Target revenue of 100,000 billion, maximum issuance of 500 million USD of international bonds

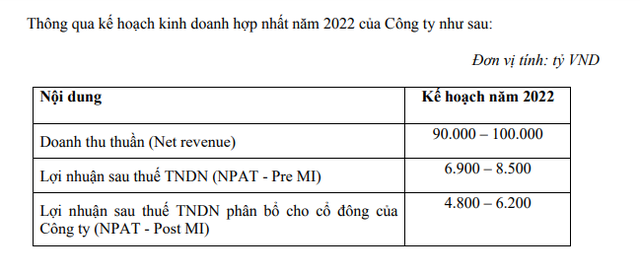

Recently, Masan Group announced the document of the 2022 General Meeting of Shareholders. Regarding the business plan, the Board of Directors proposed a consolidated business plan for 2022 including 3 targets:

Net revenue in 2022 will reach VND 90,000-100,000 billion. The audited business results report shows that Masan’s consolidated net revenue reached VND 88,629 billion, up 14.8% from 77,218 in 2020. Thus, the 2022 business plan sets a revenue target. Masan’s net income will increase from 1.5% to 12.8%.

Profit after tax reached 6,900-8,500 billion VND. Audit data for 2021 shows that Masan’s profit after tax will reach VND 10,101 billion, 7.24 times higher than VND 1,395 billion in 2020. Thus, Masan’s profit plan will decrease from 15.8% to 31. .7%.

Profit after CIT allocated to shareholders is from 4,800 to 6,200 billion dong. This figure of Masan in 2021 is VND 8,563 billion, nearly 7 times higher than VND 1,234 billion in 2020. This target is also carefully set by Masan to decrease from 27.6% to 43.9%.

The Board of Directors of Masan also submitted to the General Meeting for approval the dividend payment plan for 2021 with the 2021 cash dividend of 12%.

In 2022, Masan also plans to issue new shares under the employee selection program (ESOP). The objective of this issuance is to increase charter capital, serve business needs and supplement working capital of the Company.

The maximum number of shares to be issued is 0.5% of the total number of outstanding shares. The par value of the issue is 10,000 VND/share.

In addition, Masan also plans to offer up to 142,372,483 new shares in 2022 to strategic investors. Specifically, the criteria for selecting investors to be offered for sale: (1) for strategic investors: domestic and foreign organizations with financial capacity or technological level to support the development of operations. business activities of the Company and its subsidiaries in the Group, (2) for professional securities investors: are domestic and foreign organizations and individuals that meet the conditions prescribed by law. the law.

The number of equity investors offered for sale to no more than 99 strategic investors and/or professional securities investors.

Not only issuing individual shares, Masan said that it is planning to issue shares to convert bonds and increase charter capital. Total number of shares expected to be issued is the entire number of shares that are duly requested by the Bond Holder to convert (“Convertible Shares”) in accordance with the Bond Documents and up to a maximum of 5 % of the total number of outstanding shares of the Company after conversion.

Besides, Masan also plans to list the bonds to be issued to the public in 2022 and before the Annual General Meeting of Shareholders in 2023.

The report to the General Meeting of Shareholders said that Masan also has a plan to issue convertible bonds to the international market and a plan to issue shares to convert bonds and increase charter capital. Expected issuance date is in 2022 and/or 2023. Bond face value is expected to be $100,000 and multiple of $1,000 or other denomination in line with market practice. 9. The maximum number of bonds to be issued is 500,000,000 USD. Masan’s selection criteria for international bond investors are foreign organizations with financial capacity and technological qualifications to support the development of business activities of the Company and its member companies. Masan. The Bonds are listed on the Singapore Stock Exchange (SGX-ST).

Regarding the remuneration of members of the Board of Directors in 2022, it is also proposed to be 0 dong. The budget plan for operating expenses of the Board of Directors, including committees under the Board of Directors (if any), in 2022 is not more than 5 billion VND.

Following Economic Life

at Blogtuan.info – Source: cafebiz.vn – Read the original article here