Stocks on April 1st: General Nguyen Thi Mai Thanh and billion-dollar ambition

At the AGM in 2022, Ms. Nguyen Thi Mai Thanh, Chairwoman of Refrigeration Electrical Engineering Corporation (REE) expressed her ambition that REE’s market capitalization will double now and billions of USD in revenue by 2025.

According to the business results report, consolidated revenue reached VND 5,810 billion, up 3% compared to 2020, and profit after tax reached VND 1,855 billion, up 13.9% over the previous year. Energy and water are the two main contributors to revenue growth, increasing by 159% to VND 3,055 billion (in 2021) from VND 1,178 billion (in 2020).

Consolidated net debt reached VND 9,230 billion at the end of 2021, equivalent to a net leverage of 56.4% – up 26.8% from 29.6% in 2020.

In 2022, REE approved the plan of 9,280 billion VND in revenue, up 59% and 2,064 billion in profit after tax, up 11% compared to 2021. Ensure effective business to achieve return on equity (ROE). ) at least 15%/year.

|

| Business results |

With the above results, REE will pay a dividend in 2021 at the rate of 25%, including 10% in cash and 15% in shares.

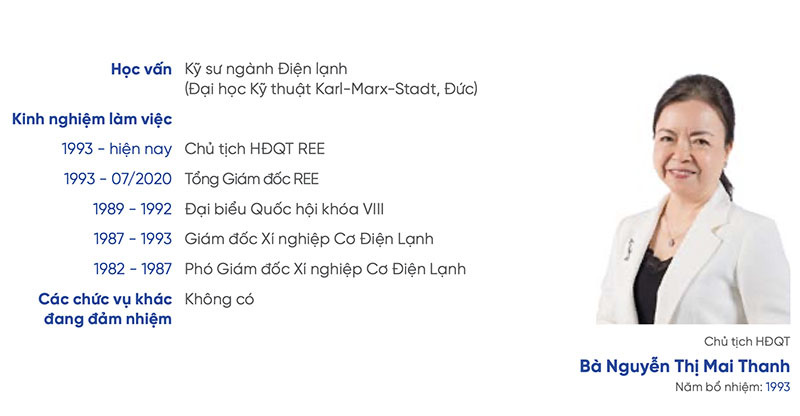

As the driver of the “ship” of REE from the first days to becoming a famous corporation as it is today, businessman Nguyen Thi Mai Thanh known by many people. In 2014, entrepreneur Nguyen Thi Mai Thanh was honored by Forbes Magazine, she ranked 28th in the list of 48 most powerful business women in Asia (ASIA Power Businesswomen) and one of the 80 richest people on the stock exchange. Vietnam.

According to Decree 72/2017/ND-CP, the Chairman of the Board of Directors cannot concurrently hold the position of Director (General Director) of the same public company from August 1. In 2020, Ms. Thanh left the post of general director after 30 years of leadership.

|

| General Nguyen Thi Mai Thanh has great ambitions |

According to Ms. Thanh, renewable energy is REE’s strategic investment. Currently, REE’s portfolio has only one thermal power company and the rest are all clean energy such as wind power, solar power, and hydroelectricity. REE will continue to seek investment opportunities in the renewable energy segment. On the other hand, the new member of the Board of Directors has a lot of experience in this field and is expected to contribute much to the future development of the business.

REE sets a target that by 2025, REE’s market capitalization will double the current level and billions of dollars in revenue, a sharp increase from the current 10,000 billion.

Closing session 30/3, REE shares traded at 81,700 VND/share. Market capitalization reached VND 25,249.46 billion.

Investors are psychologically stable

After a slight decrease, market sentiment was somewhat more stable, helping VN-Index to recover slightly. At the end of the last trading session of March, VN-Index stood at 1,492.15 points, corresponding to a decrease of 0.41% compared to the end of 2021. HNX-Index decreased by 5.14% to 449.62 points. Meanwhile, UPCoM-Index increased 3.87% to 117.04 points.

At the end of March, the index continued its sideways trend like 2 months ago, closing and correcting from the strong resistance area of 1,515 points. Today’s gaining momentum continued to be maintained thanks to the increasing force of VN30’s key stocks, VNM and VRE.

Selling pressure continued to increase in midcaps and smallcaps. In general, the short-term bullish channel of the VN-Index has signaled to form and will confirm when the index surpasses the resistance area of 1,515 points.

According to SHS, the support zone of 1.480-1.485 points is still held and will continue to support market next time.

It is forecasted that in the last session of the week, the market may continue to recover towards the psychological resistance of 1,500 points.

According to VCBS, short-term investors may consider taking profits gradually from stocks that have “fished at the bottom” before, if the market continues to trend closer to the resistance area around 1,500 points in the coming sessions.

Long-term investors can still take advantage of this moment to restructure their portfolios as well as look for new long-term investment opportunities, in which stocks of companies are expected to have positive business results in the near future. The first quarter of 2022 is a top priority.

Duy Anh

at Blogtuan.info – Source: vietnamnet.vn – Read the original article here