All week sleeping on a beanbag chair, not at home, want to use almost all of his $20 billion fortune to charity

The Economic Club of New York has hosted kings, prime ministers and presidents, along with billionaires like Jeff Bezos and Jamie Dimon of JPMorgan. The comments made by central bankers when speaking at the 115-year-old institution are what often change the market. Sam Bankman-Fried – a 30-year-old cryptocurrency billionaire, is probably the first person… to play a game while giving a presentation.

As the club’s featured guest on a February morning, Bankman-Fried looked as chubby as ever. He leaned back in his gaming chair in blue shorts and a gray t-shirt with the logo of crypto exchange FTX. He was giving a presentation via Zoom from his office Bahamas.

Behind the camera, the “pieces” of an ordinary person living at work appear on Bankman-Fried’s desk: crumpled purchase receipts from the US and Hong Kong, 9 lipsticks. , one stick of deodorant, 1 sachet of salt and an opened packet of instant chickpea curry. Nearby was a pea-sized chair, the “place” his assistant said Bankman-Fried spent most of the week sleeping on.

When questioned about how the US should regulate the cryptocurrency sector, Bankman-Fried was playing a role-playing game called Storybook Brawl with the character “Peter Pants” and preparing for a battle with “Funky Kangaroo”. . The young billionaire shared: “We predict this field in the US will grow strongly.”

Bankman-Fried was a bit of an oddity when he let a Bloomberg reporter see six screens when it came to content that is often considered a “state secret” by executives. He once received a text message saying MoneyGram was for sale and it took him a few seconds to consider whether it was a “bargain”. An assistant informed that the owner of an investment bank was in the Bahamas and he wanted to meet in just 5 minutes. That evening, Bankman-Fried planned to fly to the Munich Security Conference to meet the Prime Minister of Georgia.

He found Bitcoin to be an attractive asset class. Bankman-Fried decided this would be the right path to making money. Now, Bankman-Fried is one of the richest people in the world with a fortune of more than $20 billion, according to the Bloomberg Billionaires Index. Venture capitalists have poured a total of $40 billion into FTX and its US branch.

How does FTX work?

In 2017, the cryptocurrency market is in the first phase of a boom. The price of Bitcoin increased tenfold that year, and investors poured $5 billion into hundreds of ICOs. To buy Bitcoin, Litecoin or Ether, users have to send USD, yen or euros to an exchange, trade back and forth for a while and then withdraw cash. Bankman-Fried found that some coins could be resold for a higher price on other exchanges. This is the arbitrage opportunity he learned from Jane Street.

In the above transactions, some have wrong data and some cannot execute. Capital controls have prevented traders from sending money “home” from South Korea, where Bitcoin sells for 30% more than in the US. But Japan doesn’t have those rules, Bitcoin still trades with a 10% premium. In theory, one could make 10% a day by buying Bitcoin on an American exchange and sending it back to the exchange in Japan for sale. With this momentum, within 4 months, 10,000 USD will turn into 1 billion USD.

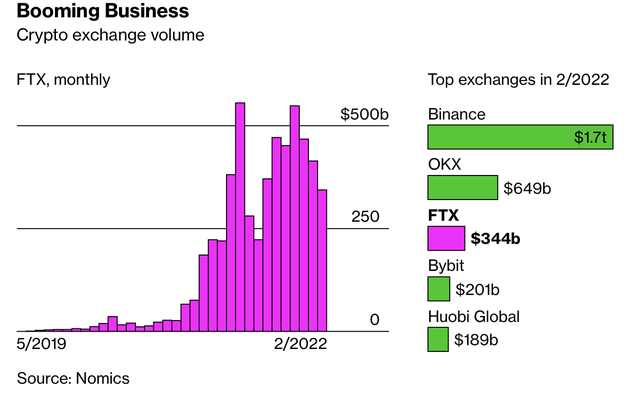

Trading volume of the world’s largest cryptocurrency exchanges and FTX.

Bankman-Fried recruited a few friends to help him with this project, including Gary Wang – a friend he studied with at MIT who now does flight data for Google; Caroline Ellisin – trader from Jane Street and Nishad Singh – a friend who was then an engineer at Facebook. Later, they moved into a three-bedroom house in Berkeley and delved into the arbitrage business.

Bankman-Fried named the company Alameda Research. However, banks in the US do not appreciate cryptocurrencies, so they do not allow him to open an account here. Meanwhile, Japanese exchanges only allow Japanese people to withdraw money in yen. Therefore, he opened a subsidiary in Japan and hired a local representative. However, business was not going well, and banks were always questioning Bankman-Fried’s overseas transfers.

Every time she finds a bank she likes, Alameda feels like she’s racing. If they don’t move money out of Japan before the banks close, they will miss out on that day’s 10% profit. Completing this cycle requires precise “tricks”. Another group in the US spends 3 hours a day making sure the money transfers go smoothly, and another group in Japan queues for several hours at the counter to get their money back. At its peak, Alameda sent $15 million a day and generated $1.5 million in profits. Within a few weeks, they made about $20 million.

In 2019, Bankman-Fried’s company spent hundreds of thousands of dollars in profits every day building a cryptocurrency exchange. His team took 4 months to write the code for this exchange and opened its doors in May 2019. It’s FTX – specializing in large transactions, allowing users to bet on dozens of different cryptocurrencies, use leverage, futures or even bet on elections and stock prices. .

FTX customers can borrow up to 101 times collateral (now cut to 20 times because of criticism). Importantly, traders can use cash as collateral to invest in any digital currency. FTX has been a huge success because many people want to use it to trade Alameda. Daily trading volume reached $300 million in July of that year and averaged $1 billion in 2020. According to Bankman-Fried, the exchange’s revenue last year was $1.1 billion and profit was $350 million. USD.

The 30-year-old billionaire lives like… a college student

Owning a fortune of several tens of billions of dollars, Bankman-Fried said his core philosophy remains unchanged. He only keeps enough money to maintain a comfortable life, which is 1% of his income or at least 100,000 USD/year. In addition, Bankman-Fried intends to use all remaining funds to charity.

To date, Bankman-Fried has spent more on some causes than on charity. For example, buying the naming rights to the Miami Heat stadium for $135 million over 19 years and the Super Bowl advertising service featuring comedian Larry David is estimated at $30 million. So far, Bankman-Fried is investing to maximize his earnings, even if he’s risking his fortune.

These days, Bankman-Fried lives in Nassau, the capital of the Bahamas. FTX is planning to build a working campus with 1,000 employees, with an office overlooking the sea. Currently, the company’s headquarters is located in a red-roofed 1-story building near the airport.

A day before the interview with Bloomberg, when asked about the trip to the Super Bowl, Bankman-Fried shared: “I don’t know if the word ‘fun’ is exactly what I would use to describe it. no. I don’t really like parties.”

Until now, as a billionaire, Bankman-Fried lives as a… college student. He drives a Toyota Corolla. And when he’s not at the office, he’ll return to an apartment with about 10 roommates (though it’s the most beautiful penthouse on the island).

Talking about his spending style, Bankman-Fried shared that although he doesn’t want to waste time thinking about how to save, he doesn’t see much value in shopping. The billionaire said: “You might be happier when you spend money. But I don’t like owning yachts.”

Put your trust in the US market

The cryptocurrency sector does not seem to be a popular choice for philanthropists, as the technology sometimes facilitates scams and also consumes a lot of energy. However, Bankman-Fried does not think so. He said that FTX operates a transparent marketplace, regularly checks customer backgrounds, buys emissions certificates to offset emissions, and the technology is more efficient than the mainstream financial system. But, clearly, what made Bankman-Fried most attractive was getting rich quickly.

Bankman-Fried will smile when he sees a chart showing that FTX is growing faster than major competitors like Binance. The cryptocurrency market is very large, FTX is only the world’s 3rd largest exchange in terms of volume but handles 15 billion USD in transaction value in a “busy” day. Instead of investing in Microsoft, users are buying and selling Bitcoin, Ether, Dogecoin and hundreds of other exotic cryptocurrencies.

Bankman-Fried sets its sights on the US market, which is currently dominated by Coinbase. He wants to offer services like futures, swaps and options for cryptocurrencies. If it succeeds in dominating the cryptocurrency market, then Bankman-Fried’s next target will be the financial markets. The billionaire said: “We are just going around the children’s pool area. My goal is for FTX to become the largest source of financial transactions in the world.

Bankman-Fried said he donated $50 million to charities last year, including pandemic relief in India and initiatives to combat global climate change. This year, he is expected to give away at least a few hundred million dollars and up to 1 billion dollars to the largest funds.

The billionaire said that his top priority right now is to be prepared for the pandemic. A future outbreak of disease, he said, is as dangerous as Ebola and as contagious as Covid-19.

Around 5 p.m. on the day of his presentation at the New York Economic Club, Bankman-Fried collapsed and fell asleep in his gaming chair, then lay down on the beanbag chair beside his desk.

Business and marketing

at Blogtuan.info – Source: cafebiz.vn – Read the original article here