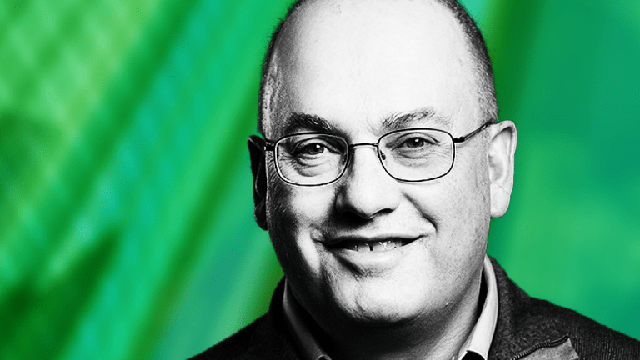

Looking back at the insider trading scandal that shook Wall Street, making “hedge fund king” Steven Cohen think he was defeated, but… only an aide was in prison.

A lot of people don’t trust Wall Street. They see Wall Street as a money machine for the people who work there. They are not interested in the original purpose of transferring capital to businesses and helping them develop for the common good of society. For such skeptics, Steven Cohen is the prime example.

The “boss” committed a crime, the aide was imprisoned

On Wall Street, everyone knows the legendary Steven Cohen. He is an iconic figure in the financial industry and has been dubbed “the king of hedge funds” or “the king of short-term stock trading”. Cohen’s approach to investing has catapulted his firm into one of Wall Street’s most successful hedge funds.

Cohen’s hedge fund SAC Capital was founded in 1992 and is headquartered in Stamford, Connecticut. With an estimated initial capital of $20 million, Steven Cohen turned Capital SAC into a hedge fund with $14 billion in assets under management. With Cohen’s talent and acumen, SAC Capital dominated Wall Street stock trading. At that time, the FBI began tracking lawsuits against large hedge funds and SAC Capital became a target.

In the 1990s, SAC emerged with rumors of injecting brokerage fees for valuable information that analysts recommended. Investigators seized the sources. In the end, the prosecutor charged several employees of SAC Capital. The hedge fund was found guilty of insider trading in 2013 and had to pay a $1.8 billion fine.

New York writer Sheelah Kolhatkar, who has been a staunch follower of SAC Capital’s story, sheds some light on how hedge funds became “lucky”. The book is titled “Black Edge: Inside Information, Dirty Money and the Quest to Bring Down the Most Wanted Man on Wall Street”. wanted on Wall Street).

Writer Kolhatkar’s book sheds light on the biggest insider trading scandal on Wall Street since the late 1980s. It’s also a story that reflects the darker sides of both Steven Cohen and the big banks that helped him. successful.

Despite their best efforts, prosecutors and regulators were unable to arrest Cohen. The most they can do is get Mathew Martoma to serve nine years in prison and Cohen himself accused of failing to prevent insider trading at his company.

Mathew Martoma is a close associate of Steven Cohen and the director of portfolio management at CR Intrinsic Investors. Martoma obtained inside information from two pharmaceutical companies Elan Corporation and Wyeth about an Alzheimer’s drug from a doctor.

Because of the negative results on this drug, CR Intrinsic Investors quickly turned their positions to bears. As a result, CR Intrinsic Investors earned profits and avoided losses of hundreds of millions of dollars. However, there was not enough evidence to convict Cohen, even though SAC made $276 million through this deal.

“Advantage” helps defeat all opponents

Despite being the “head” of SAC Capital, Cohen escaped the indictment spectacularly. Because the SAC consists of many small mutual funds under the management of many individuals, Cohen is only interested in the returns and results of SAC Capital as a whole. Though past his prime, Steven Cohen hasn’t completely disappeared. In 2018, Cohen founded and runs his own hedge fund called Point72 Asset Management.

In 2020, Point72 Asset Management earned $2.5 billion and ranked 12th in the top 20 best performing hedge funds. As of January 2021, Point72 Asset Management has $20.2 billion in assets under management. Cohen’s net worth was then estimated at $10.2 billion.

In an interview about the collapse of SAC, the Wall Street billionaire bluntly replied: “I feel like a very lucky person, a very happy man. And when looking at his career overall I wouldn’t trade it for anything in the world.”

No one reading the New York writer’s book can conclude that Cohen is completely innocent. He created an “intelligence bureau” based on a network of data some of which were deemed illegal.

Cohen paid the banks huge commissions so he could know in advance useful new information for the transaction. So he has the “advantage” to beat the competition.

Cohen put great pressure on traders to create “advantage”. He asked for trading strategies to come with a confidence rating on a scale of 10. Just like how Martoma gave the Alzheimer’s drug information a score of 9 out of 10. This saves the founder of SAC from the legal risk of a “moat” around the company’s valuable assets.

The fact that Cohen has always been a great trader and it is that quality that keeps Steven Cohen afloat. He rose from the position of junior trader in the arbitrage department at Gruntal instead of a prestigious company like Goldman or Morgan Stanley. A former colleague recalls that Cohen was exceptionally brilliant, gritty, and adventurous.

Kolhatkar’s book details Cohen’s beginnings as an “outsider,” uninterested in economics, strategy, or even the companies in which he traded shares. Cohen’s later dragged Wall Street down his path. Cohen was also a pioneer in the transition of power from banks to hedge funds.

On the way to building a career, Cohen changed the concept of “investment”. He buys stocks not to hold like traditional mutual funds or pension funds, but to buy and sell quickly. That turned out to be highly profitable, but changed the main goal that is the growth engine for Wall Street’s economy.

Business and marketing

at Blogtuan.info – Source: cafebiz.vn – Read the original article here