Inflation will cause house prices to rise, but the market can’t afford to buy

Right in the first months of the year, the pressure to control inflation in Vietnam has become an important issue raised in macroeconomic management. According to data from the General Statistics Office (Ministry of Planning and Investment), on average, in the first two months of 2022, CPI increased by 1.68% over the same period last year, core inflation increased by 0.67%. According to the analysis of economic experts, three main reasons for inflation in 2022 include a sudden increase in aggregate demand during the period when the economy recovers from the pandemic; the dependence of the Vietnamese economy on imported raw materials; and disruption of global supply chains.

In 2022, the National Assembly of Vietnam sets the CPI target to increase by about 4%. At the time of January, this was considered a target that was completely “within reach” of Vietnam. However, after the sudden fluctuations of the world economic – political situation, this goal became a big pressure.

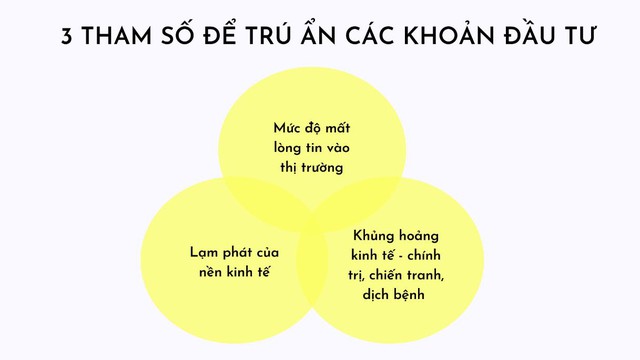

Three variables to control inflation 2022

According to Dr. Su Ngoc Khuong, Senior Director of Savills Vietnam, the National Assembly’s target of maintaining inflation within 4% is achievable. However, the context of political instability in the world in which the Russia – Ukraine war is affecting production and business activities in Vietnam.

Typically, the oil price has increased sharply from 70 USD/barrel to over 120 USD/barrel in the last 6 months. International experts also forecast that oil prices could rise to $200/barrel if oil supply from Russia is cut. Similarly, precious metal price volatility increased significantly. In the international market according to statistics of the Kitco floor, the world gold price in the past 1 month peaked to 1,991.16 USD/ounce. Along with that, the domestic gold price has a big difference compared to the world gold price, nearly touching the mark of 69 million dong/tael on March 18. These fluctuations lead to higher raw materials, higher production costs, and ultimately higher commodity prices.

“Thus, under the impact of the war as well as the lingering effects of Covid-19, the goal of keeping inflation below 4% is very challenging for the economy as well as for fiscal policy. This goal can only be achieved if the post-Covid-19 economic recovery goes as expected and the war situation between Russia and Ukraine is resolved through early negotiations.“, said Mr. Khuong.

Dr. Su Ngoc Khuong – Senior Director of Savills Vietnam

According to Dr. Su Ngoc Khuong, whether Vietnam can ensure inflation control at 4% or not depends on 3 main variables.

The first is the impact of the war on the price of oil, precious metals, input materials of the production fields, and the value of products.

Second, trade tensions between Russia and Western countries with sanctions create trade conflicts between many countries in the world, including Vietnam. Specifically, the import and export of raw materials and goods becomes more difficult due to restrictions on maritime and air transportation.

The third is the epidemic factor. In fact, we are expecting the economies of the world to be able to come to a normal state, living with Covid-19. However, the goal of recovering and developing the post-Covid-19 economy is not easy to achieve. The reason is that the current resistance of enterprises is quite low, loan interest rates increase, production costs and raw materials also increase in the current context.

Real estate price fluctuations in inflation

An analysis by Savills World Research has shown that if inflation occurs due to economic growth (demand-pull inflation), the demand for real estate will be pushed up and help increase the value of real estate. However, if inflation is caused by costs such as raw materials, rising labor costs (cost-push inflation) will lead to a constraint on the supply of real estate. Cost-push inflation is also difficult to predict, often due to unforeseen events such as the environment, geopolitics, etc.

According to Mr. Khuong, in the face of fluctuations such as wars, epidemics, and financial crisis, there are three major asset havens, namely oil, precious metals and real estate.

“When the inflation rate tends to increase due to uncertainties about war, world economy – politics, financial investment in real estate is considered a solution to help preserve capital flows against risks. This helps them preserve asset value and avoid instability in other investment channels“, Mr. Khuong analyzed.

In particular, in Vietnam, in recent years, the supply of residential real estate is very limited. People mainly invest in land, while residential real estate products including land and properties on land account for a lower proportion. Therefore, Mr. Su Ngoc Khuong said that in the context of world economic and political instability, With rapid inflation and tight supply, the real estate market, including residential and commercial segments in Vietnam, is expected to increase significantly in the coming time. and is an investment channel to help reduce risks in the context of inflation.

However, the senior director of Savills also emphasized that when inflation occurs, although real estate prices increase, the market cannot afford to buy, there is no liquidity. At the same time, many investors also use financial leverage to invest in real estate, making low-liquid assets a great burden for them as well as putting pressure on the banking system.

“Therefore, I think that in today’s complicated context, it is especially important to consider carefully when using financial leverage to invest in real estate, to avoid repeating the situation of “dead on the pile”. property” has happened in the past. In the next 9-12 months, it is possible for some investors to be forced to sell off assets because they cannot bear the pressure from financial support tools. However, the speculative nature of this group is not large, making it difficult to manipulate the market, affecting the price level. Besides, the supply of housing in Vietnam in the near future is still very limited, so a reduction in real estate prices is very unlikely.” he added.

Analyzing more about this point of view, Mr. Khuong said that looking at the history of the first crisis of the world economy in 1917, which originated in the US until now, there has been almost only one crisis that caused real estate prices to fall. was in 2007-2008 with a decrease of 30-40%.

Particularly in Vietnam, although from 1975 to now, the economy has also experienced a number of events such as the crisis of 1997-1998, 2007-2008, 2011-2012 and most recently the period of 2020-2021. Only in the 2011-2012 period, real estate prices in the whole market decreased by 30% because investors used too much financial leverage at that time. Rest, In fact, after each economic crisis, real estate prices increase.

That is why, Dr. Su Ngoc Khuong recommends: “For investors, before deciding to put money down, it is necessary to pay attention to the price and legality of real estate. For investors who intend to sell real estate at this time, it is necessary to carefully consider the purpose the purpose of using the money after the sale of that property. It would be reasonable if this money was invested in more effective investment channels in the context of the epidemic and international political instability.”

From a macro perspective, Dr. Khuong noted that the high rise in real estate prices also affects the attractiveness of foreign investment in expanding production and business activities in Vietnam. With inflation, the commercial real estate segment also has to push up service prices, while the ability of businesses to pay is still limited after the Covid-19 pandemic.

By Business and Marketing

at Blogtuan.info – Source: cafebiz.vn – Read the original article here