Which bank has the highest savings interest rate?

Entering April 2022, many banks are preparing to increase their deposit interest rates during the Tet holiday, with the lowest adjustment being 0.01% points. If you have a savings deposit, which bank should you choose to have the highest interest rate today?

|

Recently, Military Bank (MB Bank) has announced an increase in deposit interest rates for June and 12-month terms in the form of prepaid interest rates. Accordingly, at the 12-month term, this bank adjusted the interest rate to increase from 4.85%/year to 5.39%/year, increasing by 0.54%.

Vietbank also adjusted up 0.10%/year for the 9-month term interest rate from 6.10%/year to 6.20%/year.

Bac A Bank also adjusted to increase the deposit interest rate for 6-month term from 6.00%/year to 6.10%/year; 9-month term from 6.10%/year to 6.20%/year; 12-month period from 6.50%/year to 6.60%/year

Vietcapitalbank increased the deposit interest rate for 9-month term from 6.00%/year to 6.20%/year.

PvcomBank increased the interest rate on Tet savings for individual customers for a 6-month term from 5.40%/year to 5.60%/year; 9-month term from 5.55%/year to 5.85%/year; and 12-month term from 5.55%/year to 6.20%.

Similarly, at ABBank, the 1-month term was adjusted to increase from 3.35%/year to 3.65%/year; 3-month term increased from 3.55%/year to 4.00%/year; 6-month term from 5.20%/year to 5.60%/year; 9-month term from 5.20%/year to 5.70%/year.

Saigonbank increased 0.10% interest rate for 1-month term from 3.10 to 3.20%; increased from 3.40 to 3.60%/year at 3-month term; increased from 4.70 to 5.10%/year for 6-month term; increased from 4.70 to 5.20%/year for the term of 9 months; increased 5.60 to 5.90% at 12-month term.

And OCB also adjusted to increase the savings deposit interest rate for individual customers from 5.20%/year to 5.40%/year for 6-month term; increased by 5.40%/year to 5.60%/year for the term of 9 months; increased by 5.90%/year to 6.10%/year at 12-month term. For online savings, this bank also increased from 5.60 to 6.20%/year for 6-month term; increased by 5.90 to 6.40%/year for 9-month term; increased from 6.30 to 6.50%/year at 12 month term.

Eximbank increased from 3.30%/year to 3.40%/year for 1-month term; increase by 3.60%/year to 3.70%/year at 3-month term; increased by 5.00%/year to 5.20%/year at 6-month term.

HDBank alone adjusted the online deposit interest rate. Specifically, the January term increased from 3.10%/year to 3.80%/year; 3-month term from 3.20%/year to 3.90%/year; 6 and 9 month term from 5.40%/year to 5.60%/year; 12-month term increased from 5.70%/year to 5.95%/year.

Besides banks that adjusted to increase deposit interest rates, there were also some banks that slightly adjusted interest rates. Specifically, DongABank reduced the interest rate by 0.10%/year for all terms.

In addition, ACB also reduced from 3.60%/year to 3.30%/year for 3-month term; down 4.70%/year to 4.50%/year at 6-month term; down 4.90%/year to 4.60%/year at 9-month term; down 5.60%/year to 5.10%/year at 12-month term.

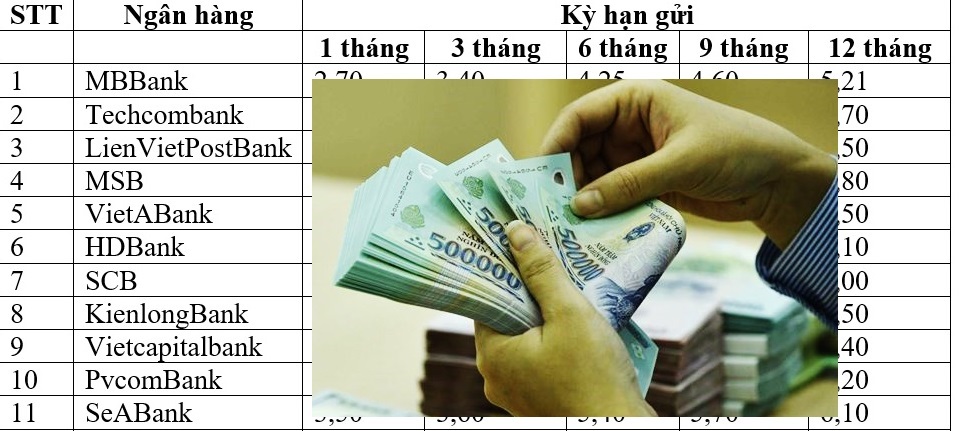

Below is a table comparing the latest bank interest rates in April 2022:

|

| Latest bank interest rate comparison table in April 2022 |

PV

at Blogtuan.info – Source: infonet.vietnamnet.vn – Read the original article here