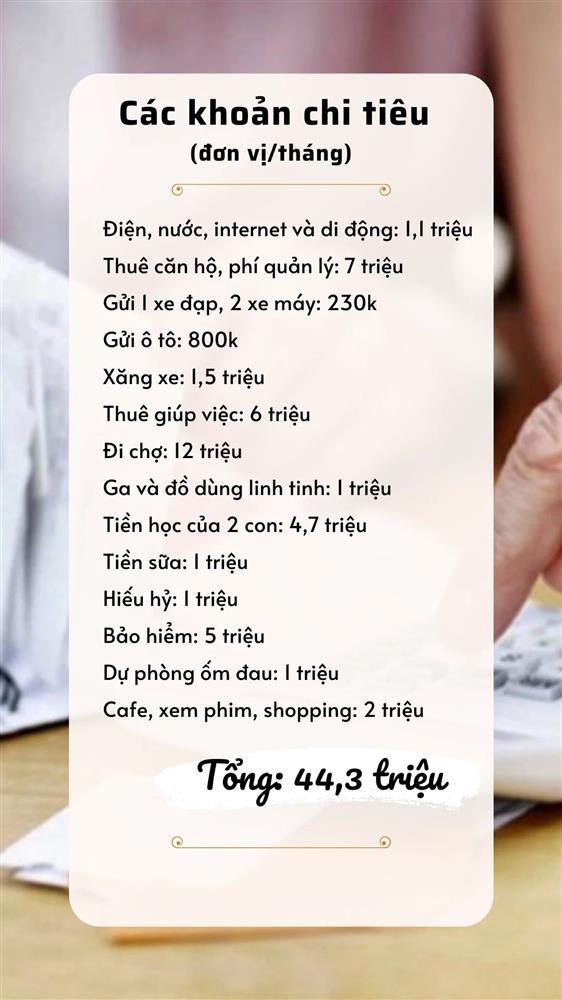

The table of spending 44 million / month for a family of 5 in Hanoi

There are 5 people in the house and they hire more helpers. Tram and her husband have never spent less than 40 million VND in a month.

This is the reality of the family expenditure problem of Ms. Vo Hoai Tram (32 years old). Currently, she and her husband have three children (1 adult, 1 small and 1 newborn), and are renting an apartment in apartment Dong Da area, Hanoi.

Actual spending for a family of 5 in Hanoi

The total monthly income of this young couple is about 45-50 million/month. Family income is not fixed because Tram sells online, the average monthly income is 25-40 million.

Tram’s husband works outside electricity and water, so his monthly income is estimated at 12-16 million. Therefore, the amount will fluctuate from month to month.

They haven’t bought an apartment yet because Tram and her husband are afraid of borrowing money that they can’t afford to pay, partly because the family and children are still quite small and small, partly because they have to keep their capital and still do business.

The house is crowded with children, and she is busy with business, so Ms. Tram hires an extra maid. Each month, the total amount of hard money she has to pay is “like a picture” as follows:

– Electricity, water, internet and mobile bills: 1.1 million/month

– Apartment rental, management fee: 7 million/month

– Deposit for 1 bicycle, 2 motorbikes: 230k/month (100k/motorcycle, 30k/bike)

– Car deposit: 800k/month

– Gasoline: 1.5 million/month (because Tram’s car is only used to go home or go out on weekends, she and her husband use it every day to go to work, take the children to school, go to the market, they both use it. Using a motorbike, the cost of gas per month is about: Wife’s car: 300k, husband’s car: 400k, car: 800k).

– Maid rental: 6 million/month

– Market fee for family of 5 + 1 maid: 12 million/month. To save money, Ms. Tram’s family goes to the market every week at the wholesale market and eats breakfast 100% at home. Normally, for breakfast, Ms. Tram’s family eats fried rice, cooks sticky rice, cooks vermicelli, porridge, noodles and alternates meals.

– Gas and miscellaneous items in the house: 1 million/month. Normally, a month in Tram’s family, she doesn’t use up a gas can, but she has to buy toilet paper, toothpaste, soap, face towel… And this money doesn’t go away every month.

– Tuition for the first child: 3 million/month, go to a public school, including extra tuition.

– Tuition for the second child: 1.7 million/month. Her son was 5 years old, so she sent her to a kindergarten in a public school. This amount has included meals, extra surcharges and money for children to learn more English.

– Milk money for children: 1 million/month

– Filial piety: 1 million/month

– Insurance for 5 people: 5 million/month

– Cafe, watching movies, enjoying, shopping for clothes and shoes for the whole family: 2 million/month. On weekends, Tram and her husband often let their children go out to play. If she doesn’t go in a month, she will put it in a separate corner for trips on holidays for the whole family.

– Sickness reserve: 1 million/month

Total expenditure: 44,330,000 VND/month

Summary of expenses of Ms. Tram’s family.

Talking about the total expenditure of her family, Ms. Tram shared: “Not a month, my family does not have to spend that much. In general, my family’s spending is not too frugal, but it’s also just going out to enjoy a bit. WOMEN

If the couple earns every month, they still have money to save. In the month when I earn less, I have to limit my travel, shoes, and eating out to try to balance my family’s expenses.“.

Tips to save money to have money to prevent illness, buy insurance every month

According to this housewife, in order to try to have money to save each month in case of illness, having a job or buying insurance, she always has to apply the following spending tips:

– Set aside an amount right away save if possible: If every month, her husband’s income from electricity and water works is stable, or sales are more, Ms. Tram will save those few million right away to save an amount for the future.

This savings, she deposited in the bank. Depending on the interest rate that varies from bank to bank and from time to time, you calculate and deposit at that bank.

– Always have a reserve for sickness: The family has small children, so almost every month, this account must be used when “visiting” the doctor or getting medicine. Therefore, right from the beginning of the month, Ms. Tram also set aside this reserve. If you don’t use it for a month, you put it into a savings fund.

– When going to the weekend wholesale market or going to the supermarket, only buy the goods on the listed list. Decide not to buy unexpected expenses or expenses.

– List the hard expenses for the whole month. That’s the amount of money that Tram has to spend every month, such as rice, fish sauce, salt, cooking oil, gas, transportation, soap…

“I always have to do that so that the remaining amount is expected for daily consumption, divided equally among the days of the month. Only then will I know how much to spend each month. In general, such spending, I personally think is reasonable. Spending for 5 people, adding 1 domestic helper in Hanoi, that should be enough”, Ms. Tram shared.

Following the Vietnamese Lifestyle

at Blogtuan.info – Source: 2sao.vn – Read the original article here