The first time pocketed a few hundred billion, the second time was criminally prosecuted

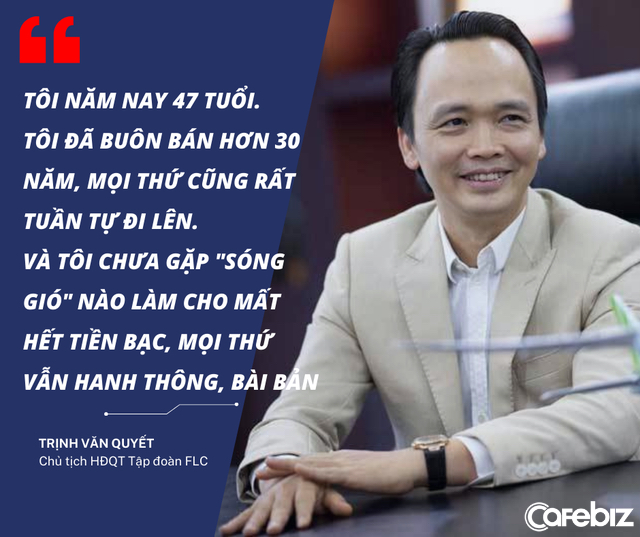

On the evening of March 29, information from the Ministry of Public Security, the Investigative Police Agency of the Ministry of Public Security (C01) conducted an investigation and verification against Trinh Van Quyet, Chairman of the Board of Directors of Group Joint Stock Company. FLC, individuals of FLC Group Joint Stock Company, BOS Securities Joint Stock Company and related companies on The act of “Manipulating the stock market”, “Concealing information in securities activities” occurred on January 10, 2022, causing serious damage to investors, affecting the operation of the stock market. Vietnamese securities.

The above behavior of Trinh Van Quyet, Chairman of the Board of Directors of FLC Group Joint Stock Company, has enough elements to constitute the crime of “manipulating the stock market”, specified in Article 211 of the Penal Code. Initially, on March 29, 2022, the Police Investigation Agency of the Ministry of Public Security issued the Decision to prosecute the criminal case No. 06/QD-VPCQCSĐT, the Decisions to prosecute the accused, and the arrest warrant for the accused. with Trinh Van Quyet. At the same time, organizing search of residences and workplaces at 21 locations for related subjects.

According to the 2017 Penal Code, for intentionally disclosing false information or concealing information in securities activities, the maximum prison sentence is up to 7 years.

Back on January 10, 2022, the “undercover sale” of Mr. Trinh Van Quyet’s shares caused a lot of anger among investors. Specifically, at the trading session on January 10, 2022, FLC shares of FLC Group, chaired by Mr. Trinh Van Quyet, had a strong rally. Right from the beginning of the morning session, this stock hit the ceiling at 24,100 dong/share.

However, in the afternoon session, in just a few minutes, this stock suddenly dropped to the floor, causing investors to panic, falling into a sell-off situation, pushing the price to the floor at 21,000 dong/share. The total trading volume of FLC in this session amounted to 135 million out of 710 million shares outstanding on the market of FLC, equivalent to nearly 20%.

After the end of the trading session, the website of FLC Group posted information that Mr. Quyet had registered to sell 175 million shares, also from January 10. However, this document is dated January 5. A few hours later, the FLC website posted another document, announcing that Mr. Quyet had registered to sell 175 million shares, but the time was from January 14.

By the morning of January 11, both of these documents had been removed. Meanwhile, the website of HOSE or the Securities Commission does not have these two documents. Also in the morning of January 11, the State Securities Commission said that at 5:45 pm on January 10, the Commission received a report from HOSE about Mr. Quyet’s illegal sale of 74.8 million FLC shares on January 10. first.

The State Securities Commission immediately issued a document directing HOSE to block all accounts of Mr. Trinh Van Quyet, and at the same time ordered the illegal sale of 74.8 million shares mentioned above. Investors who matched orders with shares sold by Mr. Quyet were refunded.

January 18, The State Securities Commission issued a decision to fine Mr. Trinh Van Quyet 1.5 billion dong and apply the additional sanction of suspending securities trading activities for 5 months.

Dozens of policemen were present at the house and company of Mr. Trinh Van Quyet on the evening of March 29

It is worth mentioning that this is not the first time that Mr. Trinh Van Quyet has conducted an “underground sale” of shares. In 2017, Chairman Trinh Van Quyet was once fined for selling “undercover” shares of FLC and AMD.

Specifically, from October 20-24, 2017, this giant sold 57 million FLC shares but did not report transaction information. For this act, Mr. Trinh Van Quyet was fined 65 million VND.

However, the fined money is only “salt from the sea” compared to what Mr. Quyet has pocketed by selling shares. According to transaction statistics, when the boss of this corporation sold “underground” FLC shares in 2017, the market price of this stock was at 7,100-7,700 VND/share. Thus, Mr. Trinh Van Quyet may have earned no less than 400 billion VND at market price. And yet, after Mr. Quyet sold a huge amount of shares, the market price of FLC dropped to VND 6,500/share, equivalent to a decrease of nearly 10% in value.

Also during the above period, FLC Faros was sanctioned for not reporting on the expected trading of AMD shares of AMD Group Minerals and Investment JSC. The amount that the company of the giant Trinh Van Quyet was fined for this behavior is 130 million VND.

According to the Law and readers

at Blogtuan.info – Source: cafebiz.vn – Read the original article here