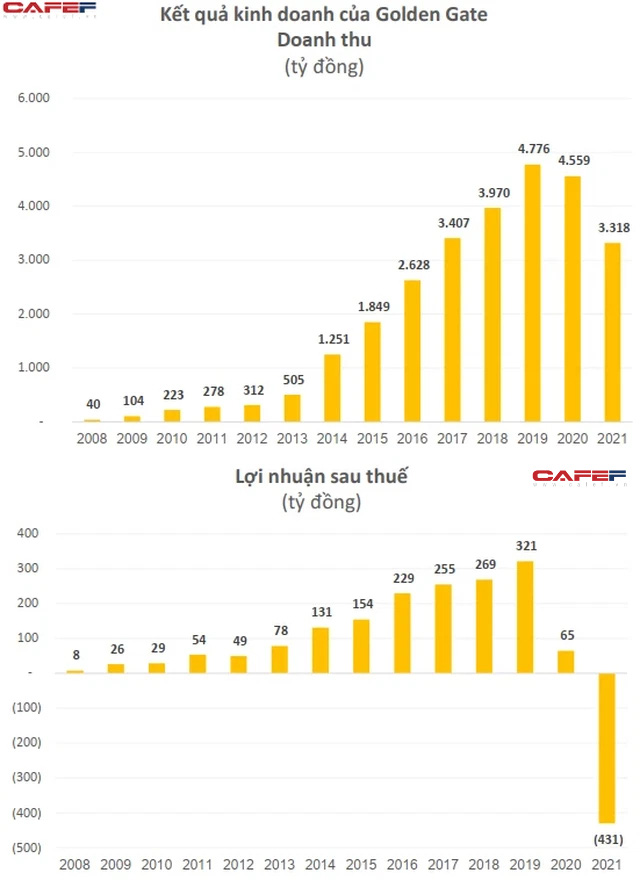

The famous restaurant chain tycoon Golden Gate reported a big loss of VND 431 billion in 2021

In 2021, the revenue of Golden Gate Trading and Service Joint Stock Company (Golden Gate) decreased by 27.2% from 4,559 billion VND in 2020 to 3,318 billion VND. In which, revenue from selling food and beverages reached VND 3,304 billion, accounting for 99.6% of the company’s revenue structure.

Golden Gate’s gross profit reached VND 1,926 billion, profit margin narrowed to 58.1% compared to 59.5% in 2020.

Golden Gate’s financial expenses in 2021 will reach VND 44 billion, an increase of 112.6% compared to 2020. This is mainly due to a sharp increase in interest expenses when the company issues VND 488.6 billion of bonds, period 36-month term, secured by 573,372 shares of the company owned by Golden Gate Partners JSC.

Although it has reduced selling costs by 11.5% and administrative expenses by 7.5%, Golden Gate’s profit after tax in 2021 is still negative 431 billion dong. Recorded the first time Golden Gate reported a loss since 2008 until now.

In addition, on March 15, 2022, the share transfer transaction between the company’s shareholders was Prosperity Food Concepts Pte. Ltd., Mr. Tran Viet Trung and Mr. Nguyen Xuan Tuong and their partners are Seletar Investments Pte. Ltd, Seatown Private Capital Master Fund and Periwinkle Pte completed. Subject to the terms and conditions of the contract, Seletar Investments Pte. Ltd received over 1.5 million shares, Seatown Private Capital Master Fund transferred 768 thousand shares and Periwinkle Pte received 436 thousand shares.

at Blogtuan.info – Source: Soha.vn – Read the original article here