Stocks on March 21: Plunging without brakes, the number 1 giant in Vietnam fell out of the top 5, then lost the top 10

Current difficulties along with a less-than-bright outlook have dragged the No. 1 dairy giant – Vinamilk dropped out of the top 5 by market capitalization last year and continued to fall out of the top 10. A stock that “plays and wins” is disappointing for many people. many people.

For the first time in the past 2 years, VNM stock of Vietnam Dairy Products Joint Stock Company (Vinamilk) fell to the threshold of VND 75,000/share and became share Rare big drop in an uptrend market. This is a scenario few people think about, especially when Vinamilk is known as the leading enterprise in an industry and upstream impressive growth number one on the stock market for a whole decade.

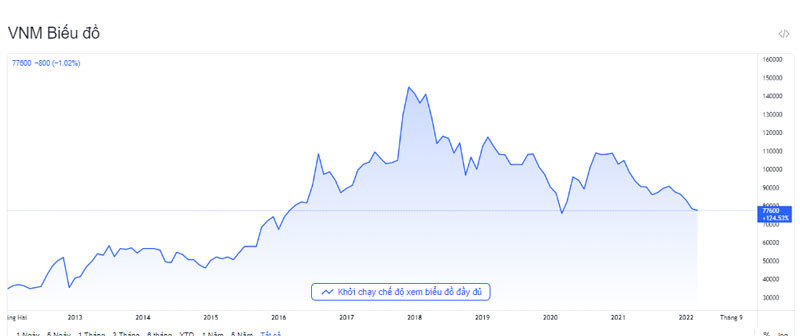

Since going public in 2006, Vinamilk shares have recorded a continuous upward process, and recorded at least 10 years of going against the downtrend of the market. From a price of over 3,000 VND/share (conversion price, equivalent to over 50,000 VND/share when listed on the stock exchange), Vinamilk shares increased continuously and peaked at over 120,000 VND/share (adjusted price) in early 2018.

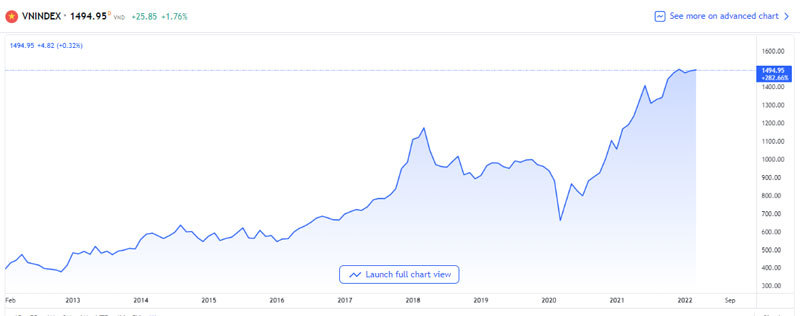

In 2007, Vietnam’s stock index VN-Index reached a historic peak of 1,170 points and then sank into a decade-long crisis, down to 660-700 points.

Since its listing in 2006 until the beginning of 2018, Vinamilk shares have increased nearly 40 times, bringing huge and steady profits to institutional and individual shareholders.

The movements of Vinamilk stock are in stark contrast to the movements of the VN-Index in the period 2007-2017. Put 10 dong into VN-Index in 10 years then, investors will lose more than 4 dong. But if you put 10 dong into Vinamilk during this period, investors have nearly 400 dong.

|

| Vinamilk stock price movement. |

On the stock market, the investment story is focused on finding “Vinamilk stocks” rather than paying much attention to the overall score of the market. This is an extremely difficult job because Vinamilk is a rare case and controlling emotions in investment is very difficult. It overwhelms investment analysis. Timing deviations also cause investors to lose money.

Contrary to the attractiveness of the decade of glory, Vinamilk stock is now seen as a huge disappointment for many people as the share price goes against a vibrant market and has increased sharply in the past 2 years.

While blue-chips increased in price a few times, small stocks even increased a few dozen times, Vinamilk steadily decreased to the bottom in 5 years.

From the peak price of over 120,000 VND/share (adjusted price) in early 2018, VNM stock dropped to 75,000 VND/share.

In recent days, Vinamilk dropped out of the top 10 largest enterprises on the stock exchange, with market capitalization down to the same level as the VN-Index by 700 points, in the context of corporate profits falling in the past year and prospects not bright.

At the end of May 2021, Vinamilk also dropped out of the top 5 largest capitalization in the market. Series of new stocks have replaced. Investors witnessed the strong breakthrough of stocks such as Hoa Phat, Masan, Techcombank, VPBank, Novaland, Mobile World…

In the whole year of 2021, Vinamilk stands out from all rising waves of the general market. While VN-Index grew among the top in the world with 36%, many stocks increased by times or even dozens of times, Vinamilk still went down.

|

| VN-Index volatility. |

Vinamilk’s growth momentum is nothing new, the domestic market is difficult to expand and shows signs of saturation, while the export promotion strategy has not been reported positively. Profits in 2022 are expected to continue to decline, with profits falling to a 6-year low.

For many years in a row, Vinamilk has been valued at a very high P/E due to high expectations. But now, the momentum for the breakout growth is gone and the outlook is not bright is a big pressure for this stock. Since 2017, VNM’s profit has been stable at over 10 trillion dong, without many breakthroughs.

Retest the threshold of 1,500 points

According to BSC, after a series of cautious sessions, the cash flow poured into the market in the session of March 21. The reaction of the world market including Vietnam was quite positive to the news that the Fed only raised 25 percentage points instead of 50 points. Foreign investors were strong net buyers on HoSE while slight net sellers on HNX. The liquidity increased again, the cash flow spread to the industry as well as the weakening effect of negative macro information making the VN-Index become quite positive.

According to MBS, the market maintained its upward momentum for the 5th consecutive session after the week of ETF portfolio restructuring and derivatives maturity. Cash flow seems to have been removed from the cautious sentiment and directed to blue-chips, notably real estate stocks with many stocks hitting the ceiling. The market’s rising chain is being supported by key stocks, besides that foreign investors turned to be strong net buyers.

Technically, VN-Index had the 5th consecutive gaining session, thereby regaining important MA levels like MA100 and MA50. The uptrend promises to bring this index to re-test the level of 1,510 points in the coming sessions. The world stock market has also passed the most difficult time, the markets are recovering after the recent sharp decline. In the domestic market, the return of banking and real estate stocks may be a signal that VN30 stocks are likely to attract cash flow again.

V. Ha

at Blogtuan.info – Source: vietnamnet.vn – Read the original article here