New peak of gold price this year still ahead?

Worries about inflation and the pandemic and the Ukraine crisis will keep investors looking for safety in gold.

Gold prices will rally to new highs this year as investors seek safe havens amid uncertainties made worse by the conflict between Russia and Ukraine.

The gold price of the reference contract on the New York Stock Exchange last week sometimes rose above $2,078 per ounce, touching the highest level since August 2020, when tensions between Ukraine and Russia increased and Western countries were pondering. tougher sanctions against Russia.

Fed raises interest rates

The US Federal Reserve (Fed) on Wednesday (March 16) raised interest rates for the first time since 2018 by 25 basis points. The Fed’s moves are always closely watched by investors.

In a normal market, rising interest rates draw investors into bonds and cash, and away from non-yielding assets like gold. However, this time there is a difference. Fed Chairman Jerome Powell has made it clear that the Fed will raise rates cautiously to avoid triggering a recession in the US, and he has reinforced that cautious stance since the Ukraine crisis.

“If the Fed follows through with its plan, interest rates will be at 1.75% at the end of the year, and will stay below 2% this year. I don’t think the market has much to worry about.” George Milling-Stanley, head of gold strategy at consulting firm State Street Global Advisors – based in the US – said. “Now we know the rate hike for the first time, and we know what to invest/reserve over the next 9 months. We’ll be paying more attention to the inflation data. Probably the right thing to focus on.”

“History shows that the price of gold regularly rises in tandem with rate hikes, adding that this is exactly what happened when the Fed raised rates nine times in the period since,” said Milling-Stanley. December 2015 to December 2018 – when the price of gold rose 17%, and when the Fed raised interest rates 17 times from June 2004 to June 2006 – when the price of gold rose 57%.

“Given the lessons of history, combined with the current environment with significant levels of both economic and geopolitical uncertainty, I expect gold prices to continue to rise,” he added.

Inflation and the Russia-Ukraine crisis

Continued high inflation coupled with increasing geopolitical tensions set the stage for gold prices to rise this year. Gold is often used by investors as a hedge against inflation.

The price of bullion in the past 10 days has cooled down as Russia and Ukraine conduct peace talks. However, not long ago, the price set a record near the highest in history also because of the conflict between these two countries.

“I expect gold investors to continue to increase their profits until something is done that can solve the Ukraine problem, which at the moment seems very far away,” said Mr. Milling-Stanley. And he added: “I will not bet on the gold price to rise in this situation (the crisis in Ukraine is resolved)”, because the incident of Russia carrying out the “special operation” in Ukraine has “poured more”. oil’ into an already uncertain economic and political environment.

Global demand for gold reserves increases sharply

The current environment is too uncertain, and with the ongoing Covid-19 pandemic, investors continue to hoard gold. “The purchases of gold come from many investors, from individuals to large institutions,” said Mr. Milling-Stanley.

Demand for bullion, bullion and gold coins in 2021 will reach 1,124 tonnes, the highest level in nearly a decade, with US and German investment at record highs, according to the World Gold Council. Mr. Milling-Stanley expects this trend to continue.

According to Mr. Milling-Stanley: “The strong increase in demand for bullion, bullion and gold coins around the world last year is raising fears of even hotter inflation among investors. personal”. “There is no question that the perception that gold’s role in providing some protection against high inflation is a strong motivating factor for investors, particularly in Europe, is not without question. Europe.”

Inflows into gold-backed exchange-traded funds (ETFs) are growing globally. According to the World Gold Council, global gold ETFs netted 35.3 tons of gold in February.

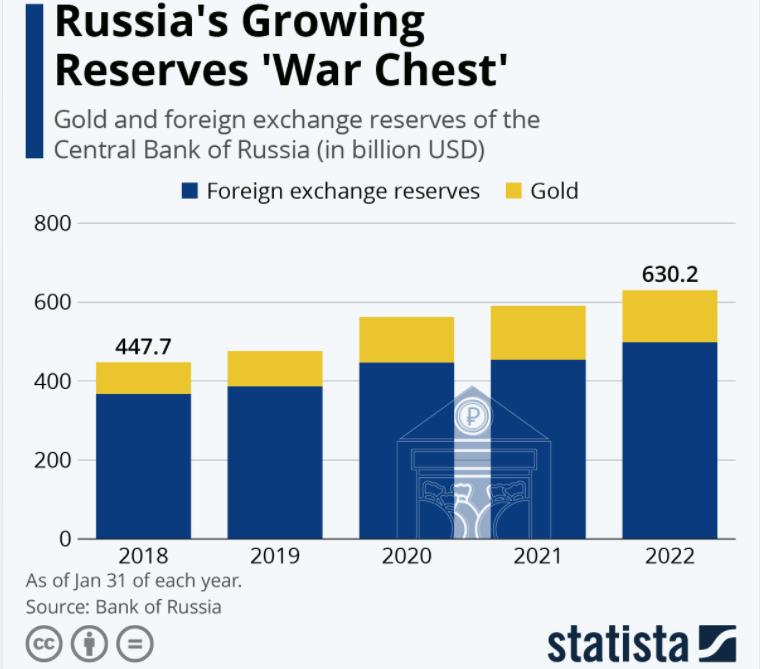

The World Gold Council (WGC) said that Russia’s central bank had 2,298 tons of gold as of January, making it the world’s fifth-largest reserve, after the United States, Germany, Italy and France. According to the WGC, Russia has more than doubled its gold holdings over the past decade to 21% of its total reserves.

|

Gold Reserve of the Central Bank of Russia. (Source: Statista) |

Can Russia devalue the gold market?

There has been speculation in the market as to whether Russia will sell any of its gold to protect its currency and economy from harsh sanctions.

With the ruble depreciating 80% of its value since the beginning of the year, to about 136 rubles to a dollar, Russia has been banned from the international payment network SWIFT and the US has banned Russian oil imports, some have said. wondered if Moscow would sell gold to finance its recoupment.

“It’s very difficult to see a scenario where the country suddenly turns around and starts selling gold for foreign currency, which makes up 80 percent of the nation’s reserves,” Mr. Milling-Stanley said. According to him, any attempt by Russia to sell gold will be thwarted.

About 95 percent of Russia’s gold reserves are believed to be stored in Moscow, and any trading from these reserves would involve transportation to a financial center, Mr. Milling-Stanley said. international politics”. “And all of this raises questions about who can act as a counterparty to any gold sales that Russia may undertake, amid existing international sanctions.”

This year’s peak in gold prices may still lie ahead

With a series of uncertain factors as above, investors are still optimistic about the prospect of gold prices next week, as well as during the time when the Russia-Ukraine conflict has not come to an end.

The survey results of Kitco News show that the majority of investors on Wall Street and Main Street expect gold prices to increase next week. Of the 16 Wall Street analysts surveyed, 9, or 56%, think gold prices will rise next week; only 4 people (24%) forecast prices to fall, and 19% of people still forecast prices to move sideways. On Main Street, 822 online surveys were distributed, of which 560 people, or 68%, expect prices to rise next week, 18% expect prices to fall and 14% expect prices to move sideways.

On the further horizon, State Street Corp. – which manages $3.9 trillion in assets, and manages SPDR Gold Shares, the largest physical gold ETF in the world – is optimistic that prices will rise further, and recommends Investors should allocate “between 2% and 20%” of their assets in gold, depending on their individual needs for liquidity and willingness to accept risk.

Reference: Nikkei

According to Economic Life

at Blogtuan.info – Source: infonet.vietnamnet.vn – Read the original article here