What is the level of assurance? Where is the scale compared to Malaysia, Singapore?

Illustration. Source: Workers.

After the deal, the State Securities Commission requested to cancel 9 lots of bonds issued by Tan Hoang Minh Group, with a total value of over VND 10,000 billion, the market corporate bonds (TPDN) experienced a new turning point, with many controls and warnings from the authorities.

In the first half of April, the Prime Minister issued additional documents requesting relevant agencies to correct and stabilize the operation of the corporate bond market, ensuring the market’s safe, efficient, and transparent operation.

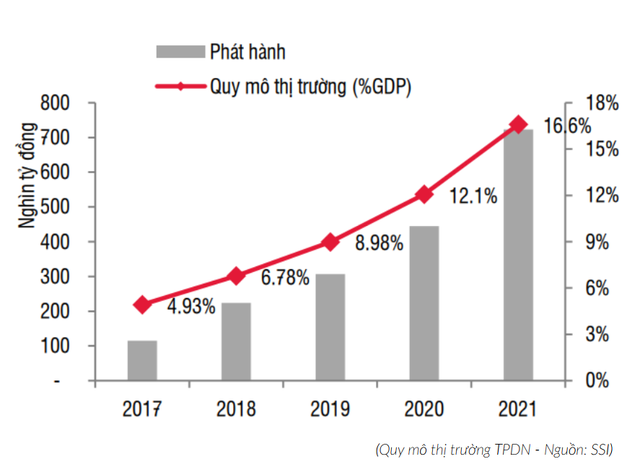

The Vietnam Real Estate Brokers Association (VARS) said that corporate bonds have experienced strong growth for four years with an explosive issuance value, reaching more than VND 700 trillion, equivalent to 16.7% of GDP, accounting for nearly 12 % of national credit balance in 2021.

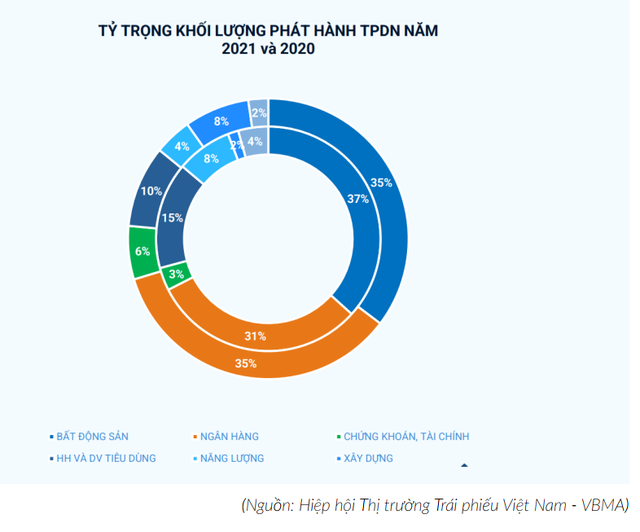

It is noteworthy that real estate corporate bonds have grown continuously in the past few years when investors prioritized using the form of bond capital mobilization, rather than capital sources from banks or investors, customers. . Real estate businesses have surpassed banks, topping the value of corporate bonds issued in 2021 with the proportion of 35% of the total value of corporate bonds issued.

“Nearly half of the value of real estate corporate bonds is unsecured. Having collateral is not required, but it is one of the conditions that create the reputation of the business as well as the corporate bonds that are issued – to ensure the safety of investors (bondholders).“, VARS commented.

As of mid-April 2022, the total value of corporate bonds issued reached nearly 40,000 billion VND. More than half the value of bonds issued in January. Proportion of corporate bonds real estate in the first quarter of 2022 accounted for 43%. What makes market regulators worried about the corporate bond market in general and real estate corporate bonds in particular include:

– Enterprises use bonds for improper purposes, leading to risks for bondholders.

– The business is at a loss, information to bondholders is not complete and transparent.

– The phenomenon of banks selling corporate bonds to individual investors, who do not have enough knowledge and experience to participate in the corporate bond market, which has unequal information and is only available to professional investors.

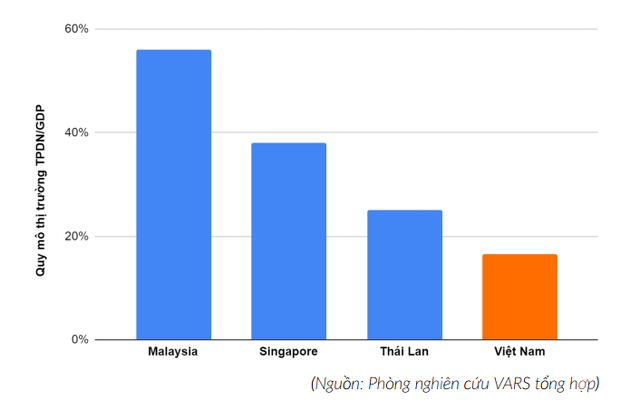

However, according to VARS, in the long run, corporate bonds are still an effective capital mobilization channel, demonstrating the dynamism of an economy, and giving investors diverse investment opportunities. Compared to other countries in the region such as Malaysia, Singapore, and Thailand, the size of Vietnam’s corporate bond market is still very modest.

VARS believes that the corporate bond market in general and the real estate corporate bond market in particular need a synchronous and effective solution for healthy development. Concerns of state management agencies often stem from information asymmetry between enterprises and investors (individuals or organizations).

VARS recommends that credit rating for bond issuers is essential. The credit limit allows investors to have an overview that is objective enough to assess the possible risks when investing in businesses through bonds.

In addition, according to VARS, the authorities, especially the Ministry of Finance and the State Securities Commission, need to set up an effective inspection mechanism with bond issuers right from the submission of documents. instead of detecting mistakes and canceling successfully issued deals.

Following the Economic Lifestyle

at Blogtuan.info – Source: cafebiz.vn – Read the original article here