Japan changes its virtual currency management policy to keep up with the world

Cryptocurrency exchanges in Japan are simplifying the approval process to increase the number of crypto exchanges in the country.

The Japan Virtual Asset and Cryptocurrency Exchange Association (JVCEA) is planning to release a “green list” of 18 popular cryptocurrencies by the end of March this year.

This is an alliance of 31 cryptocurrency exchanges in Japan. JVCEA was established in 2018 as a regulatory body after a series of hacks occurred at Japanese cryptocurrency exchanges. However, the organization’s slow processes have created a barrier in promoting the popularity of cryptocurrencies.

Previously, members of the JVCEA had to go through an Association screening process before being able to list cryptocurrencies. With the new regulations, the dong cryptocurrency on the “green list” will no longer be subject to mandatory screening.

The “Green List” will include cryptocurrencies that are considered popular and widely used in Japan such as Bitcoin, Ethereum, XRP, Litecoin, etc. The conditions to be included in the “green list” are: The cryptocurrency must be listed on at least 3 authorized exchanges in Japan. In addition, this asset class must be listed for the first time in at least 6 months.

|

| Japan changes its mindset and policy on cryptocurrency management to keep up with the world. |

It is a fact that Coinbase – the leading US cryptocurrency exchange has listed a total of 139 cryptocurrencies by the end of 2021. Meanwhile, only about 40 cryptocurrencies are being listed on the exchanges. Japanese exchange. Japan’s most diverse exchange has only listed 20 cryptocurrencies.

It is estimated that the total value of cryptocurrencies held by users on Nhat Ban exchanges is currently 1.18 trillion yen, or about 9.8 billion USD. This is only a fraction of the amount of virtual assets ($278 billion) held on Coinbase.

Explaining the decision to loosen the above barrier, many Japanese cryptocurrency exchange executives said that sophisticated traders have flocked to unlicensed exchanges due to a shortage of cryptocurrency exchanges. options of mainstream exchanges.

According to Genki Oda – Vice President of the Japan Cryptocurrency and Virtual Asset Exchange Association (JVCEA), only a few exchanges in Japan are profitable because it takes a long time for cryptocurrencies to be introduced. listing. Therefore, investors in Japan mainly flock to foreign cryptocurrency exchanges.

|

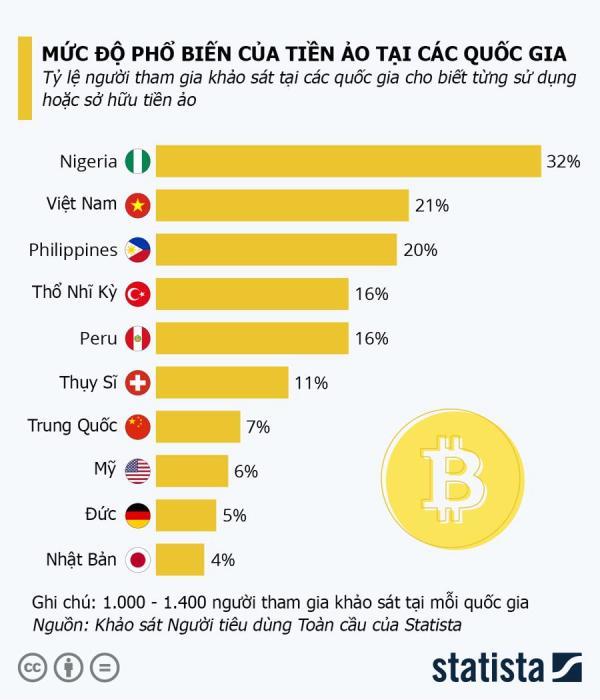

| The popularity of “virtual money” or cryptocurrencies in some countries around the world. (Data: Statista) |

In Japan, exchanges go through a lengthy screening process before listing new cryptocurrencies. This happens even with widely circulated cryptocurrencies like Bitcoin and Ethereum.

In fact, the above process leads to a backlog of records and makes it difficult for exchanges. At the end of last year, there were 80 applications to list new cryptocurrencies awaiting approval in Japan.

Thus, the goal of the aforementioned policy change and easing is to remove the clutter in order to bring the Japanese cryptocurrency industry closer to global standards.

This is just one of a number of policies being implemented by Japan to promote the development of Japan technology Blockchain and cryptocurrencies.

|

| The Japanese stablecoin is expected to start being used in 2023. |

Previously, Japan said it would issue a cryptocurrency with a value pegged to the Japanese yen. It’s essentially a stablecoin – a digital asset designed to mimic the value of fiat currencies.

Different from traditional fiat currencies, stablecoins allow users to transfer digital assets globally at a cheap price and faster execution time, while maintaining price stability. Banks in Japan are expected to be allowed to issue stablecoins under a revised law that will take effect next spring.

The settlement of securities transactions in common currency takes days and costs tens of millions of dollars a year in Japan alone. The use of a stablecoin developed based on Blockchain technology is expected to help eliminate such costs.

Before Japan, many countries in Asia, including Vietnam, have researched, piloted, and even deployed central bank digital currencies (CBDCs) using Blockchain technology.

Most recently, Deputy Prime Minister Le Minh Khai has just directed the ministries of Finance, Justice, Information and Communications and the State Bank of Vietnam on building a legal framework related to virtual assets and virtual currency.

Trong Dat

at Blogtuan.info – Source: vietnamnet.vn – Read the original article here