Can 500 million buy a house?

Hi Nguyen Duy,

With an existing amount of 500 million, if you are intending to buy an apartment of 2 billion, the amount you need to borrow will be about 1.5 billion. This is the amount we calculate separately for your home purchase, excluding other expenses incurred if your family has needs, for example: interior design, home decoration,…

Because you did not specify when to buy a house while the interest rates of banks change from month to month. Therefore, we will advise you 4 home loan bank with the lowest interest rate at the moment.

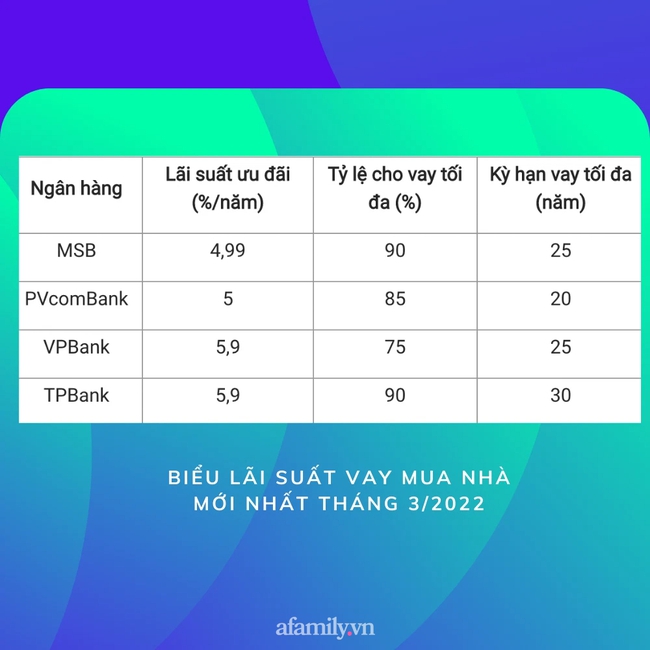

Today, most banks implement this product. Below are some banks with Lowest home loan interest rate in March 2022 that you can refer to.

In March, home loan interest rates ranged from 4.99%/year to 8.99%/year with preferential interest rates from 3 months to 36 months. However, if you plan to buy a house in April, you can completely refer to these 4 banks because the interest rate is not expected to change much.

1. MSB . Bank

– Interest rates: 4.99%/year

– Borrowing limit: up to 90% of the value of the collateral

– Tenor: up to 25 years. The repayment period of this loan package lasts up to 24 months.

Conditions for applying home loan interest rates:

+ Age from 20 to 65;

+ Minimum income from 5 million VND/month;

+ Having collateral of customers or relatives;

+ Live or work for at least 1 month in the same province as the MSB branch/business unit receiving the loan application.

Find out more about MSB’s home loan program HERE.

2. PVcomBank

– Interest rates: 5%/year, applied for the first 6 months of the loan. At the end of the preferential period, the loan interest rate will be changed to a fixed rate of 12%/year.

– Borrowing limit: Customers can borrow up to 85% of the value of the collateral.

– Tenor: lasting up to 20 years.

Conditions for applying home loan interest rates:

+ Age from 18 to 70 years old;

+ Minimum income from 5 million VND/month;

+ Residing/working in the province/city where PVcomBank is headquartered;

+ Customers have no bad debt, group 2 debt at the time of credit granting.

See more information about PVcomBank’s home loan program HERE.

3. TPBank

– Interest rates:

+ 5.9%/year fixed within the first 6 months

+ From 7.5%/year fixed within the first 12 months

– Borrowing limit: For TPBank, a preferential loan package of 5.9%/year has a loan limit of up to 90% of the value of the collateral.

– Loan maturity date: lasting up to 30 years.

Conditions for applying home loan interest rates:

+ Borrowers are Vietnamese citizens, living and working in Vietnam and at TPBank’s headquarters/transaction offices;

+ Be between the ages of 18 and 70 and have full criminal legal capacity as prescribed by law;

+ Having a stable job and income, being able to repay the bank loan every month;

+ Currently has no bad debt at any banks or credit institutions;

+ The property used for mortgage must be lawful and under the ownership of the guarantor.

See more information about TPBank’s home loan program HERE.

4. VPBank Bank

– Interest rate: 5.9%/year

In which, VPBank is implementing a preferential interest rate for the first 3 months. In addition, customers can also choose one of two other loan product packages such as 8.1%/year for the first 6 months or 8.9%/year for the first 24 months.

Conditions for applying home loan interest rates:

+ Customers with income from 4.5 million VND/month;

Secured assets include: Real estate or valuable papers such as stocks, bonds, certificates of deposit, checks, etc.

See more information about VPBank’s home loan program HERE.

at Blogtuan.info – Source: Afamily.vn – Read the original article here