The case of President Tan Hoang Minh and FLC being arrested: Determined to clean the market

The prosecution and arrest of Tan Hoang Minh Chairman Do Anh Dung and FLC Chairman Trinh Van Quyet showed their determination to clean up the stock market and corporate bond market.

Determined to clean up the market

Share with PV. VietNamNet on the evening of April 5, a representative of the Ministry of Finance said: The recent cases of violations in the stock market and corporate bond market are also very unfortunate events, but through that, the decision is also seen. the regulator’s interest in making the securities market transparent and the market will corporate bonds.

Such violations are not common and if an individual does it, that individual must be held accountable before the law. The Ministry of Finance is ready to coordinate with agencies to strictly handle violations.

|

| The case of President Tan Hoang Minh and FLC being arrested: Determined to clean the market |

A representative of the Ministry of Finance emphasized: The view of the Ministry of Finance is to comply with and respect the law, and strictly handle cases of law violations taking advantage of manipulating the stock market to gain illicit profits. Strictly handle so that the stock market is really open and transparent, and is the business to mobilize capital for socio-economic development.

The Ministry of Finance said it has regularly reviewed amendments and supplements to perfect institutions and regulations on state management of the financial market sector, including the stock market.

“Through the recent incident, it can be seen that a number of businesses have issued false financial statements, in addition, independent auditing agencies have not fulfilled their responsibilities, leading to incorrect information of enterprises. , affecting the interests of investors”, a representative of the Ministry of Finance shared.

Notably, according to a reporter from VietNamNet, the companies that have issued 9 rounds of corporate bonds under Tan Hoang Minh Group are all unlisted companies, so to issue corporate bonds, companies This company does not have to consult the State Securities Commission. After completing the bond issuance, these enterprises are responsible for sending information to the HNX.

This is considered a loophole for businesses to take advantage of. VietNamNet’s source said that the Finance Minister asked the units to amend Decree 153, 155 to ‘seal’ this loophole.

Continuously broadcast warning information

In addition, from 2021 until now, the Ministry of Finance has continuously issued information warning about risks to investors when participating in the corporate bond market.

From September 1, 2021, Finance Minister Ho Duc Phuc soon directed to strengthen the inspection and supervision of the corporate bond market. At that time, in addition to recognizing the positive effects of corporate bonds, the Ministry of Finance assessed that the private placement of corporate bonds also revealed many risks to investors and threatened to cause insecurity. national financial security and safety.

Minister of Finance Ho Duc Phuc requested the State Securities Commission; The Banking and Finance Department and the Vietnam Stock Exchange strengthen supervision of this activity.

The Ministry of Finance requested the State Securities Commission to assume the prime responsibility for, and coordinate with the Department of Finance and Banking and relevant agencies in, strengthening and speeding up the inspection, examination and supervision of the issuance. and provide services on individual corporate bonds, especially the issuance of small and newly established businesses, operating in high-risk fields, with unclear business results. , actually; Focus on reviewing, checking and detecting enterprises showing signs of violating or circumventing the law in the issuance of corporate bonds.

“In case of detecting fraudulent acts and showing signs of appropriating investors’ assets, they should promptly transfer them to the police for handling in accordance with the law,” the Ministry of Finance made a request very early. .

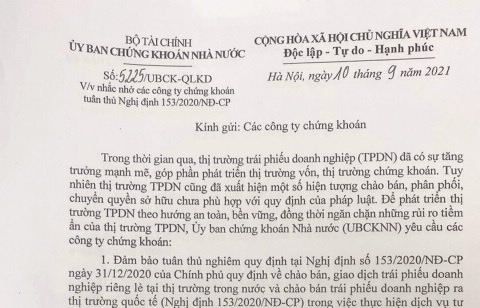

Immediately after that, on September 10, 2021, the State Securities Commission sent an official dispatch to securities companies reminding them of their compliance with Decree 153/2020/ND-CP of the Government on regulations on offering for sale. , trading corporate bonds individually in the domestic market and offering corporate bonds to the international market.

|

| A warning document from the State Securities Commission from September 2021 |

The State Securities Commission early discovered that the corporate bond market had some phenomena of offering, distributing and transferring ownership that were not in accordance with the provisions of the law.

Therefore, in order to develop the corporate bond market in a safe and sustainable direction, and at the same time prevent potential risks of this market, the State Securities Commission requires securities companies to ensure compliance with the regulations. Strictly comply with the provisions of Decree 153 dated December 31, 2020 of the Government

By December 2021, in the face of hot growth of corporate bonds, the Ministry of Finance has assessed the market situation over the past time to develop a draft Decree amending and supplementing a number of articles of the Decree. No. 153/2020/ND-CP on private placement of corporate bonds.

According to the Department of Finance and Banking, current regulations, enterprises mobilize capital for individual bonds on the principle of self-borrowing, self-paying, and self-responsibility. State management agencies do not issue issuance permits. However, among the bond issuers, there are still small-sized enterprises that mobilize capital with large volumes and high interest rates, and bond issuers without collateral or quality assurance. poor guarantee.

This agency believes that in cases of enterprises with weak financial situation, when raising capital for bonds with a large volume and high interest rates, the issuers themselves will be at risk if their production and business activities are not successful. difficult, and will not be able to repay the bond principal and interest to investors. With a higher risk nature, private placement corporate bonds are only suitable for professional securities investors who are able to analyze and evaluate risks, have financial capacity and dare to invest in securities. accept risk when deciding to buy bonds.

Accordingly, if you are not eligible to become an investor, stock As a professional, investors should consider the regulations on conditions, supporting documents and regulations on penalties for violations for professional securities investors.

“Investors need to be very careful that high interest rates come with high risks, so they must carefully evaluate risks before deciding to buy bonds” – Finance and Banking Department once said. continuously make recommendations.

Luong Bang

at Blogtuan.info – Source: vietnamnet.vn – Read the original article here