After ‘Black Monday’, how should witnesses act?

Following a series of “dark” days, the market once again started a new trading week with strong selling pressure throughout the session. The sell-off continued to spread, causing the market to close with a record drop. At the end of the session, VN-Index dropped -68.31 points (-4.95%) at 1,310.92 points. The liquidity decreased slightly compared to the previous session with 696.9 million shares matched on HOSE. Thus, in just the past 3 weeks, VN-Index has decreased by 214 points.

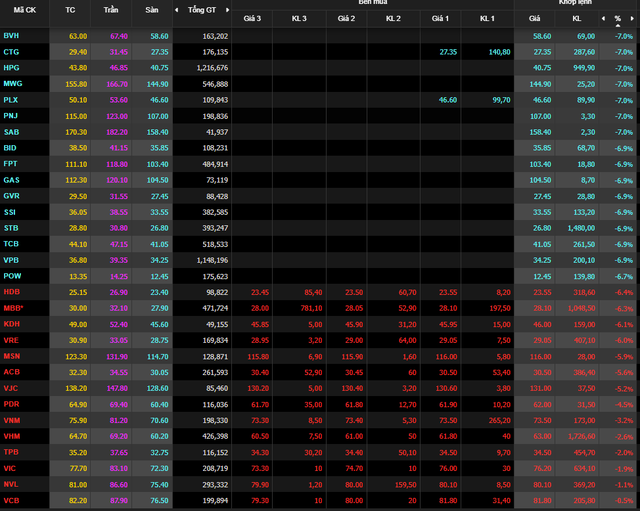

The VN30 group is considered the main reason with the highest drop ever of the stock market. All stocks in this group closed below reference, of which 16 stocks closed in a state of “white buyers” such as BVH, CTG, HPG, MWG, PLX…

All industry groups saw negative movements today. Leading in terms of price decline was Technology, followed by Petroleum and Securities. The group that supported the index in the previous session like Bank could not resist the general trend and turned to drop sharply today. Fisheries, Textiles, Chemicals and Seaports saw the second consecutive decrease.

VN30 stocks closed on April 25th

Rong Viet Securities

According to Rong Viet Securities Company, the liquidity decreased compared to the previous session, showing that the cash flow still hasn’t had a strong buying move even though the index dropped deeply. However, the current deep drop has brought the VN-Index closer to the good support zone in the past, the range of 1,250 – 1,300 points, and in a strong oversold condition.

For VN30-Index, the index is closing near 1,358 points, a good support area in July 2021. It is expected that the cash flow to catch low prices will be active in the next session and help restrain the current decline of the market. Therefore, investors should temporarily stop selling, especially stocks with good foundation and near support.

MBS . Securities

On the side of MBS Securities Company, this company believes that the current decline in the market is equivalent to the decrease at the end of January last year, but more intense. The fact that a series of stocks fell to the floor regardless of good or bad fundamentals is making investor sentiment low, cash flow will be cautious when the recent bottom-fishing sessions fail.

Contrary to the movements of domestic investors, foreign investors still maintained a net buying circuit in the past 4/5 weeks. Therefore, downtrends are still an opportunity for long-term investors like institutions, however For short-term investors, they should not average the price, limit the use of margin, usually after a deep decline like today, the market will have a technical rebound, investors can take advantage of it to restructure their portfolio. or reduce the proportion.

VN-Index dropped 214 points after 3 weeks, lowest since August 2021

SHS Securities

According to SHS: VN-Index fell 5% in the first session of the week, marking the biggest drop since early 2021, just after January 28, 2021 with a decrease of 6.7%. Today’s liquidity also increased slightly and was slightly above the average of the last 20 sessions, showing that sellers have completely overwhelmed the buyers.

From a technical perspective, the RSI (14) is now at 20 points, which is an oversold level (<30) higher than all three previous oversold times of July 2021, January 2021 and January 2021 respectively. July 2020. This level is only lower than the oversold level of March 2020 when RSSI (14) sometimes reached only 7.

From the elliott wave perspective, VN-Index has moved from rising wave 5 to correcting wave a after losing the support level of 1,350 points (fibonacci retracement 127.2% correcting wave 4). The theoretical target of corrective wave a is around 1,200 points (fibonacci retracement 38.2% bullish wave 5).

However, from a valuation perspective, the P/E of the VN-Index after today’s session is about 15.5 times, approximately the 5-year average. Meanwhile, the P/E of VN30 is only 14.8 times, lower than the 5-year average. With the above valuation, SHS thinks that the possibility of a sharp drop in the market is unlikely and in the next trading session April 26, VN-Index can still recover if the psychological support level is around. 1,300 points held.

Yuanta Securities

Yuanta thinks that the market may have a technical recovery when the VN-Index drops to the psychological support level of 1,300 points and the bottom at the end of August 2021. At the same time, market risk is still high and the market may only see short-term technical retracements. Besides, the short-term sentiment indicator continued to drop sharply into the overly pessimistic zone, showing that the market is likely to establish a short-term bottom.

The short-term trend of the general market remains DOWN. Therefore, Yuanta recommends that short-term investors can continue to stay out of the market and limit selling at falling spans or prioritize bringing the margin ratio to a low level to avoid being disbursed during the P/E period. TTM of VN-Index is at 14.7x.

Following Economic Life

at Blogtuan.info – Source: cafebiz.vn – Read the original article here