Alarm “wave” of withdrawing one-time social insurance

In recent days, at many social insurance agencies in Ho Chi Minh City, hundreds of people have lined up since early morning to complete the one-time withdrawal procedure because many facilities in the city are overloaded.

According to research, from the beginning of April, social insurance units in Thu Duc City, District 12, Binh Tan, Hoc Mon, Cu Chi and Binh Chanh districts have been overloaded because the demand for withdrawal of social insurance has increased dramatically. . Therefore, workers have to go early to get the procedure done.

Ho Chi Minh City Social Insurance said that in March, there were more than 12,000 people receiving one-time social insurance benefits. Accumulated from the beginning of January to the end of March, 2022, this number has reached about 37,000 people, an increase of 19% compared to the same period in 2021.

The trend of withdrawing one-time social insurance increases rapidly

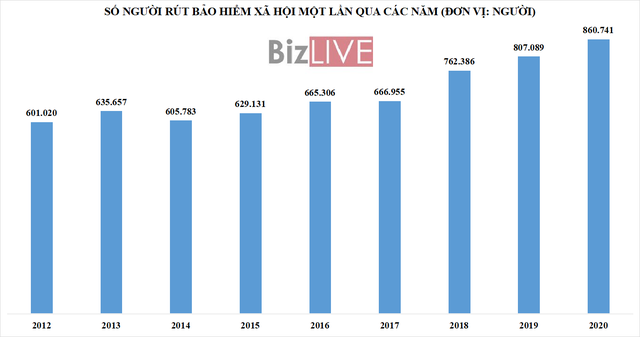

Not only in Ho Chi Minh City and not only recently, the trend of withdrawing one-time social insurance has been established many years ago and the number has increased gradually over the years, but the most obvious one is from 2020.

According to statistics of Vietnam Social Security, from 2016 to 2020, there are over 3.7 million people who choose to enjoy the one-time social insurance policy, an average of nearly 750,000 people leave the system every year, accounting for over 5% of the total number of participants. This figure corresponds to one out of every two new people joining the social insurance system, one person leaves. Due to the impact of the COVID-19 epidemic, this situation shows no sign of stopping. The proof is that in 2 consecutive years 2020 and 2021, each year, Vietnam Social Insurance records more than 860,000 employees withdrawing social insurance once.

Social insurance considers this to be a worrying fact that not only directly affects the interests of employees but also affects the socio-economic situation as well as its goals, efforts and determination. of the Government to implement social security for the entire population.

Recently, Ho Chi Minh City Social Security also pointed out 5 disadvantages when receiving one-time social insurance:

Firstly, when re-joining social insurance in the future, employees will not be added to the time of payment of social insurance, but calculated into the time of paying new social insurance. Thus, employees lose the opportunity to enjoy pension, have no income to ensure life when they reach the end of working age.

Secondly, if the employee participates in social insurance for a full time, in addition to the pension, the employee will also be granted a free health insurance card by the Social Insurance Fund.

Third, the amount of money contributed to the Social Insurance Fund is a valuable savings of oneself, it is not lost but will be accumulated. If the family is unfortunate enough to die, the family will be entitled to a funeral allowance, while the next of kin will be entitled to a survivorship allowance according to regulations.

Fourth, receiving one-time social insurance is to accept a huge disadvantage, when with 22% of the monthly salary paid to the retirement and survivorship fund, the total payment per year is 2.64 months’ salary. While the one-time social insurance allowance calculated for each year of payment of social insurance premiums is only 1.5 months the average monthly salary on which social insurance premiums are paid for the years before 2014. Those who pay social insurance contributions from 2014 onward will receive two months of the average rate. monthly salary on which social insurance premiums are based.

Fifth, when the participants of social insurance enjoy pension, the pension level is adjusted periodically according to the consumer price index and economic growth.

Why do workers massively withdraw one-time social insurance?

Most of the workers who withdrew their social insurance once in the past few days, when asked about the reason, answered that they needed money to cover their living expenses, or lost their jobs, so they could not continue to pay.

According to experts, it is not only the COVID-19 epidemic that is the main reason why employees rush to withdraw their social insurance once.

There are many reasons why employees choose to receive one-time social insurance benefits.

First of all, the income and living conditions of workers today are still too difficult. According to a survey by the Vietnam General Confederation of Labor on wages, workers’ income shows that only 15% of workers have little accumulation. Life is too difficult, so when they have to quit their jobs, most employees are forced to choose to receive one-time social insurance to have an amount of money to take care of their immediate living.

This is a choice that not every employee wants. Meanwhile, the situation that many businesses are looking for ways to eliminate older workers (over 35 years old) to reduce costs, makes it difficult for many workers in this situation to find work in areas with labor relations.

Recently, at a conference to consult and dialogue with employees, trade union officials and employers on the implementation of social insurance policies and laws, Mr. Andre Gama – In charge of the ILO’s social security program According to Vietnam, the majority of people who withdraw one-time social insurance are women under 35 years old. The increase in child-rearing costs and loss of income due to job loss are the biggest reasons in Vietnam for the one-time withdrawal of social insurance.

|

In addition, our country’s current social insurance policy system is not really attractive and flexible, so it has not attracted a large number of employees who have long-term commitment to the social insurance system.

According to the current law, employees who want to enjoy the retirement regime must have at least 20 years of paying social insurance contributions and ensure their age according to regulations, while the age of the majority of employees when leaving work is still young. . They can’t wait to pay the full 20 years to enjoy their retirement benefits.

One of the other reasons is that employees do not know the regulations and benefits of the social insurance benefits they are entitled to, while the propaganda and dissemination of social insurance regimes and policies are still limited. .

In addition, the one-time social insurance policy is still quite open and easy to access as at present, employees will look to it as a financial tool in the immediate future.

How to stop the “wave”?

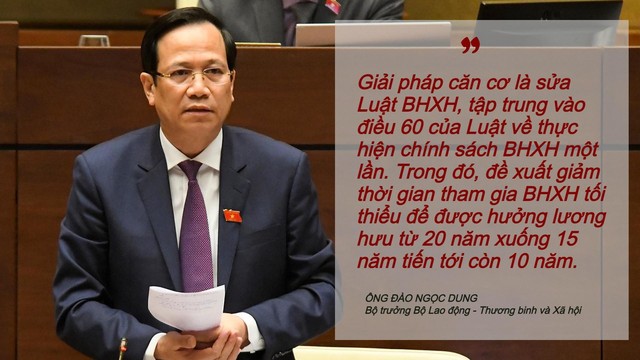

At the 2nd session, the 15th National Assembly, Minister of Labor – Invalids and Social Affairs Dao Ngoc Dung mentioned fundamental tasks to limit the one-time withdrawal of social insurance, but the first thing is to take care of take care of workers’ lives. Because, most people who withdraw one-time social insurance are workers, people with difficult circumstances, …

Along with that, Minister Dao Ngoc Dung also emphasized on strengthening propaganda so that employees understand the necessity and long-term benefits of social insurance, that “social insurance is the pension of employees when they are old.” “.

Minister Dao Ngoc Dung also mentioned “the fundamental solution is to amend the Law on Social Insurance”, focusing on article 60 of the Law on implementing the one-time social insurance policy. In particular, it is proposed to reduce the minimum period of participation in social insurance to enjoy pension from 20 years to 15 years, to 10 years in the future.

“The Ministry of Labor has completed the dossier and strives to submit it to the National Assembly in 2022 for consideration. In which, besides the one-time policy, it will enhance other benefits for employees. For example, if the employee is an employee, If you don’t withdraw social insurance once, in addition to receiving money, employees will also enjoy other policies such as sightseeing, tourism … Experiences of countries often encourage participation in social insurance like this.” Minister Dao Ngoc Dung suggested.

|

The social insurance agency also pointed out that, in fact, most businesses register to pay social insurance premiums for employees just above the regional minimum wage and no other supplement. Through inspection, many businesses only build ladders and salary tables to pay social insurance at the lowest level, equal to the regional minimum wage plus 7% for trained workers, 5-7% for workers doing heavy work. laborious, toxic.

This agency said that the current law has not specified what types of additional amounts for calculating social insurance contributions include. Many companies offer other incomes such as support for house rent, phone, petrol, product, etc. deliberately circumventing the law to reduce the cost of contributing to the social insurance fund.

According to Vietnam Social Security, it is necessary to amend the regulations on salary paid for social insurance in the direction of at least 70% of the average total income of employees. This is to minimize the ability of the business to evade payables. And when the employee’s rights are guaranteed, there is a pension that meets the minimum standard of living, then the employee will not choose to withdraw the one-time social insurance.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here