“Mountain” of mortgage red book in banks

In the business activities of commercial banks, lending activities bring the largest source of profit, but at the same time, there are always potential risks because borrowers may not be able to repay their loans for many reasons. Therefore, collateral for loans is very important for banks, as a rescue plan for bad debts.

According to statistics, the total loan balance of 26 banks by the end of 2021 will reach VND 7.3 million billion, while the value of collateral assets is up to VND 16 million billion, which is more than twice the loan balance. .

There are many banks with very high ratio of collateral to outstanding loans such as NCB (487%), VietABank (352%), MB (371%),… In big banks like BIDV, VietinBank, Vietcombank, Sacombank, ACB…also popular from 150-200%.

Security assets at banks today are diverse from real estate, movables, deposits, gold, gems, valuable papers such as stocks, bonds, means of transport, machinery and equipment, inventory, receivables,….However, the main and most popular asset is still real estate.

Real estate is preferred by banks to receive mortgages and mortgages because these are assets with clear documents and proof of ownership. Moreover, the value of real estate is rarely lost like machinery, vehicles, .. but even increases in the future. When bad debts arise, the bank’s ability to recover debts will also be higher.

The amount of mortgaged real estate at 26 banks (excluding Agribank) increased by 18% in 2021 to more than VND 9.6 million billion, accounting for 60% of total collateral.

Agribank has not released data for the end of 2021, but it is still likely to be the bank with the most collateral being real estate. Before that, at the end of 2020, the number of mortgaged real estate assets at this bank reached more than 1.8 million billion VND, much higher than other banks.

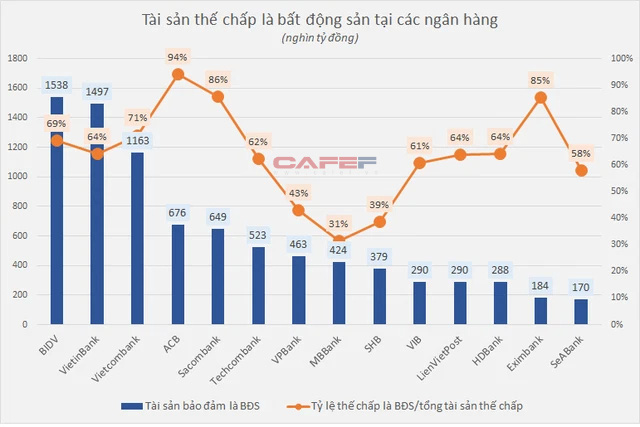

Next is BIDV with the amount of mortgage real estate valued at more than 1.53 million billion dong at the end of 2021, an increase of 18% compared to 2020. In addition, the 2 banks with real estate collateral over 1 million billion dong are VietinBank (1.49 million billion), Vietcombank (1.16 million billion), … The proportion of real estate in the collateral of these banks is usually 65-70%.

In the group of private banks, ACB, Sacombank, Techcombank, VPBank, and MB lead in terms of assets secured by real estate. In which, ACB and Sacombank prefer real estate when this type of collateral accounts for 94% and 86%.

In addition, many other banks have the ratio of real estate collaterals over 80% such as Eximbank (85%), VietABank (86%), Saigonbank (92%),… and approximately 80% like VietBank (76%) ), VietCapitalBank (78%).

Meanwhile, some other banks have a lower proportion of mortgages on real estate assets, they accept many other assets as collateral such as valuable papers, real estate, etc. For example, at VPBank, real estate only accounting for 43% of total collateral, the bank received a lot of valuable papers as collateral (25%),… Or at MBBank, the collateral is real estate accounting for only 31%, while The bank received a lot of receivables (accounting for 39%).

Real estate mortgaged at a bank includes land, houses, factories, construction works attached to land, assets attached to construction works. It can be existing assets, it can also be future assets (i.e. assets formed during and after the conclusion of the mortgage agreement) such as income from use. Real estate, assets formed from loans, future construction works…

Despite the preference for real estate as collateral, disposing of these assets for debt recovery is not always easy. Especially for large land plots and real estate projects entangled in legal disputes, related to criminal cases, the liquidation will face many difficulties. In fact, real estate blocks of trillions of dong, banks often have to put up for sale many times, lasting several years and continuously reducing prices to be able to sell successfully.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here