This bank’s profit can increase by 175%, “surpassing” a series of giants

VPBank may “surpass” Techcombank, Vietcombank, MB, and VietinBank in terms of profit in the first quarter

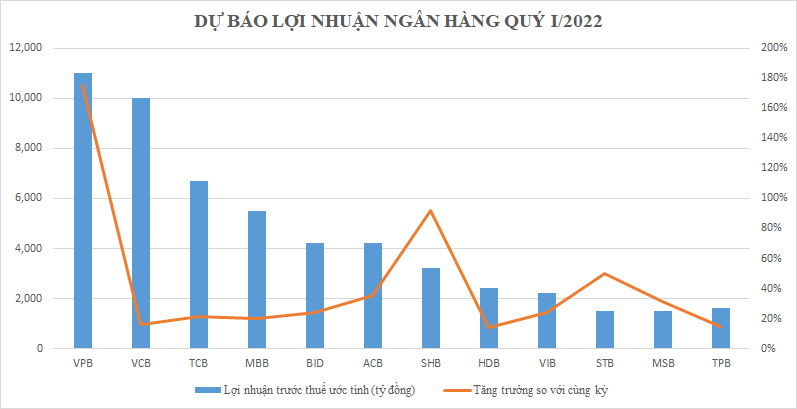

Specifically, with a forecast of VND11 trillion in the first quarter of this year, an increase of 175% over the same period VPBank will become the profit champion in the first quarter.

In the same period last year, VPBank ranked last in the TOP 5 industry profits with more than 4,000 billion dong. If SSI’s estimates are true, VPBank will “surpass” both state-owned banks, Vietcombank and Vietinbank, and also leave Techcombank and MB behind in the race for profits.

The reason VPBank is forecasted to be optimistic about profit is because banks fully recognized prepaid fees from bancassurance contracts with AIA and grew well in the balance sheet (credit and deposit growth reached 7% and twelfth%).

SSI also forecasts for the whole year 2022, profit VPBank reached about VND 25,000 billion (up 71% compared to last year).

Profit before tax of 12 banks as forecasted by SSI (Photo: LT)

Next is Vietcombank (VCB) with an estimated profit of 9.5-10 trillion dong, up 10-16% over the same period. Asset quality improved slightly due to reduced debt restructuring. VCB’s credit growth remained strong in the first quarter of 2022 at 6-7%. NIM also improves thanks to LDR optimization. SSI believes that the bank will probably record a bancassurance prepaid fee in the period, which is similar to the same period last year.

In third place is Techcombank (TCB). According to SSI’s estimate, the bank’s pre-tax profit in the first quarter of 2022 will reach VND 6,500-6,700 billion (up 18-21% over the same period), thanks to strong credit growth and reduced credit costs.

MBB can grow credit by 10-11% in the first quarter of the year, helping the bank achieve a pre-tax profit of at least VND5,500 billion, up 20% over the same period. In the same period last year, MB ranked 4th in terms of profit in the first quarter with 4,580 billion dong.

BIDV (BID) and ACB of marshal Tran Hung Huy are estimated by SSI to both achieve profits of about VND 4,200 billion. However, to catch up with BIDV, ACB must have a stronger growth rate than BIDV. Specifically, it is estimated by SSI that in the first quarter of 2022, ACB’s pre-tax profit will increase by 35% over the same period, while BIDV’s will only increase by 23.7%.

Particularly at BIDV, profit before tax in the first quarter of 2022 is estimated to increase by 23.7% over the same period last year thanks to good credit growth (4.7% compared to the beginning of the year and 14.7% increase over the same period last year). optimize LDR coefficient (deposits increased by 1.4% compared to the beginning of the year). The bad debt ratio was maintained at less than 1%.

At ACB, the business results were positive in the first quarter, thanks to credit growth of 5% compared to the beginning of the year, good progress in bad debt recovery and stable asset quality.

SSI also estimates that SHB’s pre-tax profit in the first quarter of 2022 will reach VND3,200 billion (up 92% y/y) thanks to 5% y/y credit growth and 2.5% y/y deposit growth the begin of the year. NPL ratio is at 1.5% while NIM is estimated to be stable.

With HDBank (HDB), credit growth at the parent bank and HD Saison is estimated at 7% and 10% in the first quarter. Asset quality is well controlled, keeping the bad debt ratio at the parent bank at a stable level. 1.2 – 1.3% and HDSaison below 7%. Therefore, with the reduction in provisioning pressure, pre-tax profit can reach VND 2,300 – 2,400 billion (up 10-14% over the same period).

At VIB, the analysis team expects the bank to reach VND2,200 billion in the first three months of the year, up 24% over the same period. Bancassurance revenue increased by 8% to VND270 billion while NIM was stable.

Sacombank’s profit (STB), is estimated at 1,400-1,500 billion VND, up 40-50% YoY with growth coming from strong operating income and good control of provision expenses.

MSB is forecasted to have credit growth of 9.5% compared to the beginning of the year and the bad debt ratio to be controlled at less than 1.3%, so MSB’s pre-tax profit growth is expected to reach VND1,500 billion (+31%). % over the same period). This result does not include profit from the sale of FCCom.

The last bank out of 13 statistically forecasted positive profit growth is TPBank (TPB). According to forecasts, this bank’s credit growth may reach 10-11% in the first quarter of the year. However, SSI believes that profit growth is quite good at around 14-15% yoy as the bank can spare to create a better buffer for credit growth.

VietinBank’s pre-tax profit may decrease in the first quarter of 2022. (Photo: CTG)

The “rare” bank among the banks that SSI experts have estimated that is forecast to decrease profits in the first quarter is VietinBank (CTG).

SSI believes that, although credit and deposit growth is estimated at high levels (7% and 5%) at the end of March, the bank’s pre-tax profit may be lower compared to the same period last year due to the high comparison in the first quarter of 2021. Prepaid fees from Bancassurance with Manulife may not be recognized in the first quarter of 2022.

In the same period last year, VietinBank ranked in TOP 2 in terms of pre-tax profit with more than 8,000 billion dong, just behind Vietcombank. According to information recorded from the recent investor meeting, the bank’s leaders revealed business results in the first quarter with credit outstanding increased by 7% compared to the previous quarter, total assets increased by 6%.

However, the profit figure has not been disclosed by VietinBank. The Bank has not yet announced any further information on the recognition and distribution of prepaid premiums from the insurance contract with Manulife.

Estimating VietinBank’s full-year 2022 profit, the analyst team thinks it will reach VND21,500 billion, up 22% year-on-year thanks to decent credit growth at 10-12%, improved non-interest income and pressure reduced provision. This estimate does not include the upfront fee from the bancasssurance contract with Manulife and the profit from the divestment of the subsidiary.

Profits of banks still grew positively in the first 3 months of the year. (Photo: TN)

4 notable bank codes

In the report Prospects for Vietnam’s stock market in the second quarter of 2022, experts at KBSV also believe that high credit growth expectations (forecast 14-15%) and reversal of bad debts are the two main decisive factors. positive assessment for the banking sector this year.

Accordingly, in the fourth quarter of 2021, the total restructuring debt recorded a decrease of 2,400 billion compared to the third quarter of 2021. Many banks have also stepped up to set aside most of the debt for restructuring instead of spreading it out over 3 years, making the provisioning pressure in 2022 significantly reduced.

Besides, capital increase will also be a factor that positively affects the profits of banks this year.

With a positive outlook, KBSV believes that banks with good asset quality with solid backup buffers such as Vietcombank, BIDV, Techcombank, MB are suitable investment opportunities.

at Blogtuan.info – Source: danviet.vn – Read the original article here