Stock market “lost brake”, how far can VN-Index fall?

In terms of fundamental analysis, the current valuation of VN-Index is at 1,310 points, equivalent to a P/E of about 15 – the average level in the last 5 years. If calculated according to the growth of business results of businesses on the floor for 2022, the P/E of the VN-Index will head towards 13.

The market represented by the VN-Index decreased by 5% of market capitalization, this is the strongest decrease of the market since the beginning of 2021 until now, only after the session of January 29, 2021 with a decrease of 6.7%. caps.

After a slight recovery yesterday, investors in the market were completely “shocked” when the market plunged again in today’s session. Even this is a rather rare correction when VN-Index “evaporates” to nearly 5%. The question is, how far can VN-Index fall?

Securities “lost brake”, how far can VN-Index fall?

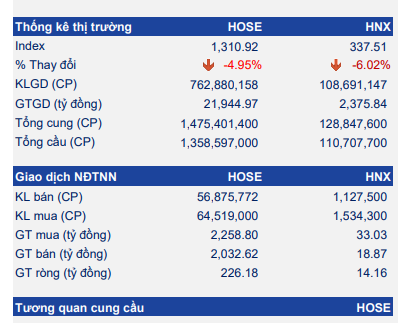

At the end of the session, VN-Index dropped 68.31 points (down 4.95%) to 1,310.92 points. The breadth was negative with 443 losers (171 stocks hitting the floor), 21 references, 37 advancers (4 stocks hitting the ceiling).

HNX-Index dropped 21.61 points (-6.02%) to 337.51 points. The breadth was negative with 193 losers (53 stocks hitting the floor), 33 reference stocks, 53 advancers (6 stocks hitting the ceiling).

Matching liquidity decreased slightly compared to the last session of last week but was still slightly higher than the 20-day average with a trading value of 23,381 billion dong on the two exchanges, corresponding to a trading volume of 850 million shares.

Source: SHS

Selling pressure appeared at the beginning of the session and strengthened until the end of the session, causing the indexes as well as stocks in them to end at or near the lowest level.

Pillar stocks of VN30 (down 4.95%) were sold strongly with all 30 stocks falling, of which 16 stocks fell to the floor like HPG (down 7%), VPB (down 6.9%), MWG (down 7%), TCB (down 6.9%), FPT (down 6.9%)… created strong correcting pressure on the market.

Stocks with high market value such as banks with STB (down 6.9%), CTG (down 7%), BID (down 6.9%)…, securities with VND (down 7%) ), SSI (down 6.9%), SHS (down 9.8%), real estate with DIG (down 6.9%), IDC (down 9.9%),…, steel with HPG (down 7%), HSG (down 7%), NKG (down 6.9%)… were all sold strongly and quite a few stocks in the above groups were at the floor.

According to analysts at Saigon – Hanoi Securities, in terms of valuation, the P/E of the VN-Index after today’s session is about 15.5 times, approximately the 5-year average. Meanwhile, the P/E of VN30 is only 14.8 times, lower than the 5-year average.

With the above valuation, experts believe that the possibility of a sharp drop in the market is unlikely and in the next trading session on April 26, VN-Index can still recover if the support level of the heart is not strong enough. around 1,300 points is maintained.

VN-Index “lost brake” at one point dropped 81 points in today’s session. (Photo: VTC)

Sharing with PV, Mr. Nguyen Minh Hoang – Senior expert, Nhat Viet Securities Joint Stock Company said that there was a time when the VN-Index decreased by 81 points. A series of stocks that fell to the floor, from basic to speculative stocks, from stocks with bad business results to good business results, were all on the floor, showing “extreme” panic. This drop in points severely hurts investors’ accounts.

Market capitalization was “blown” over $36 billion in just 3 weeks. This number is even larger than the size of the entire market capitalization in 2012.

To answer the question how far can VN-Index fall? According to Mr. Hoang, two aspects can be considered: technical analysis and fundamental analysis.

In terms of technical analysis, VN-Index has broken the upward momentum that has lasted from March 2020 to the present. With this downtrend, it is difficult to predict when VN-Index will bottom.

In terms of fundamental analysis, the current valuation of VN-Index is at 1,310 points, equivalent to a P/E of about 15 – the average level in the last 5 years. If calculated according to the growth of business results of businesses on the floor for 2022, the P/E of the VN-Index will head towards 13.

“This is a very attractive number if compared with the average valuation of the VN-Index in the last 5 years or compared with regional markets (the area is about 17-18). Thus, VN-Index is at an attractive valuation, I expect VN-Index will have demand at this price range to help VN-Index recover and investors have the opportunity to restructure goods,” Hoang emphasized.

What should investors do at this point?

Mr. Hoang, in case VN-Index recovers in the coming sessions, investors should restructure their investment portfolio.

Accordingly, speculative stocks that do not have a fundamental basis should be “exited”.

For long-term investment stocks, it is advisable to reduce the asset weight of the portfolio to safety. For example, holding only about 30% stocks and 70% cash.

“It is a reasonable structure to wait for the VN-Index to create a real bottom, then come back to participate in the market”, Mr. Hoang recommended.

Sold out in panic

The strong drop today with low liquidity showed that the demand was very weak and the psychology of the market participants was quite panic selling at all costs. Stocks from many industry groups, many capitalization groups were under the same pressure of strong decline, in which many Bluechips stocks with positive Q1 business results also fell to the floor. In our opinion, the short-term risk level of the market is getting bigger and bigger with high damage. Support levels continue to underperform in a market with panic pressure and susceptible to the herd effect.

Nguyen Trung Du _ Director of Investment Services Division vs QLTS (Tan Viet Securities – TVSI)

at Blogtuan.info – Source: danviet.vn – Read the original article here