What’s so special about gold bars held by ETFs?

ETFs and similar products held 3,570 tonnes of gold worth $210 billion as of the end of 2021, according to data from the World Gold Council (WGC), which tracks the sector.

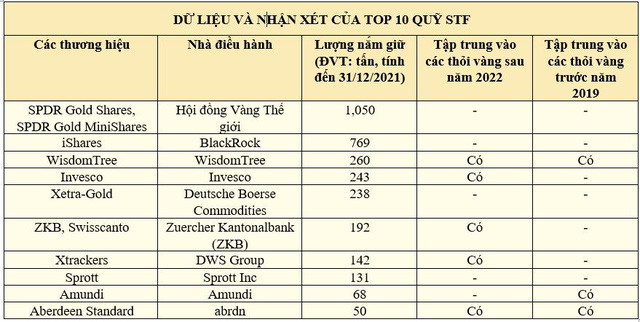

As part of its report on ethical gold investments, Reuters asked the ten largest ETF operators – all based in Europe or North America – what gold they own.

All funds that hold only gold bars refined by companies are accredited by the London Bullion Market Association (LBMA), a body responsible for setting standards in the gold and silver industry.

Six of them, holding 955 tonnes of gold, said they preferred bullion bars produced since 2012, when the LBMA introduced regulations aimed at preventing criminal or criminal use of gold. violence.

Prior to that date, the LBMA’s rules focused solely on the purity, weight, and size of gold bars.

Three of the six ETF issuers that focus on newer gold bars said they want to keep bars produced after 2019, when LBMA rules become tighter. These three companies hold 378 tons of gold as of the end of 2021.

Four of the top 10 fund operators, with 2,188 tonnes of gold holdings, said they were comfortable holding gold bars produced both before and after 2012.

The following are data and comments from the funds.

The WGC said that as an industry body, it is working to implement higher ethical standards for gold miners, refiners and traders.

According to the WGC, the LBMA considers old gold bars eligible for trade and that their exclusion would not have a significant ethical impact in the gold industry and would reduce the liquidity needed for the ETF to perform. does what investors want, which is to track gold prices effectively.

“This is about improving liquidity, gradually raising standards and making sure everyone understands that,” said Joe Cavatoni, WGC’s general manager of global and Americas business. An adequate amount of gold bars is acceptable.

Data and comments of the top 10 ETFs in the world:

BLACKROCK (ISHARES)

A spokesperson for the fund said: “Our ETPs (swap-traded products) are classified by the LBMA as responsibly sourced based on industry standards set by the association, and we only accepts metals from LBMA-accredited refineries.

WISDOMTREE

“The WisdomTree-backed physical gold swap-traded items (ETCs) aim to allocate responsibly sourced bullion, to promote high ethical standards,” the company said.

“Our entire physical gold ETC offering is now 100% backed by LBMA’s responsible gold, which means at a minimum all bullion is sourced after 2012, and (we) allocated gold bars after 2019.”

“Responsibility standards continue to improve, and we work to keep our physically backed gold ETCs allotted as responsibly sourced gold bars as possible.”

INVESCO

Invesco says it works with mining companies, the World Gold Council and the LBMA to raise ethical standards.

“The Invesco Physical Gold ETC sought to minimize exposure to mined gold before the LBMA introduced its Responsible Gold Guidelines, in 2012,” the fund said.

“While much of the gold mined before 2012 may well have followed responsible gold guidelines, it wasn’t required in the past. Our gold holdings are currently 100% gold bars. after 2012.”

DEUTSCHE BOERSE (XETRA)

“I don’t have any problems with the old LBMA gold bars,” said Steffen Orben, chief executive officer of Deutsche Boerse Commodities, which runs the Xetra-Gold fund. redo them… only to have them relabeled (with the date being after 2012).”

He said Xetra-Gold was designed to track wholesale gold prices and needed a liquid market to do so.

ZUERCHER KANTONALBANK (ZKB / SWISSCANTO)

ZKB says its main ETF launched in 2006, before responsible sourcing rules went into effect, and has evolved rapidly.

“As a result, the fund retains its pre-2012 gold bars. For the fund’s new gold purchases, we fully favor ingots minted after 2012, subject to applicable sourcing rules. responsibility from the LBMA”.

The fund said it was “aware of the growing importance of responsible sourcing” and therefore in 2018 launched a gold fund for institutional clients that only hold mints. after 2012.

DWS GROUP (XTRACKERS)

“We aim to only manage eligible London Good Delivery (LGD) gold bars minted after 2012,” said DWS Group, “It is not uncommon for customers to ask if the ETC is compliant with the Findings Guidelines. responsible sourcing by the LBMA.”

SPROTT

“We are required to keep LGD gold bars from LBMA-accredited refineries,” Sprott said in a statement.

“Given the seniority of our fund, we own gold bars from a variety of time periods that are subject to industry sourcing standards at the time they are manufactured.”

“We support continuous improvements in responsible sourcing standards.”

AMUNDI

“Until today, we only hold gold bars dating back to 2019 or later,” said Frederic Hoogveld, head of product development and specialist at Amundi – ETF.

“We see a big trend in responsible investing,” he said. “I expect the market to continue in this direction.”

ABRDN

“We believe it is important that gold owned by SGOL (Aberdeen Standard) be responsibly sourced,” abrdn said in a statement.

“For a number of years we worked with the custodian to manage our inventory, and most of the gold is now owned by the fund created in 2012 or later.”

“Through the production/retouching process, we’re working to get that to 100%.”

Reference: Reuters

at Blogtuan.info – Source: cafebiz.vn – Read the original article here