For the first time in history, one of the largest FDI enterprises in Vietnam with a profit of billions of dollars has set the target of going public and listing on HoSE.

In a notice to the Stock Exchange of Thailand, Charoen Pokphand Foods (CPF), the parent company of CPP, said that during the Board meeting held on April 22, 2022, the Board of Directors approved the company. Vietnam Joint Stock Company may register to become a public company through the issuance of common shares to minority shareholders. Once approved by the relevant authorities with the completion of the share issuance, CPV will submit an application for listing on the Ho Chi Minh Stock Exchange (HoSE).

This is very remarkable information because of the large scale of this enterprise, in addition, it is also an FDI company.

On the stock exchange, two businesses with business models quite similar to CP Vietnam are Dabaco and Masan MEATLife with market capitalization of VND 7,213 billion and VND 24,589 billion, respectively.

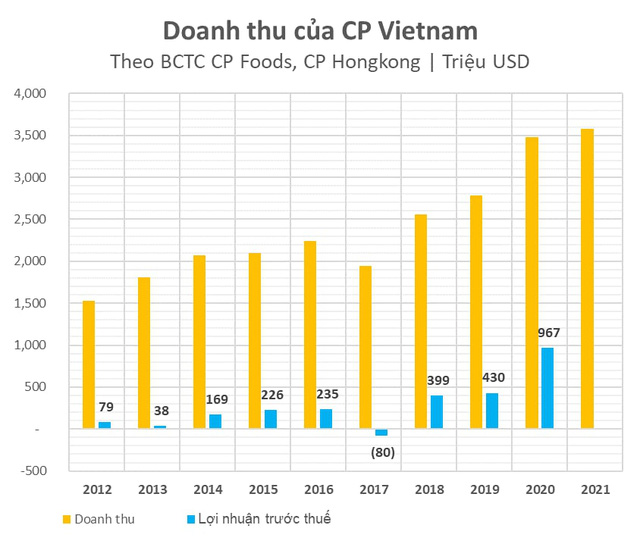

In 2021, CP Vietnam’s revenue will reach more than 111 billion Bath (equivalent to about 3.6 billion USD), up 3% compared to 2020.

CP Vietnam is among the best profitable businesses in Vietnam, in the billions of dollars that can only be counted on the fingers.

CP dominates the Vietnamese livestock segment, specifically with pork and chicken. In terms of structure, more than 70% of this company’s revenue comes from the livestock and food segments, the rest is mainly from animal feed (contributing proportions are aquatic feed, pig feed, respectively). and poultry feed).

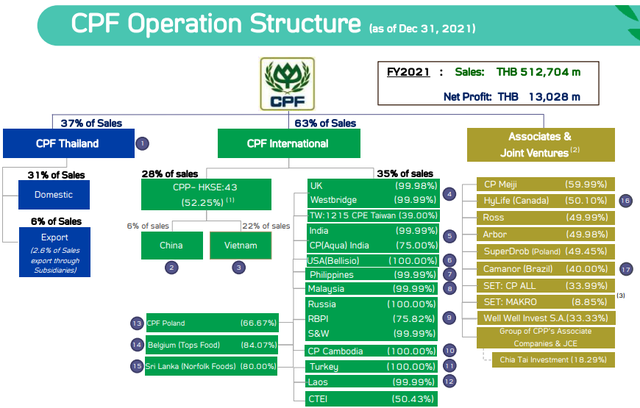

As we reported earlier in October 2021, CP Pokphand (CPP), the company in charge of business activities of CP Vietnam, plans to privatize and delist on the Hong Kong Stock Exchange. Kong (HKEX).

In an earlier notice to the Stock Exchange of Thailand (SET), Charoen Pokphand Foods (CPF), the parent company of CPP, said: “The delisting will allow CPP to make centralized strategic decisions. on growth and long-term gains, free from market expectations and stock prices that arise from being a public company.”

The plan is also expected to reduce administrative costs associated with maintaining CPP’s listing status and complying with listing regulations, thus allowing CPP flexibility in managing operations. its business as well as its subsidiaries.

Up to now, only 11 FDI enterprises have converted from limited liability companies to joint stock and listed companies. However, there are currently only 8 FDI companies trading on the stock exchange, 3 companies have canceled their listing due to business losses (2 of which are registered for trading on UPCoM). Compared to the market, the capitalization of FDI enterprises accounts for only a small proportion (about 0.3%).

Given its size, CP Vietnam is likely to increase the contribution proportion of FDI companies on Vietnam’s stock market significantly. Not to mention the event could act as a catalyst for other FDI companies wanting to list on the stock exchange, some of which have been stuck for years.

In addition to CP Vietnam, a major FDI, Aeon Vietnam, also plans to list on the stock exchange in the future.

In fact, FDI enterprises account for a large proportion of Vietnam’s economy, but do not appear much on the stock exchange.

Returning to CP Vietnam, late last year, this company signed a strategic cooperation agreement with PAN Group, thereby investing 25% of Sao Ta Foods (Fimex) – a large shrimp enterprise in Vietnam. Male.

According to Mr. Nguyen Duy Hung, Chairman of PAN Board of Directors: “CP Vietnam is famous for shrimp seed and feed, while Fimex is very successful in farming and processing for export. CP Vietnam’s investment with PAN is not merely sharing profits from Fimex, but what they want is to combine with PAN to expand Fimex”.

Shrimp is one of Vietnam’s impressive growth industries, hitting double digits year on year. The Vietnamese government has set a target of 10 billion USD in shrimp export turnover by 2025. CP Vietnam has announced a strong investment in shrimp since 2018.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here