From Vinamilk’s case study, a securities expert reveals how to quickly evaluate any stock just by looking at an index.

“Why does Vinamilk keep rushing like that, please experts for comment on this stock code”, an audience asked a question to Passion Investment CEO La Giang Trung in the Matching program on March 28.

Referring to Vinamilk, many shareholders must be embarrassed. Starting from 2021, Vinamilk continuously reduced prices and ended the morning trading session on March 23, 2022 to only VND 76,600/share, equivalent to the price at the end of March 2020. Thus, after 2 years of Covid, Vinamilk has returned to the starting line, although the VN-Index has increased more than 2 times.

The continuous price reduction also made Vinamilk out of the top 10 largest enterprises on the stock exchange, even though 2 years ago it was the 4th largest enterprise in the market.

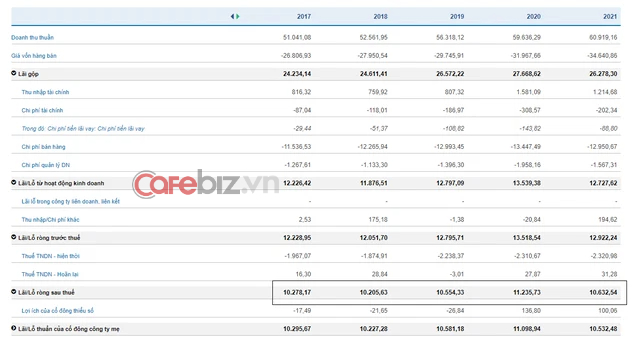

From Vinamilk’s situation, Mr. Trung revealed how to help investors quickly evaluate basically any stock on the stock market. Currently, Vinamilk’s market capitalization is about 157,000 billion VND, the profit after tax in 2021 is about 10,600 billion VND.

“We see that from 2016 to now, profit after tax has been flat around VND 10,000 billion. Vinamilk has a market capitalization of about 150,000 billion, profit after tax is 10,000 billion, then P/E is about 15 times. Vinamilk’s price has decreased in recent years, not because Vinamilk’s business is worse, but because the market revalues the business. Previously, Vinamilk grew very well from 20-30% per year, sometimes the market valued P/E over 20 times. The lack of growth in corporate profits caused the market to drop valuations and share prices down even though the business was fine even though it didn’t grow.“, analyzed by Mr. La Giang Trung.

How much is the price of Vinamilk?

“I share my investment opinion with stocks that are no longer profitable, P/E somewhere around 6-7 times is attractive to invest. In my opinion, Vinamilk is a good business, good corporate governance, good finance I can accept a P/E of about 8x. Equivalent to a market capitalization of about VND 80,000 billion, which means I can accept half the price right now“, CEO Passion Investment shared.

According to this expert, through the P/E index, investors can partly understand the business valuation without going into depth. P/E can be understood as the price you pay for the profit you receive. Let’s say we own 100% of this company. For example, if the company has a market capitalization of 10,000 billion VND, after-tax profit is 1,000 billion VND, the P/E is 10, it takes 10 years for us to recover the capital. If the same 10,000 billion dong company brings in 2,000 billion dong in profit, then the P/E is five and it only takes us 5 years to recover the capital. This indicator is very simple, intuitive and easy. The lower the P/E, assuming constant profits, the faster the return on investment.

“If I go to buy Vinamilk shares now, I feel that it is still a good movie, but we have not bought it yet and have to wait very tiredly. Like the movie show at 9pm and we went to buy it at 9am and bought it while there were many other movies at 10am, suddenly at 12pm I suddenly saw everyone screaming in the theater and I couldn’t watch it because of that money I bought it Vinamilk at 9 pm already. So we consider that at 9am the movie shows, then at 8am we buy tickets, then the waiting time will be less tiring.“, host Hoang Nam added.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here