Potential risks when operating a manual accounting apparatus

The seminar with the participation of two keynote speakers from Base.vn is Mr. Vu Van Cuong, who used to hold the role of Deputy Accountant at FPT Corporation, and is currently the Chief Accountant at Base.vn; Mr. Truong Quoc Thang, Head of Data Department.

“Pain” from the manual accounting machine

In many businesses, Accounting is the department that has to coordinate most often with other departments. However, this inter-departmental process is often not strictly managed, errors in documents and invoices, payment invoices, etc. are not detected in time, leading to serious consequences in the future. .

From the point of view of Chief Accountant, Mr. Vu Van Cuong pointed out the danger when the enterprise does not manage the accounting apparatus in a scientific way: “Other departments transfer records to the accounting department late, omission,. .. while the workload of the accounting department is huge, that can cause a lot of documents to ‘hang.’ In fact, for every invoice not made on time, the business can be fined. up to 8 million dong. With large enterprises handling tens or hundreds of invoices every day, the damage can be huge.”

Besides, with more than 5 years of experience in consulting to build data systems for dozens of Vietnamese businesses, Mr. Truong Quoc Thang assessed: “Many businesses claim that they have data, however, the cycle and the frequency of re-entering the data is very low, over a period of time in quarters; or when the enterprise has to make a tax report, the Accounting department will collect and process the data. leaders have separated the story of corporate governance and financial management, then completely passive before business decisions.”

Digitizing accounting operations: From departmental data to corporate financial picture

Based on actual operating experience at Base, the two speakers shared about how to use technology to solve the above pains.

In order to make the most of the department’s resources, businesses need tools that can help capture the work progress in the accounting department, as well as evaluate the performance of each employee. This can be solved on applications like Base Request or Base Workflow.

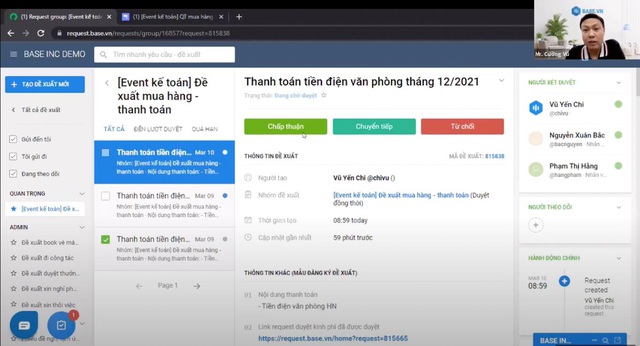

Mr. Cuong introduced the process of approving payment proposals on Base Request

With the Base Request proposal management solution, businesses can pre-set the types of documents and information fields that other departments need to submit to sign in each set of payment records, minimizing the cases of missing documents. preliminary, or delayed approval.

With the Base Workflow solution, the accounting department can easily keep track of which records are outstanding. After receiving and confirming enough original documents, the accounting department will begin to make payment orders, and other departments will always know if their records have begun to be processed or not when they upload the documents. not yet. On the other hand, the chief accountant also easily observes the overall picture, thereby evaluating the work efficiency of employees and handling problems between departments.

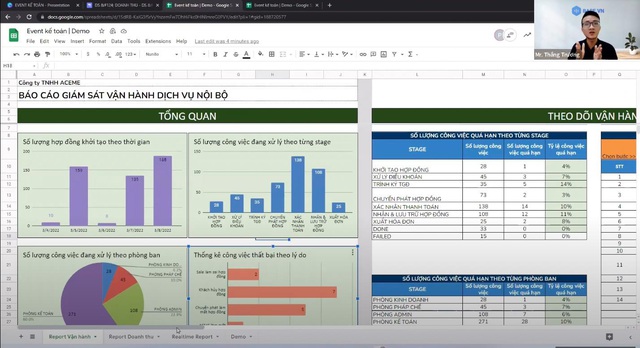

On top of that, all of these applications have the ability to connect with each other and with data warehouses to extract useful real-time administrative reports. By combining a variety of data under multiple slices, administrators can monitor the big picture: from operational reports to revenue reports.

Mr. Thang commented: “If a payment is not looked back, or only looked back after 1 month or 1 quarter, we cannot know whether the payment is really necessary or not, the effect it brings. What is it, or in that moment we approve this payment, but what about at other times?”.

Mr. Thang presented a sample report from Base Workflow application’s real-time extracted data

Regarding the question of whether there is a conflict or additional work when using accounting software and Base’s software at the same time to manage accounting, Mr. Cuong pointed out that businesses need to determine that each software will serve a specific problem. body. Accounting software helps to collect revenues and expenditures for financial statements, but cannot help check, compare, and verify documents and records right at the time of making invoices. The addition of management on Base is especially necessary for chief accountants and business managers to make decisions and control timely revenue and expenditure decisions.

An overall picture of the accounting department will help businesses be much more proactive in the financial aspect. The accounting system needs to be updated in real time, daily and continuously. “Otherwise, the number in the company’s bank account that we see does not really prove the internal strength of the business,” concluded Base.vn’s Chief Accountant.

Learn about the set of operational digitization solutions at: https://base.vn/solutions/e-office?utm_source=cafebiz

Following Economic Life

at Blogtuan.info – Source: cafebiz.vn – Read the original article here