Massively falsely declaring the selling price of real estate up to 20 times lower

Ba Ria-Vung Tau Tax Department said that within the first half of March 2022, the Ba Ria-Vung Tau tax industry had paid more than 1,200 records of real estate transfer and transfer because there were signs that the declaration was much lower than that of the tax authorities. with actual price. Of these, there are 155 dossiers of declaration, adjustment, supplement and return to tax authorities.

In particular, the re-submitted, re-declared land transfer value increased from 2-5 times compared to the first declaration. Featured has profile increased up to 20 times. That is the case of transferring land in Dat Do district from the initial 500 million VND to 10 billion VND. In addition, there are records that initially declared 400 million, but then re-declared it to 3.5 billion; declare 1.5 billion and declare again to 9.3 billion…

Accordingly, the additional tax collected on business activities and real estate transfer in the past time is more than 3 billion VND.

In Long An, from the beginning of 2022 until now, the tax branches under the Long An Tax Department have returned and requested an adjustment to raise the price in accordance with the actual transaction in many records. In which, there were 473 dossiers that taxpayers adjusted the transaction prices themselves, increasing tax revenue and paying more than 2.1 billion VND to the state budget.

The Tax Department has directed the processing departments at the tax branches in Long An province to check the transfer history at the land plot in the dossier, compare and contrast with other documents at other agencies. adjoining plots or plots with nearly identical conditions, etc., to determine the actual actual allocated land price. Thereby, the tax departments will require taxpayers to declare truthfully to be approved.

Minister of Finance Ho Duc Phuc said that he actively directed the tax authorities and coordinated with agencies in localities, ministries and branches to collect real estate tax in accordance with the real estate transfer price. Recently, within the first 15 days of January, the management agency inspected 85,000, re-declared and increased tax collection by 222 billion VND.

Currently, the management agency is also focusing on inspecting and checking suspicious documents about the declared transfer price not matching the actual transfer price to handle in accordance with the law, even for projects. real estate.

The General Department of Taxation also directs tax agencies to develop plans to inspect and detect acts of tax evasion and tax fraud related to real estate business, to perform tax assessment, collect taxes and impose penalties for tax-related administrative violations in accordance with law.

Tax Departments actively coordinate with relevant departments, agencies and sectors in tax administration for business activities and real estate transfer. Proposing the Provincial People’s Committee to develop a project to prevent loss of revenue for real estate transfer activities. Accordingly, actively coordinate with relevant state management agencies to advise and report to the People’s Committees of provinces and cities to develop a land price list close to the common land price on the market.

Along with that, coordinate with the Department of Justice in directing notarial practice organizations in the area: propagandize and guide people to correctly declare the actual purchase and sale prices in real estate transfer transactions; at the same time, collect information, review the database to determine revenue, urge tax declaration and payment according to regulations.

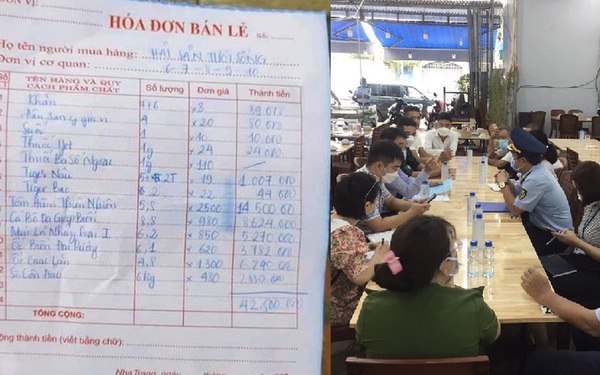

In the course of inspection and supervision, if the tax authority detects that organizations or individuals have committed violations, they must handle them according to their competence; For violations that are not within their scope, functions and handling competence, the tax authority consolidates and completes the dossier, transfers it to the investigation agency for signs of tax evasion, fails to declare, or declares tax evasion. The price on the contract or invoice is lower than the actual transfer price for consideration and handling in accordance with law.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here