Decoding FCCOM Finance

From the fourth quarter of 2021, during the meeting with analysts and investors to share 9-month business results and long-term plans, when it comes to the content of selling all 100% capital of FCCOM Finance Company Mr. Nguyen Hoang Linh, General Director of Maritime Commercial Joint Stock Bank (MSB) said that the bank is in contact with 2-3 investors and is in the process of signing a transfer contract in November 2021.

“If expectations are met and nothing changes, the bank will complete the transfer next year and record a profit,” said Mr. Linh. The estimated value of the deal is not less than 100 million USD and MSB can earn 1,800 – 2,000 billion dong in profit in 2022.

This is not the first time MSB has expressed its plan to sell FCCOM. Since 2019, the public has been stirred up by the news that Hyundai Card, the credit card issuer of the Korean automaker Hyundai Motor, announced that it will buy back a 50% stake in Community Finance Company Limited ( FCCOM) for 49 billion won (equivalent to 42 million USD). However, up to now, the deal has officially collapsed.

A few days ago, in the meeting documents of the General Meeting of Shareholders, MSB made a report on the divestment of Vietnam Maritime Commercial Joint Stock Bank in its subsidiary – FCCOM. Accordingly, MSB is looking for a strategic partner with 2 options (i) transferring a part of its capital at FCCOM (ii) transferring all of its 100% capital in FCCOM to focus on its main business.

Thus, the option to sell a part or sell out of FCCOM has not been officially decided yet.

Piece of cake market share of consumer finance companies, not easy to eat?

By the end of 2021, FCCom has 23 service introduction points (POS), 13,000 customers, most of which are farmers, small businesses, and individuals.

The company’s main lending products: Consumer loans with real estate, loans with outstanding mortgage real estate, general consumer loans, loans with salary income, consumer loans Super fast use, loans to existing customers, mortgage loans with valuable papers and other loans, ..

FCCOM has a charter capital of VND 500 billion, 100% owned by MSB. At the end of 2021, FCCOM recorded a very modest total loan balance of VND 358 billion with a revenue of VND 151 billion and a symbolic profit after tax of only VND 0.98 billion.

Thus, this is the 2nd year in a row, FCCOM’s profit goes back, not only that, the return on equity (ROE) is also very low. The highest profit after tax the company recorded was 5.1 billion dong in 2019, at that time, the calculated ROE was less than 1%.

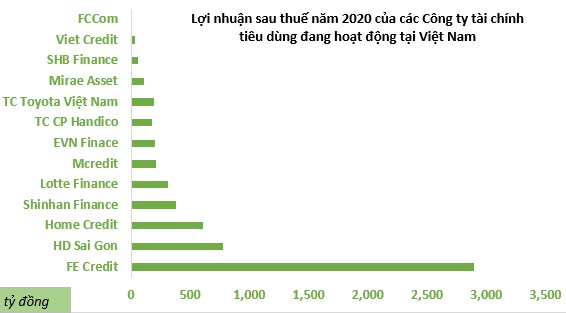

If comparing the profit after tax in 2020 of the group of consumer finance companies in Vietnam, the business performance of FCCOM is only at the level of no loss.

Data according to Vietdata

A few years ago, the domestic consumer finance lending market was dominated by 3 large enterprises with about 75% market share: FE Credit, HD Saison and Home Credit.

The participation of financial companies with 100% foreign investment capital such as Shinhan Finance, Lotte Finance, TC Toyota Vietnam,… contributes to increasing competition for the market, and also proves the funds. Foreigners and foreign investors are quite interested in this field.

According to statistics by the end of 2020, outstanding loans to the consumer finance lending industry accounted for 20% of the total outstanding loans of the whole economy. Forecasts show that there is still a lot of room for Vietnam’s consumer finance industry to develop in the coming period as it remains a flexible lending channel for individual consumer needs such as home repair and shopping. use,…

It is considered to have potential, but the entry into the industry is not simple in terms of licenses, establishment procedures, etc., so the MA (acquisition and merger) option is favored by many investors.

An industry expert shared with us: “The piece of market share in this industry can also be divided, but to do well, it is not only about money investment. Human factors, technology are very important. Look at it. Well, setting up an efficient machine is very difficult…”

MSB currently shows that they are maintaining FCCOM’s activities at a level of income sufficient to cover expenses, besides actively looking for partners to resell this “child”. With a risky field such as lending, if it is not possible to invest resources to do well, maintaining a “safe” state is also a way for the company to be easier to value, when buyers do not have to “clean up” the post-mortem. consequences of bad debt.

Following Economic Life

at Blogtuan.info – Source: cafebiz.vn – Read the original article here