Consecutively decreasing, what price will gold go to?

After leaving the peak of 74 million dong/tael, the domestic gold price this week continued to correct downward, making many investors worried about buying gold.

Cut loss tens of millions

Domestic gold buyers spent the trading week with great disappointment due to the continuous sharp drop in prices. With the psychology of buying for profit, many investors have suffered losses after buying since last week.

At the beginning of the week, the price of 9999 gold bars at SJC Hanoi was 67.4 million VND/tael (buy in) – 69.22 million VND/tael (sold out). SJC Ho Chi Minh City listed at 67.4 million dong/tael (buy in) and 69.20 million dong/tael (sold out).

At Doji Hanoi, the price of SJC gold is 67.2 million dong/tael (buying in) and 69.2 million dong/tael (selling out). Gold price at Doji Ho Chi Minh City is 67.2 million VND/tael (buy in) and 69.2 million VND/tael (sold out).

In the session of March 15, the gold price continued to plunge, the gold price of 9999 at the Saigon Jewelry Company SJC listed for the Ho Chi Minh City market at 67.30 – 69 million VND/tael (buy in – sell). out), a decrease of 400 thousand dong in the buying side and 800,000 dong in the selling side.

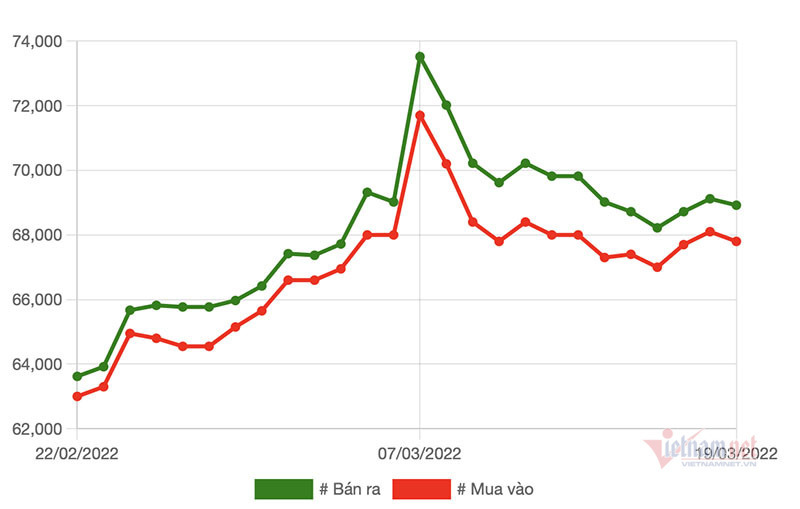

|

| Gold price chart last week |

At the same time, Doji Jewelry Group also listed gold price 9999 in Hanoi market 66.8-68.2 million dong/tael (buy in – sell out), down 200 thousand dong in buying afternoon and 600 thousand dong in selling afternoon.

In the following sessions, the domestic gold price left the mark of 69 million dong/tael in the afternoon of selling. At the end of yesterday’s trading session, the price of 9999 gold bars at SJC Hanoi was 67.8 million dong/tael (buy in) – 68.92 million dong/tael (sold out). SJC Ho Chi Minh City listed at 67.8 million dong/tael (buy in) and 68.9 million dong/tael (sold out).

At Doji Hanoi, the price of SJC gold is 67.7 million dong/tael (buy in) and 68.9 million dong/tael (sold out). The price of gold at Doji Ho Chi Minh City is 68 million VND/tael (buy in) and 69 million VND/tael (sold out).

Compared to last week’s price, the domestic gold price has decreased from 1-1.3 million dong/tael, depending on the business unit.

Before the decline in gold’s price, many investors rushed to cut losses. Ms. Nguyen Bich Thuy (Ba Dinh, Hanoi) accepted to lose 30 million dong after selling 10 gold trees. She bought it at a time when the gold price was trading at 70 million dong/tael.

“Gold skyrocketed to 74 million dong/tael and then fell, I also risked buying to invest in surfing. But seeing that gold fell too much, I had to sell,” she said.

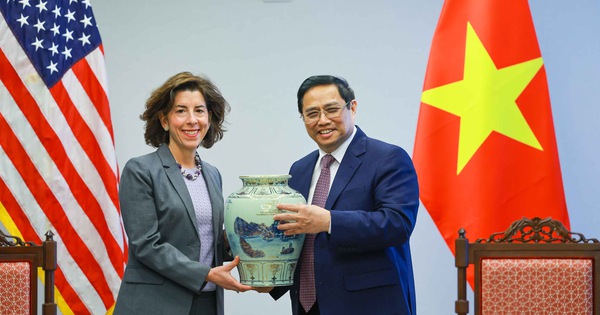

|

| Many investors cut losses because they bought gold at high prices (Photo: Bao Anh) |

Gold continues to fall?

According to experts, the reason why the world gold price plunged is due to the positive news about the Russia-Ukraine war, which helped the stock market increase, thereby putting pressure on the metal markets.

However, many investors remain bullish on gold. According to Bloomberg Intelligence, gold is considered a potential asset around the end of 2022, especially when commodities have shocking prices because of supply shortages.

According to this unit, the demand for gold reserves is increasing. Portfolio managers are looking for alternatives to recession risks and stock market reversals.

Gold is forecasted to reach $2,000-2,500/ounce by the end of the year and $2,000 will be a long-term support for this precious metal.

Currently, gold has broken through the resistance area of $1,915 per ounce and successfully tested the resistance of $1,935 per ounce. This is resistance at the short term 20 EMA exponential moving average.

“History shows that the price of gold usually rises with rising interest rates,” said George Milling-Stanley, Head of Gold Strategy. When the Fed raised interest rates nine times between December 2015 and December 2018, the price of gold rose 17%. And when the Fed raised interest rates 17 times between June 2002 and June 2006, the price of gold rose 57%.

“Looking at the lessons of history, combined with the current highly volatile environment both economically and geopolitically, the price of gold will not stop rising,” he assessed.

Told him

at Blogtuan.info – Source: vietnamnet.vn – Read the original article here