How to spend credit card properly

Mr. Duc Kim Cuong – a person with a lot of experience in shopping and spending with credithis motto is to maximize promotion rewards, avoid fees and never pay interest.

“Currently I have 10 credit cards, the annual fee of the card is not large, but in return, the benefits are great if I know how to use it. In addition to convenience and safety, when using a credit card, I will be discounts and discounts at many units,” said Mr. Duc Kim Cuong, an office worker.

Depending on the limit of each card, Mr. Cuong divides it into different ways of spending. Cards with a large limit will be used to buy items of great value or installmentlow-limit card used for general shopping.

When spending anything, he records it in a book to control it to avoid overdue debt. In addition, Mr. Cuong has a little trick that is never to miss promotional announcements on the bank’s application.

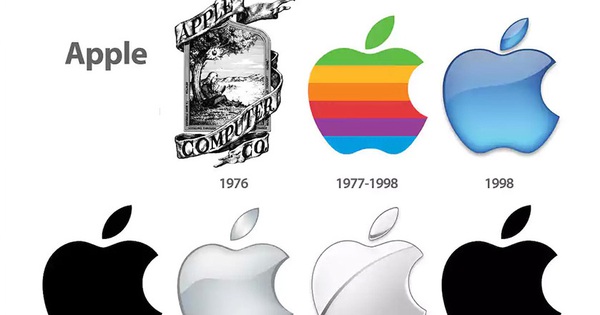

(Illustration image – Photo: Investment Newspaper)

To own a valuable item, people often think of the form of installment payment. Normally, customers need many things to secure the loan such as household registration book, driving license, identity card, etc., while the interest rate is quite high. However, now without these things, customers only need 1 credit card can still pay in installments with 0% interest rate.

For Mr. Dao Van Thao (office worker), spending with a credit card properly is both convenient because you don’t have to carry cash, and it’s cheaper than going. Consumer loans.

“As a newbie, I don’t have a large amount of money to buy a high-value phone, about 30 million, so I pay more than 5 million in advance, the rest I pay by credit card,” said Dao Van Thao. To share.

Currently, grasping the consumption trends of young Vietnamese people, especially the generation of Gen Z who are tech-savvy, like utilities and want to experience modern payment technologies, the banking system has also given launched many types of multi-applied cards, widely accepted payment points to meet their needs.

“Young people access new technologies very quickly and easily accept new services. In the past 2 years, the growth rate of some services has reached 170% a year”, said Mr. Nguyen Quang Minh, Deputy General Manager Napas, said.

According to banking experts, to avoid the risk of overdue debt, young people should make a financial and payment plan if they want to use a credit card to spend on items of great value, set a regular payment schedule for credit expenses and always ensure on-time payment.

at Blogtuan.info – Source: Soha.vn – Read the original article here