What is the driving force behind banks’ profits in 2022?

Economic recovery promotes credit growth

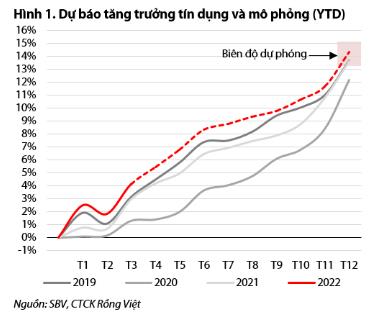

According to experts at Rong Viet Securities Company (VDSC), the credit growth trend will improve and remain stable in the first half of this year, at a higher rate than in previous years. VDSC forecasts that credit growth may fluctuate in the range of 13.3-15.2%, with an average of 14.3%.

In fact, credit in the first quarter of 2022 recorded a growth of 5.04%, which is an impressive increase of four times the increase in the first quarter of 2021. Credit increased strongly in the first quarter of 2022, proving that the economy has prospered and recovered positively. The epidemic has subsided and businesses are restoring production and business, people are also returning to normal life, so the capital demand is quite high at this time.

However, in the recent money market report of SSI Securities Company, experts said that the credit growth rate may decrease in the near future due to the tightening credit policies flowing into risky areas. such as corporate bonds, real estate. However, the tightening of capital flows into the risk sector will not have much impact on credit growth due to strong demand from businesses’ production recovery after the pandemic. Experts of SSI Research still maintain the view that the State Bank will implement a loose monetary policy this year to ensure a low level of lending and deposit interest rates. Credit growth in 2022 is expected to be around 14-15%.

Analysts at ACBS also expect to be optimistic about the credit growth rate of the banking industry this year. According to the latest banking industry outlook report, ACBS forecasts that credit growth may reach 15%, higher than 13.53% in 2021.

The pressure of provisioning is no longer great

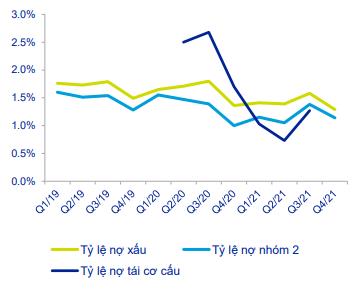

According to ACBS, the driving force behind bank profits this year will come from a reduction in provision costs. In 2021, the ratio of bad debt and group 2 debt did not increase, but the debt restructuring due to Covid-19 has increased again since the 4th epidemic broke out in Q3/2021. Many banks have therefore increased the provisioning rate higher than the prescribed level. Some banks such as CTG, MBB and ACB have set aside almost all of their debt restructuring. These grounds are the basis for experts to believe that the pressure of banks to make provision for bad debts will decrease this year, thereby improving profits.

Recently, the Government approved the proposal to develop a Resolution of the National Assembly on extending the application period of Resolution 42/2017/QH14 dated June 21, 2017 on piloting bad debt settlement of credit institutions according to regulations. proposal of the State Bank. This solution has partly eased worries about bad debt, creating favorable conditions for credit institutions to handle this problem.

In fact, in the first quarter of 2022, bad debts and restructuring loans were still well controlled. Even in some banks like VCB and ACB, restructuring loans recorded a downward trend.

Motivation comes from own stories

Besides the positive factors in the context of the economic recovery supporting the whole industry, the driving force for profit growth also comes from the individual stories of each bank.

Specifically, Vietnam Prosperity Commercial Joint Stock Bank (VPB) expects relatively positive business results thanks to the bancassurance deal with AIA. Accordingly, this bank estimates that the consolidated pre-tax profit in the first quarter will reach VND 11,000 billion. Not stopping there, the 2022 story of VPB has many prospects thanks to the bank’s M&A deal to expand the ecosystem. According to the recently announced AGM document, VPBank will buy over 90% of the capital and make OPES Insurance Joint Stock Company a subsidiary of the Bank. The purchase price is expected to be no more than 1.5 times the book value of the company.

VPBank also plans to increase its capital to nearly 80,000 billion VND to be issued privately to foreign investors and pay dividends/bonus shares from equity. With such prospects, VPBank’s profit target for 2022 is nearly VND 30,000 billion, double the profit in 2021.

MSB in the document submitted to shareholders, this bank is planning to divest from FCCom. This is Community Finance Company Limited, a member of MSB, which the bank has been planning to divest for several years. According to MSB’s leaders, the estimated value of the deal is not less than 100 million USD and MSB can earn 1,800 – 2,000 billion dong in profit in 2022.

Many other banks also set profit growth target of 20-30% profit this year. In general, most banks have a positive outlook on the industry. In a survey conducted by the State Bank of Vietnam (SBV), up to 89.3% of credit institutions expect their pre-tax profit in 2022 to grow positively compared to 2021, and 5.8% of credit institutions expect their profit to grow. negative in 2022 and 4.9% earnings estimate unchanged.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here