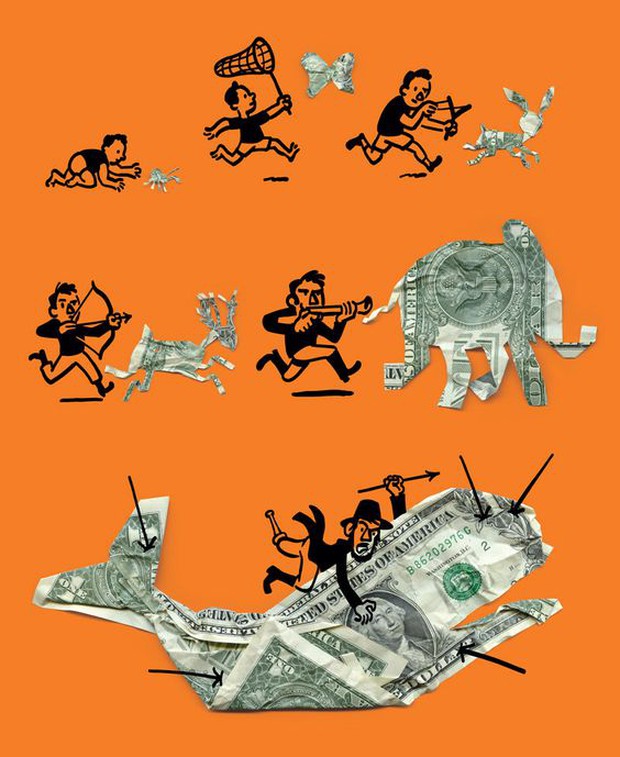

What they all have in common is that they keep VERY LOW CASH!

Surely many people want become a billionaire someday, though that’s unlikely. But an easier thing to do is to get rid of the financial mistakes that keep you away from your goals. Such as excessive spending on frivolous things and not having an investment strategy.

On the other hand, the simplest way to get the right investment strategy is to look at the strategies of experienced professionals and fine-tune from there. Here are three financial experts who will reveal the secrets behind the portfolios of their billionaire clients.

1. Portfolio with 70% stocks and 30% bonds

Nick Coleman, a financial planner with Bonfire Financial RIA, says that when he takes a look at some of his multi-million dollar clients, he notices that the clients are often already on top of their finances. That also explains why they invest about 70% in stocks and 30% in bonds. When it comes to cash, they probably have less than $100,000.

Coleman said: “Most clients want to increase their wealth and prefer capital allocation with high investment rates and little cash holdings.”

When it comes to real estate, Coleman shares that it typically accounts for less than half of his clients’ net worth. Many people don’t want to even count their home as part of their net worth.

Additionally, he suggests that clients typically have around 3% of their assets in alternative investments such as gold, digital assets and commodities.

Coleman said: “Everyone’s situation is very different and requires a specialist advisor to understand their situation and goals in order to create and optimize a strategy that is unique to every client.”

2. Some focus on real estate and diversified portfolios

Cynthia Meyer, a financial planner, finds some of her multi-million dollar clients taking a different approach.

She shares that the typical wealthy client portfolio consists of between 35% and 60% of their investment in real estate. Besides, 40% – 50% of the remaining amount goes to Stock account with diversified portfolio.

Meyer says: “These millionaire clients also typically keep $200,000 to $300,000 in cash reserves. They have no debt, except for mortgages, and they plan to spend.”

Meyer added that these clients typically save and reinvest 25% to 35% of their net income in a retirement account or invest more in real estate.

3. Many people invest in retirement accounts

Andrew Herron, a financial planner and one of the founding partners of Stone Pine Financial, says their typical multi-million dollar client has a net worth of $1 million to $5 million (23 billion – 115 billion), excluding equity in their home.

He says most of his millionaire clients have about 70% of their wealth in retirement accounts. The other 25% will normally be in various investment accounts and then they will have about 5% in cash reserves.

“Our millionaire clients have between 60% and 70% of retirement accounts. They have diversified portfolios in stock accounts, 30%-40% in bonds and other stable value investments.” Herron added.

Photo: Synthesis

at Blogtuan.info – Source: Kenh14.Vn – Read the original article here