VN-Index: “Trap” at 1,500 points?

Closing the session on March 22, VN-Index increased by 8.83 points to 1,503 points. Trading volume reached more than 947.6 million units, equivalent to more than 28,486 billion VND. The whole floor had 264 stocks of increasing price, 190 stocks of decreasing and 48 stocks of standing still.

According to the assessment, when the VN-Index moves sideways as well as maintaining the trend of “breaking the box” (ie reaching the bottom of the box and then bouncing up), the 1,500 m mark is very important. At this time, many experts believe that the market will have many other pitfalls?

Mr. Phan Linh – Product Specialist of Take Profit Vietnam Investment and Consulting Company

Responding to this issue, according to Mr. Phan Linh – Product Specialist of Take Profit Vietnam Investment and Consulting Company, the market has recovered quite well in the past 1 week, now surpassing the 1,500 point mark. . When the market hits the bottom edge of the box and then bounces, normally the volume is not too big, but this is a positive sign.

Looking back at a process of VN-Index going up from the bottom in April 2020 until now, VN-Index in the long term still maintains an uptrend (uptrend), in the short term, sideways in the long term. around 1,420 – 1,540 points, 1,500 points is a psychological milestone, but if you look at it more broadly, the VN-Index is still moving sideways to find a new trend”, Mr. Linh forecast.

According to Mr. Linh, it is very likely that the market will “test” the 1,500 point mark again before continuing the upward momentum. This will make the market more sustainable.

“If the market goes up to 1,515 – 1520 points, there may be a potential supply pressure, it will need a slight correction to retest the 1,500 point mark before going up. If the VN-Index surpasses the old peak of 1540 points, it will go up. form a new uptrend trend, entering a new growth phase of the market”, commented the product specialist of Take Profit Vietnam Investment and Consulting Company.

The return of real estate and banking?

Assessing the group of real estate stocks, according to Mr. Linh, this group has had a relatively deep adjustment in the past time, with many stocks having adjusted more than 30% since the peak. However, after an accumulation process with quite exhausted volume, it can be seen that the money flow starts to return.

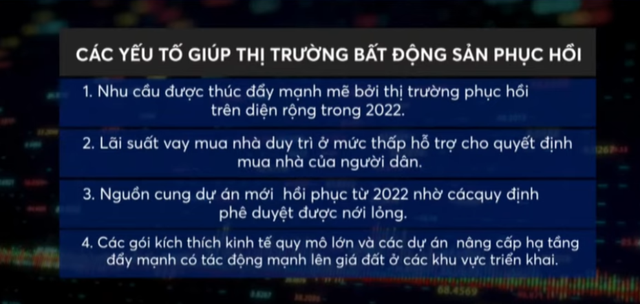

Some forecast factors help the real estate market recover in 2022

Assessing the real estate group in the near future, Mr. Linh forecast that there are a number of factors that can set expectations. Firstly, the Government’s policy to promote public investment in the next 2-3 years will be very drastic. Through this, commercial real estate benefits indirectly, when there is infrastructure, of course, real estate prices around that area will improve to a certain extent.

“It is possible to focus on real estate businesses with land funds related to public investment projects: Long Thanh Airport, North-South Expressway …”, Mr. Linh recommended.

Besides, after the effects of COVID-19, according to Mr. Linh, this year, projects will begin to be deployed and reopened for sale, which will help increase the future handover value of real estate businesses. produce.

Along with the real estate group, the product specialist of Take Profit Vietnam Investment and Consulting Company is also quite optimistic about banking stocks – the group that has been moving sideways for a long time. ,8 months ago.

According to Mr. Phan Linh, the potential of banking stocks this year is not without when the economy has begun to reopen, promoting both policies and support packages… This will certainly increase demand. credit in the economy increased.

At the end of today’s session, banking stocks only had two losers, BID and SHB, 5 stocks stood at reference, while 20 stocks increased.

Will bank stocks rebound after a long period of sideways movement?

Before. According to data from the State Bank, credit as of the end of February increased by 1.82% compared to the end of 2021. Also according to the data of the State Bank, by the end of 2021, the credit balance will reach 10.44 million billion. copper.

Thus, in the first two months of the year, the banking system net injected more than VND 190,000 billion of credit into the economy.

Previously, the State Bank said that credit outstanding increased by about 2.74% in January 2022, equivalent to an increase of nearly 286,000 billion VND. This is the highest level in 10 years, reflecting the acceleration of loan demand in the economy in the first month of the year.

“I think it is possible to focus on a few bank stocks that have ensured the minimum capital adequacy of Basel 2 so that the State has a basis to grant a higher credit room. Besides, there are banks that increase capital in 2021”, Mr. Linh recommended.

Video of the Matching program on March 22: Challenging the psychological threshold of 1,500 points?

* Invite readers to watch programs broadcast by Vietnam Television on TV Online and VTVGo!

at Blogtuan.info – Source: vtv.vn – Read the original article here