A chemical business on the stock exchange increased by more than 1 billion USD in market capitalization after a year

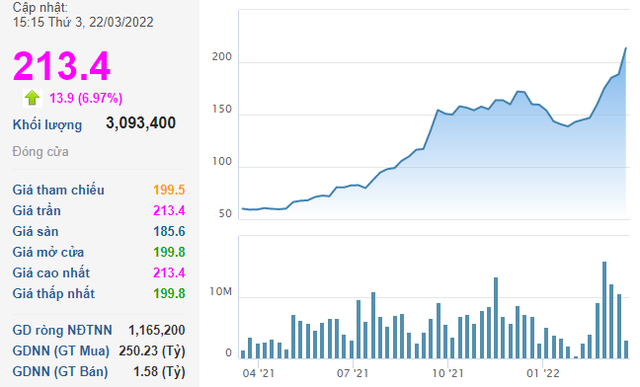

In 2021, DGC stock of Duc Giang Chemical Group Joint Stock Company recorded a solid increase. This stock continuously went up and officially joined the 100 Club (3-digit market price) in August before reaching a historic peak of 177,890 dong/share (session 13/12/2021). Right after that, DGC went sideways and entered a correction before returning to establish an impressive uptrend since the end of January 2022 until now.

In the session of March 22, DGC increased to the full range of 6.97% to 213,400 dong/share, up 65% compared to the trough of the year at 129,200 dong (session 18/1), thereby establishing a new peak since its listing. listing. At the price of 213,400 VND/share, the market capitalization of Duc Giang Chemicals surpassed the 36,500 billion VND (1.6 billion USD) mark, equivalent to an increase of more than 26,200 billion VND (1.1 billion USD) compared to the previous time. one year.

DGC’s breakout took place in the context of commodity prices, including those of chemicals, anchored at high levels due to escalating geopolitical tensions. Fertilizer – chemical stocks, including DGC, are expected to benefit directly from this “price storm”, thereby attracting cash flow in the market.

DGC stock reached historic peak, market capitalization increased by more than 1.1 billion USD after 1 year

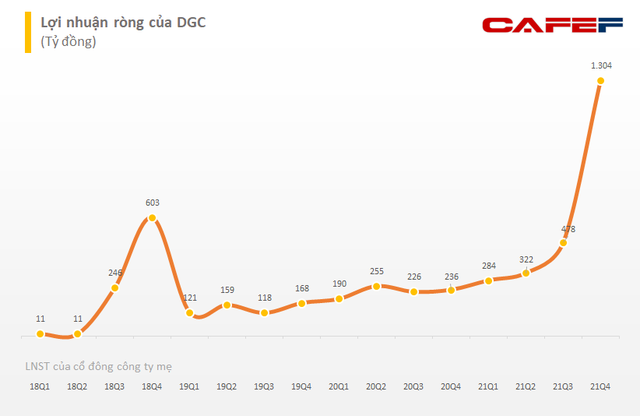

Impressive results when exceeding 128% of profit plan in 2021

In terms of business activities, despite the complicated situation of the Covid-19 epidemic, DGC’s business results still grew impressively. Specifically, consolidated revenue reached 9,550 billion VND, up 53% compared to 2020. Consolidated profit after tax increased by 165% to 2,513 billion VND and exceeded 128% of the plan of 2021 set by the General Meeting of Shareholders.

According to the management, DGC achieved positive business results by maintaining the plant at full capacity and putting the Apatite KT25 mine into operation, reducing input costs. Besides, the world market has many fluctuations in favor of the Group’s products.

With this result, DGC is expected to pay dividends in 2021 at the rate of 127%, including 10% cash dividend (advanced) and stock dividend at the rate of 117% (issued additional 200.16 million dividend-paying shares).

With the plan for the new year 2022, the enterprise sets a target that total revenue will increase by 26% compared to 2021, reaching VND 12,117 billion and pre-tax profit of VND 3,500 billion, up 39% over the same period. Notably, the Group plans to pay a dividend in 2022 at 30%.

Notably, DGC is also preparing to submit to shareholders for approval the plan to issue 8.55 million ESOP shares, accounting for 5% of the outstanding shares at the price of 10,000 VND/share. This price is much lower than the current market price of DGC shares.

The bullish story of yellow phosphorus is a strong catalyst for DGC

Currently, DGC is a leading manufacturer and exporter of yellow phosphorus, phosphoric acid, phosphate fertilizers and feed additives phosphate in Vietnam. In 2021, China’s domestic energy shortage plus this country’s implementation of measures to limit the production of products that pollute the environment has caused the price of yellow phosphorus (P4) to increase continuously, affecting The movement led to the increase in the price of yellow phosphorus in Vietnam. Up to now, although the price of this material in China has cooled down, the price in Vietnam is still stable at about 7,000 USD/ton since the beginning of the year, higher than about 3,000 USD in 2016 period. 2020.

In addition, phosphorus is also the main raw material for chip production (for 5G devices) and the trend of electric vehicle production (for batteries). With this need in mind, DGC has developed several new phosphorus chemistries for the booming lithium battery industry. Some sample products have been sent to VinFast electric vehicle segment and potential customers in China. In addition, DGC is also sending premium samples of thermal phosphoric acid (TPA) to Japanese and Korean customers, which will serve electronic applications such as LCD displays.

Viet Capital Securities (VCSC) recently forecast that DGC’s core pre-tax profit (excluding the real estate segment) could increase by 55% and 13% in 2022 and 2023, respectively. VCSC launches apatite ore mines This field is expected to supply 60% of input demand for apatite ore, thereby saving the company 400 billion VND in annual input cost.

Sharing the same opinion, BSC Securities also maintains a positive view on Duc Giang Chemical Group’s business activities in 2022, saying that DGC will continue to benefit from high world commodity prices and cutting production costs. decrease over the same period due to exploitation of apatite ore from field 25.

Business and Marketing

at Blogtuan.info – Source: cafebiz.vn – Read the original article here