The secret to setting up a backup fund and making profits cannot be ignored by women to fight after Covid

To face the current situation, finding the Contingency Fund is being concerned and shared by many women. A reserve fund is known as a reserve to save money in case you are unable to pay in the future. It not only shows your personal financial health, but also helps you pay for necessary expenses, ensuring that your life is not deprived when something unexpected happens.

There are many ways to set up a Contingency Fund that is “passed on” by sisters to properly and completely nurture their families. Here are some ways you can accumulate a reserve fund for your family.

Buying gold accounts for 30% of women’s choice

Since ancient times, Vietnamese people have had the tradition of buying gold as treasure. Gold has always attracted people’s attention and is considered the safest asset, especially based on the view against inflation and devaluation of the Dong.

Inflation is one of the main factors driving the gold price up.

Ms. Pham.N shared: “Amassed enough 4 gold trees for the emergency fund. 10 years ago, my salary was 2 gold. 10 years later, my salary is still 2 gold. And now my salary is still 2 gold. I still study. If you’re old, you’ll only get 2 for each month when you’re old.” It can be seen relatively in the long term, following the trends that have occurred in developed markets, that gold will become a defensive and accumulative instrument rather than a public investment vehicle.

Of course, at the moment there is still a war element, but it should be noted that a rapid increase in prices but low buying power is unstable. The price area where people hold the most gold is around 54-55 million VND/tael, so once the situation turns around, they will launch to sell and take profit. In the past few days, the selling force to take profit has been sporadic, so you should pay attention.

“Eat well and wear durable” with 20% cash in the safe

According to Ms. Hoang.M: “If it’s urgent, it should be an instant payment at any time of the day. No need to take time to withdraw, and no need to call to ask for a loan. because if the rooster crows at midnight, what if everyone turns off their phones and goes to sleep)”.

Whether you choose to keep your money in a wallet or a bank account, it’s always important to anticipate how much you’ll need for a day or a week to avoid ‘overspending’ or high bank surcharges due to multiple transactions.

Daily living expenses are fixed expenses, necessary to maintain basic needs. Keeping cash in your wallet is considered an effective way to keep money because it can be used “immediately and always” to eat, drink and travel.

Fastest, most convenient with 50% savings in bank or online savings book

Considered as a form of accumulation with high safety and stable income from bank interest each month, saving is a traditional form of accumulation that every family thinks about when they have leisure time. idle.

Bank savings become the first choice of women

You also have a special note that please use your own bank or withdraw money to choose to deposit online for this money, ensuring the most convenient and fastest withdrawal from this Fund, regardless of Saturday. Sunday or outside trading hours.

One of the most profitable ways to save money in a bank is to open at least two savings accounts instead of one. In which, one book has a short term, convenient to withdraw when there is an unexpected need, the other has a long term to enjoy the full and maximum profit.

For example, you can split an 18-month term deposit, a 12-month deposit, or a 1-6 month deposit. Usually, deposit with a long term will have a higher interest rate. In case you need to use money, if you withdraw the book with a short term of one month, you will lose less interest. Ideally, try not to pay off early to enjoy the full interest.

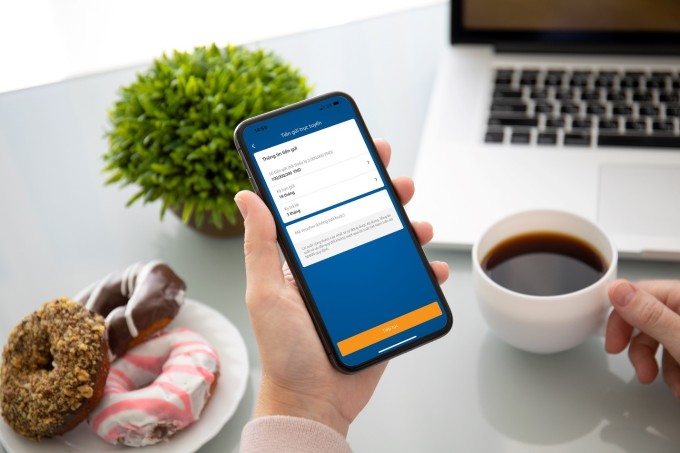

Sending money online is increasingly popular because of its convenience and safety

Ms. N shared more, about using the reserve fund for emergencies such as unexpected illness, when it is necessary to invest something but the bank deposit has not yet reached the withdrawal date (early withdrawal will lose interest), when needed Buying furniture but the money in the house is not enough, especially when she gives birth and can’t work, having a reserve fund helps her be more active while waiting for health insurance to pay.

For example, the family of Ms. Huynh. N breaks down the amount as follows:

– 20 million cash

– Buy 2 gold coins per month

– The rest deposit into savings App smart banking 3.1%/month (Emergency fund should be withdrawn quickly without high interest rate)

The division of the reserve fund into many different forms to make it easier to use and also gain interest to increase assets for you and your family.

at Blogtuan.info – Source: Afamily.vn – Read the original article here