016, Vietnam Oil and Gas Corporation Once given the scenario: Based on the assumption that the WTI crude oil price is 75 USD/barrel, PVN calculated and reported to the Ministry of Finance the amount PVN must pay to NSRP arising from the implementation of priority on behalf of the Government. Import tax commitment incentives for the Project are for the duration of the incentives as follows: One is the difference in import tax on petroleum products (paid through FPOA): about 65 trillion VND (of which 7 trillion dong to pay for excise tax obligations, VAT incurred on the tax difference). Second, the difference in import tax on petroleum products (Sold by Nghi Son Refinery to third parties) is about 10 trillion dong.

The total amount of tax compensation calculated at that time was about 75 trillion VND.

This calculated number until now is not clear whether there is any difference or not because the information is kept confidential. But as soon as the Nghi Son Refinery and Petrochemical Complex came into commercial operation, the amount of money PVN had to pay for Nghi Son refinery arising from the Government’s implementation of import tax incentives for this project was huge.

This means that the profit from the 25% capital contribution that PVN participates in this project may be much lower than the amount spent to offset tax. In the context that Nghi Son oil refinery is reporting losses like today, Vietnam is actually suffering double losses.

Not long ago, Nghi Son Refinery had to cancel the import of 2 crude oil tankers in January and face the risk of shutting down on February 13, 2022 due to serious financial difficulties. Currently, Nghi Son Refinery and Petrochemical Plant does not plan to deliver goods to key traders in April and May, especially after May, it is not clear about the ability of the plant to maintain production. . At a recent meeting, Minister of Industry and Trade Nguyen Hong Dien also informed that the accumulated loss of this business has reached $3.3 billion in 3 years, the amount of raw material debt is also up to $2.8 billion. This makes Vietnam’s petroleum supply in a passive position. Because the product has to be consumed for Nghi Son oil refinery, if there is a glut of imports, it is possible that all products of this project will not be sold (if the project returns to normal operation). As for Nghi Son with an uncertain future, a shortage of petroleum supply is inevitable. |

Luong Bang

at Blogtuan.info – Source: vietnamnet.vn – Read the original article here