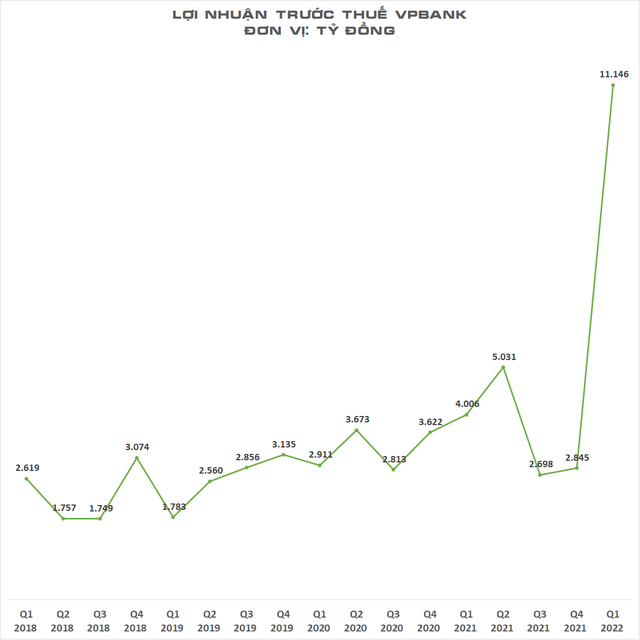

VPBank recorded a record profit of 11,146 billion dong in just one quarter, equal to many other banks doing all year

According to information from Vietnam Prosperity Commercial Joint Stock Bank (VPBank), by the end of the first quarter of 2022, the consolidated bank’s pre-tax profit reached over 11,146 billion, nearly tripling over the same period last year.

This is the record profit in a quarter that VPBank has recorded so far, contributing to bringing the bank’s equity above 95 trillion dong and capital adequacy ratio (CAR) according to Circular 41. over 15%.

The growth rate of profit from core business of individual banks reached more than 56%.

In the first three months of the year, quality credit growth at individual banks reached 10.3%, more than double the industry average, with the main contribution from strategic segments. Along with that was deposit growth of 11.5%, helping to ensure the bank’s liquidity ratios well.

FE Credit, despite having negative credit growth in the previous two quarters, has caught up with a new growth cycle when it achieved an increase of 1.6% compared to the fourth quarter of 2021. VPBank’s total consolidated operating income (TOI) increased by over 65% year-on-year to VND18,270 billion. Specifically, the parent bank’s TOI increased by over 133% over the same period.

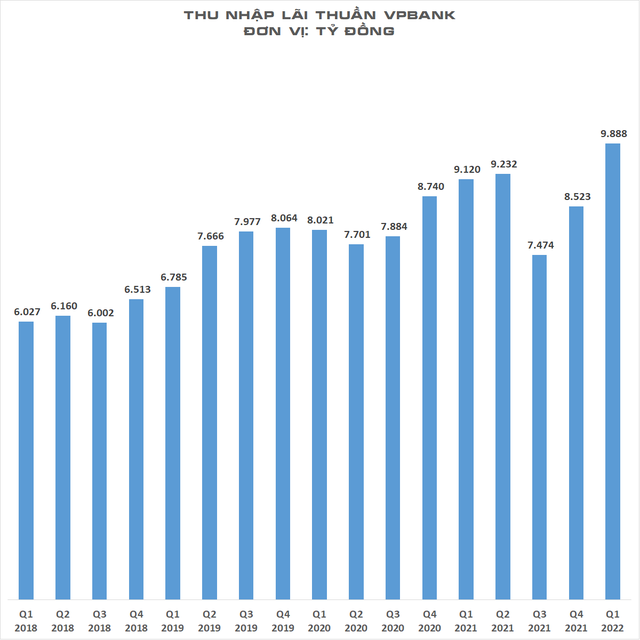

In the revenue structure, consolidated net interest income reached VND 9,888 billion, up 8.4% over the same period and 16% compared to the fourth quarter of 2021, with the parent bank increasing by nearly 30% and over 16% respectively. .

Consolidated service fee income, up 26.5% YoY. This ratio at the parent bank recorded an increase of nearly 30% and at FE Credit was 4.8% over the same period. The growth driver of service fee segment comes from payment activities, income from cards and other services.

Other incomes grew 9 times over the same period, including support fees from the exclusive cooperation agreement on insurance distribution between VPBank and AIA Vietnam Life Insurance Company. Income from debt settlement of the consolidated bank also achieved positive results with VND 714 billion, up 21.3% compared to the previous quarter.

The consolidated cost-to-income (CIR) index continued to be maintained at the lowest level in the market, showing the bank’s outstanding performance in cost management and effective use of every dollar of capital to generate profits. Return on assets (ROA) and on equity (ROE) (excluding extraordinary income) stood at 3.1% and 21.2% respectively.

VPBank said that the number of new customers registering to use VPBank banking services via digital channels in the first quarter of 2022 increased by 10% compared to the end of 2021. The average number of monthly transactions via digital channels increased. 1.7 times higher than the same period in 2021. Up to now, the total number of VPBank customers, including the parent bank and subsidiaries, has reached nearly 20 million customers.

The strategy of enhancing customer experience on digital channels through innovative products and services such as the creation of iNICK for accounts and the newly upgraded eKYC platform… has contributed to underpinning the growth of products. loan. In which, the online disbursement rate of mortgage and unsecured loan products reached 80-100%, and the ratio of online savings balance reached 61%.

The bank expects revenue in the coming quarters to continue to grow higher while the size of the banking ecosystem is expanded to the areas of securities and insurance service provision, through M&A activities such as: acquired a securities company and, in the near future, bought back shares of the insurance company OPES. In which, securities companies contributed revenue to the consolidated bank in the first quarter of 2022. This securities company plans to increase its charter capital to strengthen its business capacity in the near future.

Following Economic Life

at Blogtuan.info – Source: cafebiz.vn – Read the original article here