Sri Lanka will not be the case default only

The chaos was caused by soaring food and energy prices. Accordingly, countries such as Sri Lanka, Egypt, Tunisia and Peru are facing many difficulties. Current problems threaten to become a major debt and another threat to the fragile recovery of the post-pandemic world economy.

In addition, the Fed’s tightening of monetary policy is another threat. Rising benchmark interest rates in the US mean that debt repayment costs for developing countries are higher and tend to promote capital outflows. In addition, the Russia-Ukraine conflict is causing energy and food shocks, while there is little sign that these difficulties are coming to an end.

It can be seen that many risks combined have pushed Sri Lanka to the brink of bond default. Several other emerging economies from Pakistan and Tunisia to Ethiopia and Ghana are at risk of falling into a similar spiral, according to Bloomberg Economics. Of course, commodity exporters are benefiting from higher prices. However, other problems are still happening, as the outbreak of the disease has caused China to blockade many cities and many people fear that the US and Europe will fall into recession.

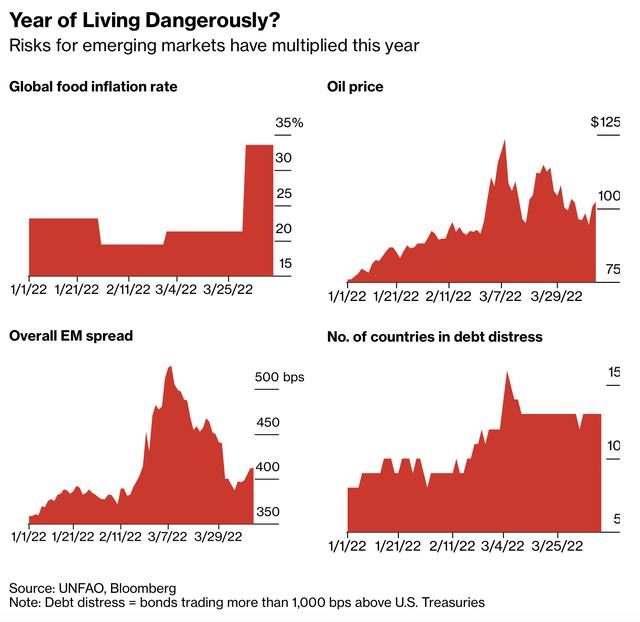

Inflation rates, oil prices, bond yield spreads and the number of developed countries at risk of default.

The world’s top economic policymakers are sounding the alarm. Meetings of the IMF and the World Bank this week both discuss slowing global economic growth and the risks facing developing countries.

In its latest World Economic Outlook, the IMF compared the impact of war to “tsunamis” that hit global economies. The World Bank also lowered its world growth forecast and announced the launch of a $170 billion rescue package for countries affected by the crisis.

The biggest default happening in emerging economies is Russia, which is economically isolated and has pledged to pay its debt only in rubles. Meanwhile, the country’s currency has lost almost 40% of its value this year. Last week, Russia temporarily suspended foreign currency debt payments, deciding to use its stockpile to pay for imported food and energy.

For the likes of Jagath Gunasena, the crisis has arrived at his doorstep. He had to leave his wife and children standing for hours to refill the cooking gas they used to run the Colombo food stall. “At least we still have leftovers from the store,” said Gunasena. “I don’t know how other people get food or cook.”

Those uncertainties have pushed protesters to call for President Gotabaya Rajapaksa to step down, even as his government tries to seek help from the IMF or major Asian countries like China and India.

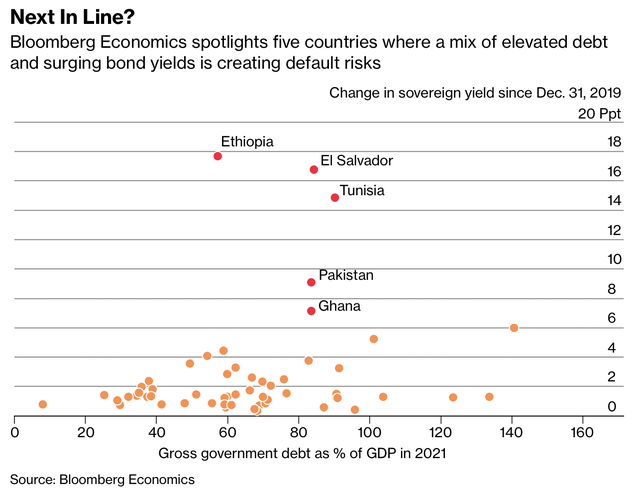

5 countries most likely to default according to Bloomberg Economics.

In this context, Sri Lanka will not be the first country to default. Bonds in about 13 emerging countries are trading at least 1,000 basis points higher than US Treasuries, up from six years ago. Credit default swaps (CDSs) on bonds of developing countries spiked in the first weeks of the Russia-Ukraine conflict. This shows that the possibility of default is increasing.

Bloomberg Economics has ranked Turkey and Egypt highest on a list of emerging markets experiencing “economic and financial impact” from the war in Ukraine. In addition, Tunisia, Ethiopia, Pakistan, Ghana and El Salvador are among the countries most at risk of default.

The direct impact of a default in 5 countries on the global economy is not so great. However, the crisis in developing countries has previously spread to other places. “The impact of a series of bond defaults in EM has a negative impact on the outside,” said Ziad Daoud, chief EM economist at Bloomberg Economics.

The World Bank estimates that 60% of low-income countries are in financial difficulty or at risk of debt. According to the World Bank’s chief economist – Carmen Reinhart, so far, investors have not paid much attention to the problems happening like the “iceberg”.

Disaster struck

The impact of rising borrowing costs could become more intense as the Fed struggles to respond to inflation and drive yields on US Treasuries higher – the benchmark for many developing economies. develop. Many central banks in these countries are also raising interest rates amid rising prices.

Along with Sri Lanka, other countries with balance of payments problems include Egypt and Tunisia. Pakistan has also seen high inflation and geopolitical tensions that have led to the overthrow of Prime Minister Imran Khan’s government this month. In Pakistan, the government was forced to cut off electricity to households and industries because they could not afford coal and natural gas from abroad.

In Tunisia, the government is running out of cash, causing fuel prices to rise at least four times in the past 13 months. Tourism is exhausted and shortages are so widespread that market vendors joke that it’s easier to buy stimulants than flour.

Raed, a 26-year-old baker, said he couldn’t buy flour on the black market for much more than the official price. Currently, he is receiving a subsidy to continue operating the bakery. Read decided to migrate to look for opportunities elsewhere.

And in Egypt – the world’s largest wheat importer, the “disappearance” of supplies from Russia and Ukraine has had a heavy impact. Last month, the country’s central bank allowed the local currency to depreciate more than 15% in a few hours and raised interest rates for the first time in five years as capital outflows massively. President Abdel-Fattah El-Sisi has urged people to make meals simpler as they enter the fasting month of Ramadan.

Major exporting countries are also facing difficulties

Meanwhile, many other countries are benefiting from rising commodity prices. For example, the regions of Latin America, where the Brazilian real is the major currency, have performed best this year. Chile’s exports also increased by more than 20% from a year earlier.

However, the exporters of Latin American goods are not immune to political turmoil. Peru – one of the countries with the highest death rate from Covid-19, has been rocked by violent protests. The country’s current account balance went from a surplus of 0.8% of GDP at the end of 2020 to a deficit of 2.8% a year later. As for neighboring Colombia and Chile, the deficit ratio increased to 6& and 7& respectively in the fourth quarter of last year.

In Brazil, less than six months before the presidential election, opinion polls show that 75% of the public believes the rising cost of living is the fault of President Jair Bolsonaro’s administration. Although the central bank of this country is trying to tighten monetary policy, the inflation rate was still 11.3% in March. Therefore, Brazil is still injecting $ 32 billion into the economy to support the people.

Maria Conceicao – lives in Rio de Janeiro, is worried about the future. She stocked up on fish for her family before Easter last weekend. “We will celebrate with a lot of fish, but later we will reduce it,” she said. Because for Conceicao, like millions of others in Brazil, they are facing the grim reality that every month things get worse.

Refer to Bloomberg

at Blogtuan.info – Source: Soha.vn – Read the original article here