How Phat Dat uses PDR shares to “suck” 2,355 billion dong of bonds

The larger the capitalization, the larger the number of bonds secured by PDR shares of Phat Dat

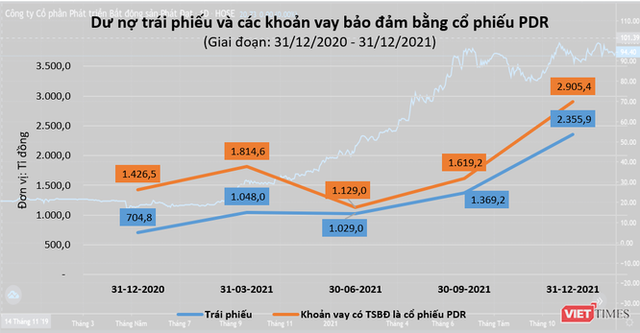

According to VietTimes statistics, as of December 31, 2021, outstanding loans and bonds secured by PDR shares of Phat Dat Real Estate Development JSC (Phat Dat) amounted to VND 2,905.4 billion , doubled compared to the end of 2020.

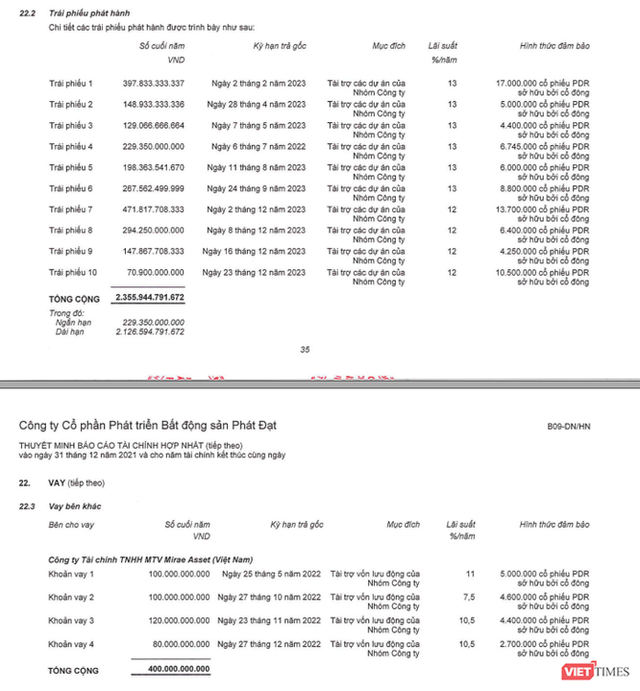

In which, bonds accounted for 81%, with VND 2,355.9 billion, 3 times higher than the beginning of the year. These bonds have an interest rate of 12%-13%/year, secured by 82.79 million PDR shares.

Besides, Phat Dat also borrows 400 billion dong from Mirae Asset Company Limited (Vietnam) with interest rates ranging from 7.5% – 11%/year to finance working capital for the group of companies. These loans are secured by 16.7 million shares of PDR.

In the past few years, bonds have gradually become an important capital mobilization channel, but also with the most “expensive” costs of Phat Dat.

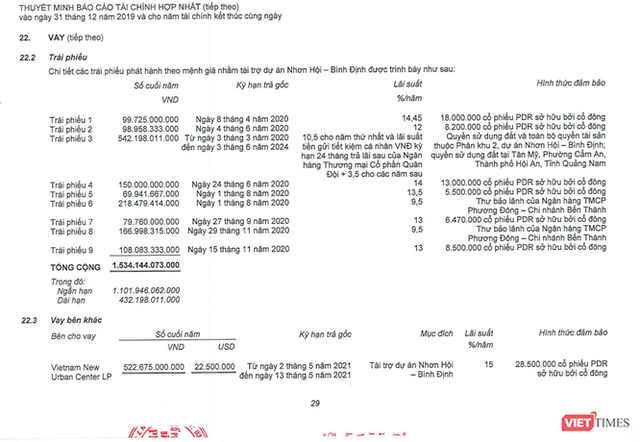

In 2019, this real estate business had 9 bond issuances. Including a bond lot of VND 200 billion, issued on April 8, 2019, with a term of 1 year, with an interest rate of up to 14.45%/year (guaranted by 18 million PDR shares. ); or a bond lot of VND 150 billion, issued on June 24, 2019, with a term of 1 year, with an interest rate of up to 14%/year (secured by 13 million PDR shares). As of December 31, 2020, this real estate enterprise has a bond outstanding balance of VND 704.8 billion. Except for the 3rd bond issuance in 2019, all 3 bond lots issued in 2020 have an interest rate of 13%/year, secured by 44.25 million PDR shares. Emphasizing that the above bond lots have the top interest rates in the Vietnamese bond market, far exceeding the interest rate for Tan Hoang Minh’s 11.5%/year bonds that are causing a stir.

Meanwhile, Phat Dat recorded a loan of VND 100 billion at Orient Commercial Joint Stock Bank (OCB) – Ben Thanh Branch, with a rather ‘soft’ interest rate, only 9.8%/year. This loan is secured by 14 million shares of PDR and is no longer recognized in Phat Dat’s 2021 audited consolidated financial statements.

Despite being “burdened” of bonds, in 2021, Phat Dat still arranges collateral for banks to secure the loan obligations of DKRB Real Estate JSC (now Northern Danh Khoi JSC) and Investment JSC Danh Khoi Holdings (DKRH).

As VietTimes mentioned, in December 2020, DKRH contributed capital to establish a series of legal entities, including: ADK Real Estate Joint Stock Company (ADK), BDK Real Estate Joint Stock Company (BDK), CDK Real Estate Joint Stock Company (ADK) CDK), EDK Real Estate Company Limited (EDK), GDK Real Estate Company Limited (GDK), Real Estate Company Limited (HDK), IDK Real Estate Company Limited (IDK).

A few weeks after its establishment, these legal entities were transferred by Phat Dat a series of land plots under the Nhon Hoi eco-tourism urban area project in Binh Dinh province (Nhon Hoi NewCity). After receiving the transfer, legal entities such as ADK, BDK, or CDK will mortgage these lands at the Public Commercial Joint Stock Bank of Vietnam – City Branch. Ho Chi Minh City (PVcomBank).

Meanwhile, by the end of 2021, PDR also recorded up to VND 1,525.5 billion in receivables related to Danh Khoi Holdings group, including: DKRH (VND 497.5 billion), IDK (VND 308 billion), NTR (306 billion VND), CDK (251 billion VND) and HDK (163 billion VND).

|

Meanwhile, Phat Dat recorded a loan of VND 100 billion at Orient Commercial Joint Stock Bank (OCB) – Ben Thanh Branch, with a rather ‘soft’ interest rate, only 9.8%/year. This loan is secured by 14 million shares of PDR and is no longer recognized in Phat Dat’s 2021 audited consolidated financial statements.

Despite being “burdened” of bonds, in 2021, Phat Dat still arranges collateral for banks to secure the loan obligations of DKRB Real Estate JSC (now Northern Danh Khoi JSC) and Investment JSC Danh Khoi Holdings (DKRH).

As VietTimes mentioned, in December 2020, DKRH contributed capital to establish a series of legal entities, including: ADK Real Estate Joint Stock Company (ADK), BDK Real Estate Joint Stock Company (BDK), CDK Real Estate Joint Stock Company (ADK) CDK), EDK Real Estate Company Limited (EDK), GDK Real Estate Company Limited (GDK), Real Estate Company Limited (HDK), IDK Real Estate Company Limited (IDK).

A few weeks after its establishment, these legal entities were transferred by Phat Dat a series of land plots under the Nhon Hoi eco-tourism urban area project in Binh Dinh province (Nhon Hoi NewCity). After receiving the transfer, legal entities such as ADK, BDK, or CDK will mortgage these lands at the Public Commercial Joint Stock Bank of Vietnam – City Branch. Ho Chi Minh City (PVcomBank).

Meanwhile, by the end of 2021, PDR also recorded up to VND 1,525.5 billion in receivables related to Danh Khoi Holdings group, including: DKRH (VND 497.5 billion), IDK (VND 308 billion), NTR (306 billion VND), CDK (251 billion VND) and HDK (163 billion VND).

at Blogtuan.info – Source: cafebiz.vn – Read the original article here