Road is the “king of steel” in Southeast Asia, keeping a “mountain” of cash of VND 40,000 billion, why does billionaire Tran Dinh Long exclaim “We operate money very poorly”?

In a recent share, King of Steel Tran Dinh Long said, “Three to four days ago, in the mass media, it was reported that Hoa Phat was the enterprise with the most cash in Vietnam, more than 40,000 billion, this shows that we run the money very poorly.” What is the truth of this statement?

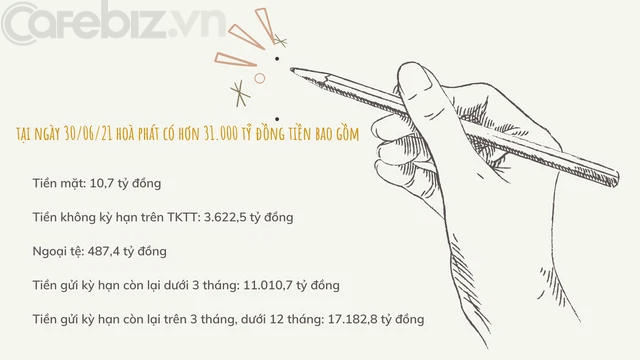

According to Hoa Phat’s fourth quarter consolidated financial statements, as of December 31, 2021, the balance of Cash and cash equivalents is VND 22,471 billion, Investment balance held to maturity is VND 18,236 billion. In total, Hoa Phat has 40.707 billion VND cash and cash equivalents.

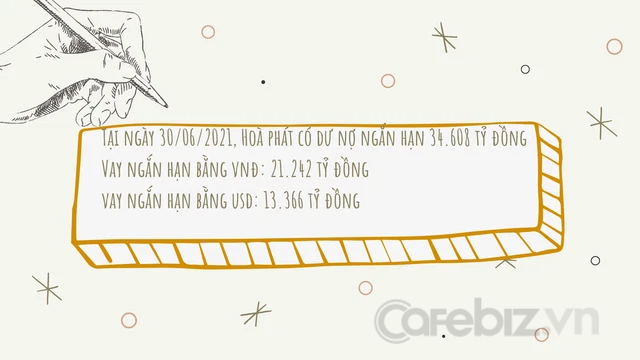

At the same time, on the capital side, the company also recorded short-term loans of 43,747 billion dong and medium and long-term loans of 13,465 billion dong.

Thus, it was not until the information about the syndicated loan of VND 35,000 billion of Hoa Phat Dung Quat 2 project was widely reported that people asked Hoa Phat, why does a lot of money still have to be borrowed?

To answer this question, let’s review the company’s financial statements, because the financial statements of the fourth quarter of 2021 are currently being audited and do not have detailed numbers, we temporarily use the reviewed semi-annual financial statements of the company. Hoa Phat.

Source: Hoa Phat’s 2021 semi-annual financial statements

Source: Hoa Phat’s 2021 semi-annual financial statements

According to the explanation in the financial statements, the deposit interest rate of the remaining term deposits from 3 months to 12 months is about 3.3% – 7.6%/year. Interest rates on short-term loans in VND from 1.6% to 6%/yearUSD loan interest rate from 0.89% – 3.6%/year.

Hoa Phat is a large enterprise with international payment activities (import and export), so the interest rates applied by banks will always be at the best in the market, so it is not difficult to understand if this enterprise can get credit lines with preferential interest rates.

Also, pay attention to Hoa Phat’s outstanding balance in USD. With the VND appreciation against the USD as in the past 2 years, this is a great financial advantage for businesses that are recognized by the industry. foreign currency loans.

In the past, borrowing in foreign currencies often faced great risks from exchange rate fluctuations. The level of volatility causes loan costs to be up to 8-10% in some years, in the 3-5% range, and around 2%. But in the two years 2020 – 2021, when the USD/VND exchange rate slips, businesses can borrow foreign currencies again double benefit: The interest rate is cheaper than the VND loan interest rate (about 2-3%/year cheaper) and the exchange rate decreases.

From October 2019, according to the provisions of Circular 42/2018/TT-NHHNN, credit institutions and foreign bank branches are only allowed to consider lending decisions in foreign currency for capital needs such as: after:

– Short-term loans for payment abroad for imported goods and services in order to carry out the plan for production and trading of exported goods through Vietnam’s border gates when the borrower has enough foreign currency from the source. revenue from production and business to repay loans;

– Short-term loans to petroleum importers that are assigned annual petrol and oil import quotas by the Ministry of Industry and Trade to make payment abroad for petrol and oil imports when the petroleum importers do not have or there is not enough foreign currency revenue from production and business activities to repay loans;

– Short-term loans to meet domestic capital needs for the implementation of plans for production and trading of goods for export through Vietnam’s border gates, but the borrower has enough foreign currency from export revenue to loan repayment.

Moving on to an idea in Mr. Tran Dinh Long’s sharing “we run the money very poorly“Is that true?

First of all, to evaluate whether a business uses working capital effectively or not will evaluate traffic speed of working capital components including cash, accounts receivable and inventory, also known as working capital turnover. With the same working capital in the same period of time, the business that generates more revenue, that business is more efficient.

If working capital is to move quickly, the stages from importing raw materials to production; sell; Debt recovery must move quickly. This means that the cash reserve period, the inventory holding period and the receivable collection period of the business are as short as possible.

However, each enterprise will have different characteristics in production and business activities, commercial enterprises have faster capital turnover than manufacturing enterprises, fields with long production cycles such as agriculture have slow capital turnover. than other fields, small-scale companies are faster than large-scale companies,…

With a large-scale unit like Hoa Phat, which produces steel, is an industry that is extremely sensitive to the price of input materials such as ore, steel billet, coal, etc., the time to store money, inventory, or recovery time Receivables cannot be too short, but must be based on the actual situation to ensure operational safety, as well as balance with other factors to achieve maximum efficiency.

For example, finished product inventory must be based on sales capacity (past output, signed contracts, orders…) to supply agents. Inventory of raw materials must ensure production according to the production plan within 3-6 months…

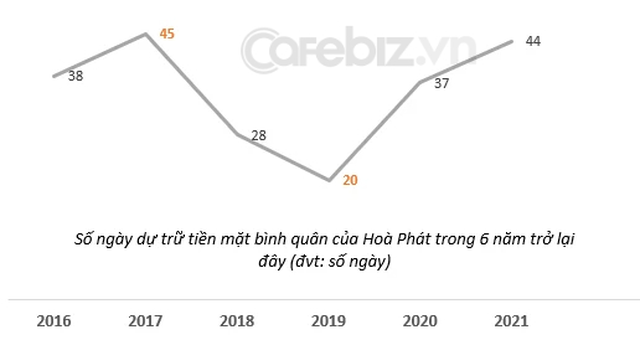

Returning to the story of Hoa Phat’s money operation, we cannot look at the cash balance at a time to evaluate, but must look at the money movement in the business. An index commonly used to assess this movement is average number of days of cash reservewhich can be understood simply as the average time in a year cash is “itself” before converting into inventory or accounts receivable.

Calculating data according to the parameters of money and cost of capital on the financial statements of enterprises

Here, in the calculation technique, the remaining term deposits from 3 months to 12 months have been removed, because these funds are not in cash-commodity circulation, but have been separated for living investment. profit (short term).

Hoa Phat’s cash reserve days is the highest 45 days, the shortest 20 days. This is a reasonable number, not to mention that the MONEY used in this calculation is over 50% of interest-bearing deposits (the remaining term is less than 3 months). If we exclude this amount, then The number of days of the company’s money reserve is only about 10 to 20 daysis a “beautiful” number for a large-scale production enterprise like Hoa Phat.

Obviously, with today’s development and position, Hoa Phat cannot have a “poor” management of any stage or field. Even the financial apparatus of the corporation will be the ones who understand and are better at calculating than anyone else.

As for investors, look at the balance of Money for fun, but this number is only for the time, always moving, flexibly changing in accordance with the calculation of the Enterprise in each period. Not a business because this year’s large cash balance, next year’s decrease means that the financial situation of that business is poor.

By Business and Marketing

at Blogtuan.info – Source: cafebiz.vn – Read the original article here