Failed bond auctions are just warnings

On the eve of the Memorial Day holiday, a group of investors handed over the datasheet with the comment: “Looking at the government bond yields in the world, ours is nothing!”.

In the market over the past week, yields of many government bonds simultaneously increased. Especially in the US, the yield on 10-year government bonds jumped over 2.7%. Yields on 10-year Vietnamese government bonds also spiked to more than 2.8%. Both of these bonds have risen above 35 points in the first few days of April alone.

Why is there this mutation and what message does it bring?

Consulting experts as well as discussions from the group of investors mentioned above, a warning is forming and the pressure to increase interest rates is now just waiting for the “explosion point” to trigger.

In fact, as clearly shown in the graph, the strong increase of the US government bond yields, as well as that of Vietnam, occurred in the middle of last March – the time when the US Federal Reserve Fed) decided to raise interest rates, creating the first milestone to gradually step through the cheap money era. Movements so far continue to reflect market expectations about the possibility that the Fed will have more rate hikes.

That possibility is getting bigger and bigger. The Fed had to acknowledge the fact that inflation was no longer “temporary”, but more permanent; Accordingly, monetary policy seems to need more drastic solutions to control.

“Inflation for the US is the number one issue right now. Government bond yields reflect medium-term expectations. It’s reflective first, but it can’t go up forever, it will eventually come to a point where it becomes neutral and stable.” , a member of an investor group commented, but in fact, a series of international organizations have recently predicted that the Fed will continue to have more/more interest rate hikes this year.

Yields on 10-year US and Vietnamese government bonds – Source: TradingView

VIETNAM HAS HAPPENED, BUT IS THE TIME OF THE “BOOM POINT”?

What about Vietnam, why has government bond yields skyrocketed recently and what does this development reflect?

An expert present in the above discussion group offered a perspective, which is first and foremost related to the reality that has been and is happening.

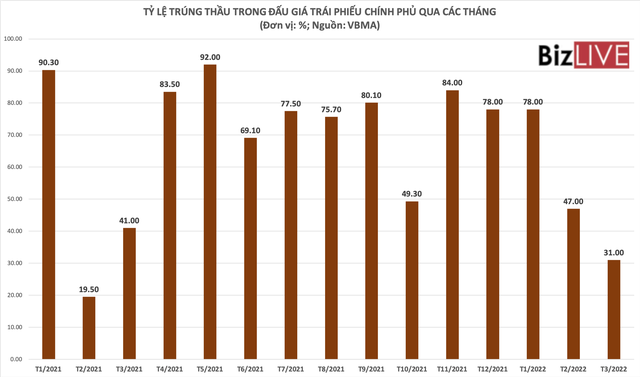

As recently updated, the market recorded consecutive failed auctions of Government bonds, even with 100% failure. Bidding interest rates in those sessions “demand” higher. This is a specific signal of pressure to raise interest rates – which is also increasingly reflected in the wide spread of interest rates on the secondary market compared to interest rates on the underlying market.

The higher the yield, the lower the price, or the less attractive the bond’s interest rate, the higher the market’s expectations. But the above pressure in Vietnam still has points worth discussing.

According to the above expert, the pressure on the issuance of Vietnamese government bonds is currently not great, there is still a delay. However, the pressure will be great because this year’s issuance plan is quite ambitious (with VND 400,000 billion), but the winning rate recently was very low (as in March, it was only 31%).

|

On the other hand, the pressure is not great because in Vietnam, there is still an important support: the participation of Social Insurance, together with the “Big 3” Vietcombank, VietinBank and BIDV.

“Government bond auctions have always had an important support in the participation of the Social Insurance, along with a certain extent of the “Big 3″. This somewhat does not reflect the context and the circumstances. characteristics of the market today. Conditions are no longer the same,” the expert analyzed.

Social Insurance creates a bridge for bidding, because participating in Government bond investment is a default requirement for their mission, not necessarily with the task of optimizing profits in capital use. The “Big 3” has a participating component, especially after capital increases, such as a reserve component in Government bonds; However, as commercial banks, they will aim for higher investment efficiency, so the demand here is limited.

Meanwhile, market conditions have not been the same.

Yields on US Treasuries have spiked and the effect on market sentiment, rising inflation is more permanent and the Fed looks to the possibility of further rate hikes.

Domestically, disbursement of public funds at the beginning of the year was still slow and there was still a stagnation of capital. Disbursement speed is expected to get stronger from Q2, and when it really gets stronger, the story becomes different. Along with that, interest rates in markets, such as the interbank market, are no longer “first one” and as low as before…

“So the pressure to raise interest rates and the high momentum of Government bond yields are present, currently just waiting for the trigger. The above factors, especially in the output speed of public investment disbursement, if implemented. The stronger the pressure becomes, the more obvious and concretized in the rising interest rates”, the expert estimated.

With that trend and expectation, Vietnam will have to gradually move away from the convenience and ease of borrowing activities. Government bonds will gradually leave the record low interest rate around 2%/year with the loan term being extended. And so, the increased cost to the budget is also a near-realistic future, if we want to ensure the progress and complete the plan to mobilize VND 400,000 billion this year.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here