Behind the rush of foreign investors pouring capital into the region ‘sounds unattractive, but is a safe investment’ of Vietnam

Last week, Quang Dung Technology Distribution Joint Stock Company (QD.TEK), a subsidiary of Greenfeed Vietnam Group, and NTT Global Data Centers Company (NTT GDC), a subsidiary of Japan’s NNT Group, officially entered into a joint venture to build a center data center in the city. HCM, with total investment up to 56 million USD.

Perspective of HCMC1 Data Center Project

Accordingly, QD.TEK and NNT GDC will establish a new company with the name NNT Global Data Centers HCMC1 (HCMC1). As a joint venture company, HCMC1 will start construction of the HCMC1 data center, which is expected to launch in 2024.

At the end of 2021, the Management Board of the High-Tech Park of Ho Chi Minh City. Ho Chi Minh City (SHTP) has awarded the investment registration certificate to Worldwide DC Solution Company (Singapore) to invest in a data center project with total investment of 70 million USD.

This is the first foreign direct investment (FDI) project in 2021 at SHTP to be granted an investment certificate after the impact of the Covid-19 pandemic.

According to SHTP Management, Worldwide DC Solution Company is a data center developer based in Singapore. With this investment certificate, Worldwide DC Solution will develop a data center project at OneHub Saigon Complex, a complex under the “campus” model invested by Ascendas Saigon Bund Co., Ltd. at SHTP.

With the goal of providing server rental, rack cabinet rental, co-location and data center management services (data center management services), project The project named 1Hub Data Center will be located at Tower 7 of OneHub Saigon Complex with a total construction floor area of over 18,000 m2.

The project is designed to meet the rigorous technical standards of level 3 data centers, and is expected to complete construction and start operation in early 2025.

In November 2021, Da Nang Information Technology Park Development Joint Stock Company and its Singaporean partner, Infracrowd Capital cooperated to invest in a data center area in Da Nang Centralized Information Technology Park with Total investment is about 100 million USD.

Behind the wave of investment in data centers in Vietnam

According to Troy Griffiths, Deputy General Director of Savills Vietnam, the main driver behind the “escalation” of demand for data centers around the world, is the increasing number of large-scale digital transformation enterprises.

“Digital infrastructure has never been as important to the global economy as it is today. From February to mid-April 2022, global internet traffic increased by nearly 40%.” Savills data from 2021 shows that demand for digital services has increased significantly compared to the increase in the previous decade. Particularly in 2020, 59% of the global population is connected to the internet, while in 2010, this figure was only 26%. Global internet traffic also increased 12 times.

Currently, most technological devices are applied for management and monitoring purposes. According to Cisco Systems, the applications emerging from the 5G deployment will also play an essential role in the growth over the next two years.

By 2026, the size of the global data market is expected to reach $251 billion, with an average annual growth rate of 4.5%. Although it may sound unattractive, data centers are increasingly attracting real estate investors, according to a report from Cisco Systems.

Explaining this, the report said, this sector is considered a safe investment, with an attractive return. In major global markets, yields range between 4-12%. It is expected that by 2026, the Southeast Asian data center market will grow at a compound annual growth rate (CAGR) of over 8%.

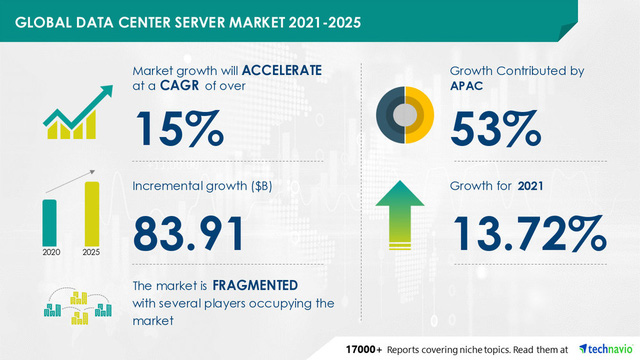

The latest report released by ResearchAndMarkets at the end of 2021 assesses that, in the period of 2021-2025, Vietnam may be in the top 10 emerging markets for global data center systems. According to the report, Vietnam’s data center market will reach about 858 million USD in 2020 and is predicted to reach a CAGR of nearly 15% by 2026.

Currently, Vietnam has less than 30 data centers, all in major cities. Viettel IDC is holding the largest data center market share in Vietnam, with 5 data centers already in operation, with a total area of 25,000m2.2.

Data from Viettel IDC shows that the average growth rate of the cloud computing market in Vietnam in the past 3 years is about 40-45%, while the average growth rate worldwide is 29%. . It is expected that by 2025, the growth rate of the Vietnamese market will remain at 40%, while the global average is forecast to be around 25-29%.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here